What is Worldcoin?

Worldcoin is an innovative ecosystem designed to be decentralized, which means it is controlled by its community of users. The ecosystem comprises the following elements:

• A "World ID": this privacy-preserving digital identity aims to solve important identity-related problems, notably by proving a person's uniqueness.

• The Worldcoin digital token: This is the first token to be distributed free of charge worldwide to people, simply because they are individuals with a unique identity.

• The "World App": This stand-alone application enables payments, purchases and transfers to be made on a global scale using the Worldcoin token, digital assets, stablecoins and traditional currencies.

As recently highlighted by Sam Altman, Worldcoin is both a blockchain focused on verifying the identity of human users, and a means of laying the groundwork for a global universal basic income, financed by artificial intelligence.

Orb: The uniqueness verification device

The Orb, an indispensable tool in the Worldcoin ecosystem, is a biometric sensor that verifies a user's unique identity. To do this, it captures images of an individual and their iris, guaranteeing that the person is real. In addition to the image, the technology certifies that the user is indeed a human, and not a hyper-realistic robot animated by an AI. Everything has been designed around privacy: data is encrypted and associated with anonymized identifiers, among other measures. Precise technical details of Orb are available, and the code is completely open source.

According to Worldcoin, the Worldcoin Foundation and its contributor Tools for Humanity do not and will never share personal data, including biometric data, with people who are not working with or helping the Worldcoin project. While this statement may reassure some, others may see it as a loophole allowing data to be shared with third parties under the pretext that they "work or participate" in the project.

The Worldcoin (WLD) token: how to get

some? For which purpose?

So you can start joining the project right now and get your first 25 WLDs. You'll need to do two things: download the World App on your Android or iPhone smartphone and physically verify your identity with an Orb, which is currently only available in certain cities.

Indeed, several countries (including the USA) currently prohibit it, raising questions about its security and legitimacy. As soon as Worldcoin's main network was launched at the end of July, users who were able to do so received tokens, and will be able to continue claiming their free tokens every week.

By the end of 2023, the firm assures that over 15,000 Orb will be available worldwide.

Worldcoin tokens can be used for a variety of potential purposes after the launch of the main network:

• Governance: WLD will give its holders the opportunity to shape the future of the protocol.

• Global application: Users can use the WLD token to make in-app payments.

• Store of value: Some users can use WLD tokens as a store of value.

Like most digital tokens, the value of WLD tokens can fluctuate. What's more, if successful, this protocol could become the universal authentication method for a whole new generation of the Internet, giving value to this currency. Perhaps this is why some of Silicon Valley's biggest names are investing heavily in the company. Venture capital firm Andreessen Horowitz recently oversaw a $100 million fundraising round that boosted the startup's valuation from $1 billion to $3 billion. Those wishing to acquire more WLDs can buy some after the launch of the main network, become a Worldcoin operator or receive a Worldcoin grant from the Worldcoin Foundation for their contribution to the project.

Worldcoin perspectives

Worldcoin is supported by a global community of developers, economists and scientists. Worldcoin is destined to become a public network owned by all. The Worldcoin Foundation is the initial manager of the protocol, fostering its growth until it becomes self-sufficient.

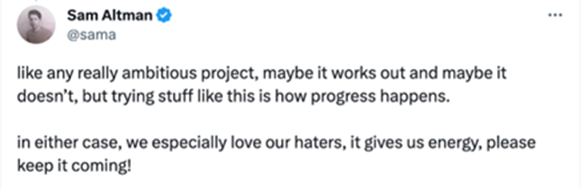

Tools for Humanity (TFH), an international technology company, led the initial development of Worldcoin and operates the World App. Although no longer affiliated with the Worldcoin Foundation, TFH will continue to develop tools to support Worldcoin and beyond. A recent tweet from Sam Altman shows that this is first and foremost an experimental project with no guarantee of success. Its universal nature is very ambitious, but the fact that the token offer is unlimited in time will certainly have an impact on investor interest in this token.

Worldcoin: the other side of the coin

1. Security and users’ privacy

Worldcoin presents significant security and privacy risks, which have caused concern among the crypto community and regulators. The platform's heavy reliance on biometrics, in particular iris scans, for user registration and identification, has been a major point of contention.

According to Ethereum founder Vitalik Buterin, Worldcoin faces four major problems: privacy, accessibility, centralization and security issues. Of particular concern is the centralization of Worldcoin's Orbs, the hardware devices responsible for capturing iris scans. This centralization could lead to the installation of backdoors by malicious or compromised Orb manufacturers, enabling the creation of false human identities. These fraudulent identities could be used for illicit transactions or illegal activities, threatening system integrity and reliability.

Another concern is the possibility of generating a large number of identities using AI-generated photographs or 3D prints of fake individuals. This could result in an influx of fraudulent identities, further compromising the integrity of the system.

Worldcoin's collection and storage of biometric data, such as iris scans and facial recognition images, also raises serious privacy concerns. Although the company claims to store only the uniqueness of the iris pattern and to immediately delete images related to the eyeball scan, critics argue that any large-scale collection of biometric data increases the risk of misuse, particularly given the irreversibility of blockchain records.

A black market in Worldcoin accounts has already emerged, with accounts sold at rock-bottom prices, starting at one dollar, on platforms such as Telegram, as reported by ZachXBT.

2. Regulatory concerns

The various regulatory bodies, such as the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), Federal Trade Commission (FTC) and others governing the US crypto-currency market, have never banned any form of crypto-currency in the US. Nevertheless, Worldcoin may take a cautious approach to avoid possible negative reactions.

Worldcoin is not available in the U.S. or China, as stated in its terms of use, which explicitly prohibit access to U.S. and Chinese persons, including citizens, residents and companies based in the U.S. or China. What's more, major US-based exchanges such as Coinbase and Kraken haven't listed it. Some supporters of the crypto-currency believe it is an unregistered security.

Despite this restriction, Worldcoin included US cities such as Miami, San Francisco and New York in its "Orb Tour", which aimed to educate and facilitate World ID registrations using the Orb device.

Surprisingly, the European Union, known for its strict security and privacy regulatory measures, allowed Worldcoin.

However, some countries, including the UK, are beginning to question the Worldcoin project. UK regulators are concerned about Worldcoin's handling of biometric data, and are investigating to ensure compliance with data protection regulations.

3. Ethical considerations

Worldcoin's in-orbit trials, mainly in developing countries in Asia and Africa, have raised ethical questions. Indeed, most of the countries where the biometric data of the first users was collected - Indonesia, Kenya, Sudan, Ghana, Chile and Norway - do not have such strict privacy regulations as European countries or the USA. Some experts, such as Pete Howson of Northumbria University, see Worldcoin's actions as a form of crypto-colonialism, where vulnerable communities are subjected to blockchain and crypto-currency experiments without the opportunity to object. The decentralized nature of blockchain technology exacerbates the damage caused by data colonialism, as it leads to limited liability when problems arise.

MIT Technology Review has revealed Worldcoin's deceptive recruitment of its first million test users, involving exploited workers and cash handouts.

Leading critics argue that Worldcoin's approach poses serious privacy risks by enticing vulnerable individuals to hand over their biometric data in exchange for a small sum of money.

In addition, concerns have been raised about fairness, as 20% of Worldcoin's coins have already been allocated, 10% to full-time Worldcoin employees and 10% to investors. This distribution raises questions about the importance the company claims to place on equity.

Conclusion

Crypto-currencies refer to a decentralized monetary system based on the blockchain and secured by cryptography. The main distinction between Worldcoin and other crypto-currencies is the verification process used to determine whether the person holding the digital currency is a real person. To acquire and use Worldcoin, you just need to hold a "crypto-wallet" provided it can be proven that the entity holding it is a person. An iris scan by the orb is used to determine this, and each person is then entitled to a certain amount of digital currency.

While Worldcoin's mission is noble and ambitious, this project will have to avoid many regulatory, ethical and user-identity preservation pitfalls. The adoption process for this crypto-asset is still in its infancy, and there is no sign that investors and users will see any value in it, as the potential for appreciation seems so limited compared with crypto-currencies such as ether or bitcoin.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)