Introduction

Over the last century, immense progress has been made in eradicating undernourishment. While this is cause for celebration, we are now faced with another challenge: the growing prevalence of obesity. This is not just a health crisis, but a complex socio-economic problem that affects various aspects of society. The struggle to lose weight is often wrongly attributed to a lack of discipline. However, recent research highlights a more nuanced reality: obesity is an addictive disorder, influenced by cravings for fatty or sugary foods and underpinned by neurological factors. The hypo- thalamus, which plays a key role in our body's reward system, functions differently in people suffering from obesity, as it does in addictive disorders. This disruption affects com- munication between the hypothalamus and adipose tissue, resulting in poor appetite regulation.

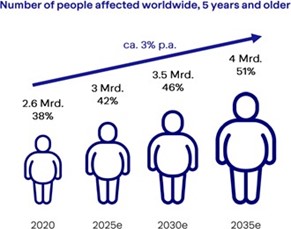

According to certain projections, around 51% of the world's population will be obese or overweight by 2035. It should also be remembered that obesity worldwide has tripled since 1975. This veritable epidemic is not just a health problem; it also has major economic repercussions. Obesity is associ- ated with over 200 diseases and is expected to cost society a staggering $4,000 billion a year by 2035, a figure compa- rable to the financial impact of the worst year of the COVID-19 pandemic.

Currently, a body mass index (BMI) greater than 30 is consid- ered obese. While wealthy countries have a higher prevalence of obesity, low-income countries are rapidly catching up.

Alarmingly, over the past 50 years, obesity and overweight rates among children and adolescents have risen from 2% to 20%. The comorbidities associated with obesity are diverse and serious, including type 2 metabolic diabetes, musculo- skeletal problems, certain cancers, cardiovascular disease and sometimes mental health problems, earning obesity its nickname of "the new tobacco". The complexity of obesity treatment requires a holistic approach that includes not only pharmacotherapy, but also surgical procedures and lifestyle changes.

One of the breakthroughs in the pharmacological approach that has come to light is the use of GLP-1, a natural hormone that regulates blood sugar levels and reduces appetite. NovoNordisk's SELECT study demonstrated that GLP-1, originally developed for the treatment of diabetes, also facilitates weight loss and improves not only various blood levels but also blood pressure, resulting in less diabetes, fewer kidney problems, fewer heart attacks and less mortality. These health improvements translated into a 20% reduction in the risk of cardiovascular disease in overweight people without diabetes.

.png)