Introduction

Arriving in a sleek, silver two-door 'Cybercab' on the fake streets of the Warner Bros. movie studio set, Elon Musk unveiled Tesla’s vision for a fleet of fully autonomous cars, along with their futuristic-looking 'Robovan.' However, disappointment came from the lack of concrete timelines, limited technical details on its rollout, seemingly optimistic price targets, and the absence of a fully operational real-world demonstration. Despite the somewhat underwhelming presentation, Tesla's robotaxi plans have sparked debate about which companies are truly poised to capitalize on this technological revolution.

Source: Tesla

Source: Tesla

Differences among players

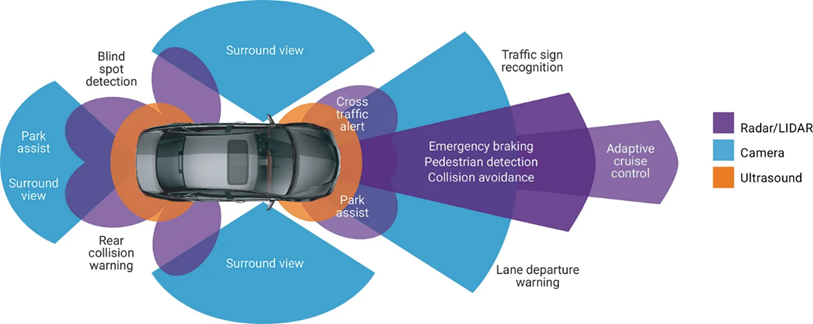

The development of autonomous driving technologies relies on a few core technologies that are each crucial to enabling vehicles to navigate their environment entirely without human intervention. These crucial technologies include sensors, artificial intelligence, and high-definition mapping.

Sensors, which provide the vehicles with real-time data about their surroundings, are central to autonomous driving. The three main types used are LiDAR, radar, and cameras. LiDAR creates highly accurate 3D maps of the surroundings with the use of laser beams, which allows the vehicles to detect objects at long distances under various lighting conditions. The precision of LiDAR is unmatched, an advantage that also comes with a heavy price tag. However, the technology isn’t bulletproof and can still struggle in adverse weather like a heavy rainstorm or fog. While radar is more affordable and functions reliably in all weather conditions, its resolution is lower, making it harder to distinguish fine details. Cameras on the other hand provide high resolution images that are crucial for identifying visual cues like lane markings and traffic signs.

While they are cost-effective, they also depend on lighting conditions, which makes them less reliable in low light environments or adverse weather.

Source: Eetimes

Each player in this space has chosen to adopt a different combination of these technologies. Waymo, a subsidiary of Alphabet, is widely regarded as the current leader in this field with its sensor-heavy approach that integrates LiDAR, radar, and cameras to provide several layers of data. Implementing this variety of sensors ensures the vehicles can operate safely even when one sensor becomes unreliable. This approach, however, comes with significantly higher costs. The expensive LiDAR systems might give them a head start in this race, but they also make it challenging to scale this technology to mass-market vehicles with an affordable price tag. The company has already launched fully autonomous Robotaxis in a handful of cities like Phoenix, LA, and San Francisco.

Another major player in the US is Cruise, the autonomous driving subsidiary to General Motors, which has opted for a similar path as Waymo, leveraging all three sensor technologies to emphasize safety.

Tesla, in true Tesla fashion, has decided to take a radically different approach. The company has chosen to forgo LiDAR altogether and instead rely on a vision-based system that uses cameras as its primary sensors, complemented by radar. The company’s full self-driving (FSD) system uses AI to process the visual data in real time and make driving decisions based on what the cameras see. This approach is far more cost-effective than that of its rivals as cameras are significantly cheaper than LiDAR systems. Another advantage for Tesla is that the company benefits from already having millions of vehicles on the road equipped with FSD hardware, allowing them to collect huge amounts of driving data, which is a key asset in refining its AI systems.

However, Tesla’s cost-effective approach is not without its setbacks. As previously mentioned, cameras are highly dependent on lighting and weather conditions. Additionally, lacking the depth perception offered by LiDAR means that Tesla’s system may be less reliable in handling complex scenarios such a crowded intersections or obstacles in low visibility. Their belief is that their AI systems will eventually overcome these limitations through continuous learning and remote software updates.

Furthermore, in addition to all the on-board sensors, connectivity will play a key role in enhancing the cars’ capabilities through IoT integration. Connected vehicles will be able to communicate with each other as well as with infrastructure like traffic lights and share real-time information on traffic patterns or roads hazards. This connected network is often referred to as “vehicle-to-everything” communication. Players like Google who already have extensive mapping data and IoT expertise will likely have a significant advantage in building a highly efficient robotaxi ecosystem.

Source: Not a Tesla App

Source: Not a Tesla App

For Tesla, on the technological side, the key advantage lies in its ability to mass-produce autonomous vehicles on a scale that few competitors can yet match. On the other hand, on the ride-hailing front, companies like Uber, Lyft, and DiDi, currently benefit from their extensive networks of drivers and highly adopted applications, which allow them to aggregate demand and provide higher vehicle utilization rate. Following Tesla's Robotaxi event, the company’s shares fell 10%. In contrast, Uber’s stock surged by around 9%, while Lyft saw a near 10% gain. As a side note, Tesla's stock had surged more than 20% last Thursday, largely due to its operating performance as an auto OEM rather than for autonomous vehicle developments.

Uber initially ventured into autonomous vehicle development with Volvo in 2016 but abandoned the effort in 2018. Since then, Uber has focused on expanding its rider-driver network, creating a platform that efficiently connects riders with nearby drivers. Uber benefits from a capital-light business model acting as an intermediary without owning cars or employing drivers directly, allowing it to scale easily and reduce costs when demand fluctuates.

To integrate AVs, Uber is partnering with companies like Cruise, Waymo, and Wayve, a UK AI start-up for AVs. Starting in 2025, Cruise will supply Uber with self-driving Chevrolet Bolts. Similarly, Uber plan to expand Waymo’s autonomous ride-hailing service to Atlanta and Austin, with Waymo’s all-electric Jaguar I-PACE vehicles available through Uber's app. Uber will handle vehicle cleaning and repairs, while Waymo will manage operations and testing. Uber is also eyeing AVs from BYD, following their July 2024 partnership. This multi-year deal plans to bring over 100,000 new BYD electric vehicles to Uber's platform, some featuring self-driving capabilities.

DiDi, the Chinese ride-hailing company, is entering the AV space through a joint venture with GAC Aion to produce Robotaxis by 2025. Their collaboration aims to launch fully autonomous Level 4 vehicles for DiDi's ride-hailing service.

Source: Arthur D. Little analysis

Source: Arthur D. Little analysis

Regulatory environment

While technology is the engine powering the Robotaxi revolution, it’s the regulatory environment that acts as either a gatekeeper or an accelerator. In the U.S. for example, regulations may vary significantly between states, which is something that companies must navigate. States like California and Arizona, where Waymo operates, have been fairly open to the testing of driverless vehicles on public roads. Understandably, stringent safety requirements remain in place, meaning that a full deployment of this technology hinges on the companies being able to prove that their vehicles can match or exceed the safety standards. In Europe, unsurprisingly, regulators are taking a more cautious approach, prioritizing strict safety guidelines and data privacy. The European Union has laid the groundwork for autonomous vehicle regulation, but individual countries retain some autonomy in deciding how fast Robotaxis can be introduced, creating a slower, more fragmented and uncertain market compared to the U.S.

China, on the other hand, is pushing forward aggressively. The government views autonomous vehicles, including Robotaxis, as a strategic industry and has already created numerous autonomous vehicle test zones in cities like Beijing, Shenzhen, and Shanghai. Regulatory support in China could lead to faster mass adoption, with domestic players like Baidu and DiDi competing to gain an edge in this fast-growing market.

Future scenarios

Faced with intense competition in the Robotaxi race, Tesla has different key scenarios at its disposal.

Scenario 1: Tesla as a car-selling company

Tesla focuses solely on selling AVs directly to end-consumers. This path would position Tesla as a car manufacturer primarily, similar to its current model, but with AV-specific offerings. Individuals or businesses could purchase Tesla's self-driving vehicles for personal or commercial use. Tesla could profit by selling the hardware, then charging a subscription for software updates like Full Self-Driving (FSD) to enable full autonomy.

Scenario 2: Partnerships with ride-hailing companies

Tesla could partner with established ride-hailing platforms like Uber, Lyft, or Bolt, which already have extensive networks and customer bases, Uber, for example, has around 150 million monthly active users globally. By selling its Cybercab Robotaxi to these ride-hailing companies, Tesla could tap into this massive network while focusing on hardware and software, leaving customer service to the platforms. There are signs of a growing Tesla-Uber partnership, such as Tesla offering up to $3000 discounts to Uber drivers purchasing its vehicles.

Uber's CEO, Khosrowshahi, has expressed in the past interest in collaborating, telling the Financial Times that he’d "love to have [the Cybercab] on the platform," Khosrowshahi highlighted Uber's extensive experience, stating, “It’s taken us 15 years. It’s taken us tens of billions of dollars of capital, and we can provide that instantly to a partner. Hopefully, Tesla will be one of those partners.” In this model, Tesla could maintain long-term involvement through vehicle maintenance, offering subscriptions for FSD software, or taking commissions on each ride where a Tesla Cybercab is used.

Scenario 3: Tesla as a ride-hailing company

Tesla decides to bypass third-party ride-hailing platforms by launching its own service. Elon Musk has long hinted at the creation of a Tesla ride-hailing network, previously dubbed "Tesla Network." In this model, Tesla’s AVs would provide direct transportation services, competing with established players like Uber and Lyft. In 2018, Musk explained that in areas where there aren't enough Tesla owners willing to add their cars to the network, Tesla would deploy its own fleet to meet demand. The approach would be a blend of Uber, Lyft, and Airbnb, where individual owners could earn revenue by sharing their vehicles, while Tesla would step in with its own cars where necessary. Musk suggested that Tesla would take a commission, possibly around 30%.

Conclusion

Whether or not the world is fully ready for self-driving cars, they are coming, and coming rapidly. One thing is certain: The established ride-hailing companies like Uber are winners in either scenario in this AV race. With a vast driver network, partnerships with AV leaders, and a capital-light business model, Uber is well-positioned to benefit from the autonomous vehicles transition without the need for heavy investment in its own fleet. The winners of this soon-to-be booming market will expand outside those directly implicated in the manufacturing of vehicles and platform providers. Critical components needed such as specialized chips and LiDAR systems means players like NVIDIA will also experience positive externalities.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Is it the “trade of the century”? MicroStrategy’s stock price soared 600% in the past 12 months, thanks to the audacious Bitcoin strategy of its visionary founder, Michael Saylor.

Treasury scenarios for 2025: fiscal policy, inflation, and yield projection

A month to shape the future of the global economy

.png)