Key takeaways

- 2025 provided two big lessons to investors. First, they should avoid playing politics with portfolios, with markets delivering robust returns despite a flurry of geopolitical headlines. Second, a well-diversified portfolio of international equities, fixed income and alternatives help to spread risk and take advantage of a broadening set of opportunities. We stick to these two key principles as we enter 2026.

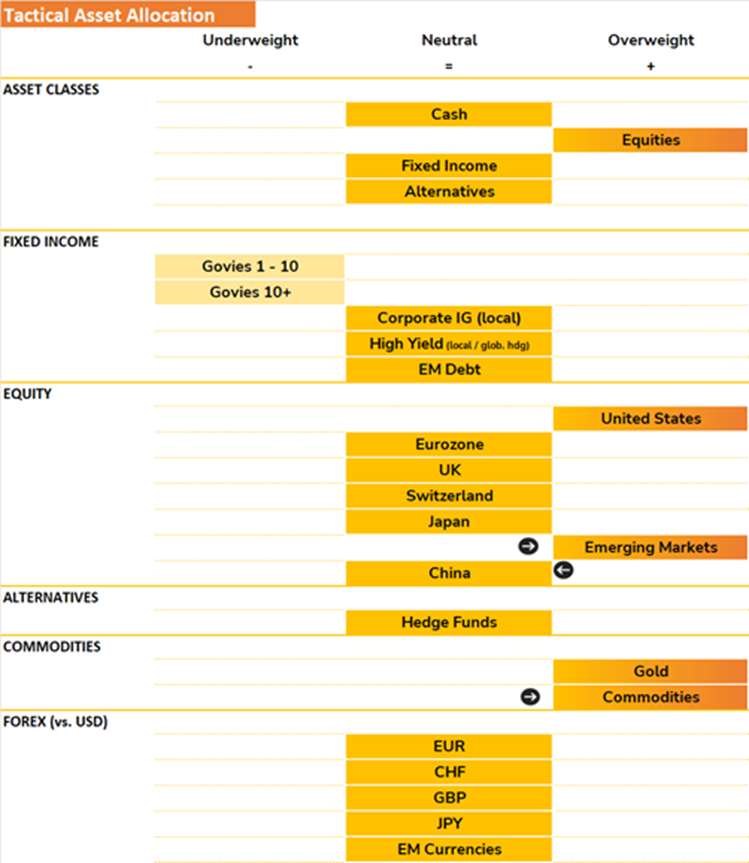

- We remain overweight equities but implemented some regional rebalancing. We are reducing China from overweight to neutral and increasing Global Emerging Markets from neutral to overweight.

- We stay overweight gold and are increasing commodities from neutral to overweight.

- Within fixed income, we are reducing the allocation to Government by reducing further the allocation to Govies 1-10 (already underweight) and increasing the allocation to Corporate Investment Grade (still neutral). We stay neutral High Yield and EM debt.

- We are neutral the dollar against all currencies.

THE BIG PICTURE

The 2025 market cycle was characterised by a sharp "v-shaped" recovery in sentiment. After navigating significant geopolitical headwinds and the highest US tariff rates since the 1930s, markets pivoted to an "everything rally" in the second half. This resulted in the first year of synchronised positive returns across all major asset classes since the pandemic.

Within global equities, Emerging Markets (EM) dominated the global landscape with a 34.4% return. Developed Markets (DM) proved resilient, recovering from a -16.5% drawdown in April to finish the year +21.6%.

Global styles converged as US growth was offset by international value performance. Global growth returned 21.3% vs. 21.6% for Global value.

The commodities market was probably the most interesting asset class in 2025. Precious metals were the year’s "alpha" generator. Gold’s rise was underpinned by structural shifts, specifically international central banks diversifying reserves away from fiat currencies and into physical bullion. Precious metals as a group surged 80.2%, led by a historic 149.1% rally in Silver. These gains successfully mitigated the impact of softening oil prices.

2025 was the year of recovery for fixed income. Global bonds returned 8.2% (USD terms), supported by a weakening US dollar and a successful "soft landing" narrative as central banks normalised rates.

From a macroeconomic perspective, global trades and inflation didn’t turn into the “Armageddon” scenario many were anticipating. Despite fears that aggressive trade protectionism would trigger a 2022-style inflation spike, price pressures remained contained. This gave central banks the necessary breathing room to pursue monetary easing.

Global growth in the second half of the year was fuelled by the positive tailwinds of both fiscal and monetary stimulus packages globally.

Overall, 2025 reinforced the value of a diversified mandate, as the interplay between metals, EM equities, and fixed income provided robust hedges against early-year equity volatility.

As we enter 2026, how does it lead us in terms of asset allocation preferences and portfolio positioning?

Below we review the weight of the evidence and subsequent investment decisions.

THE WEIGHT OF THE EVIDENCE

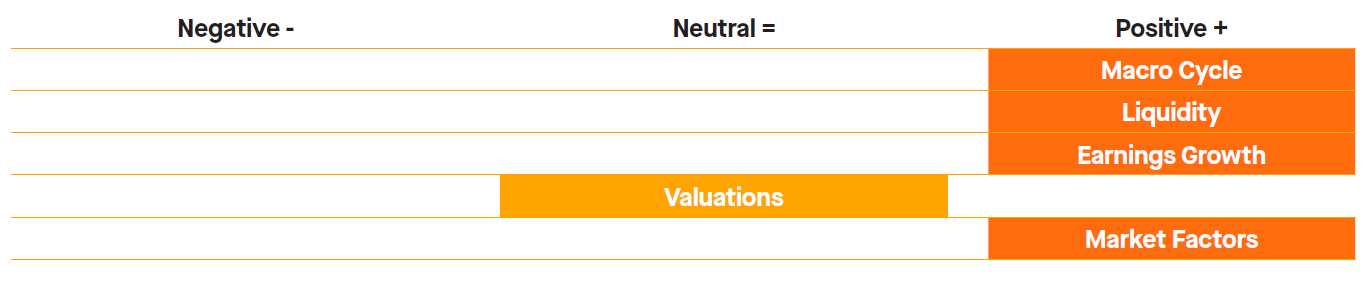

Our asset allocation preferences are based on 5 indicators, including 4 macro and fundamental indicators (leading) and 1 market dynamics (coincident). The weight of the evidence suggests a constructive view on equities (positive). Below we review the main drivers for each of them.

Pillar 1: Macro cycle

(POSITIVE)

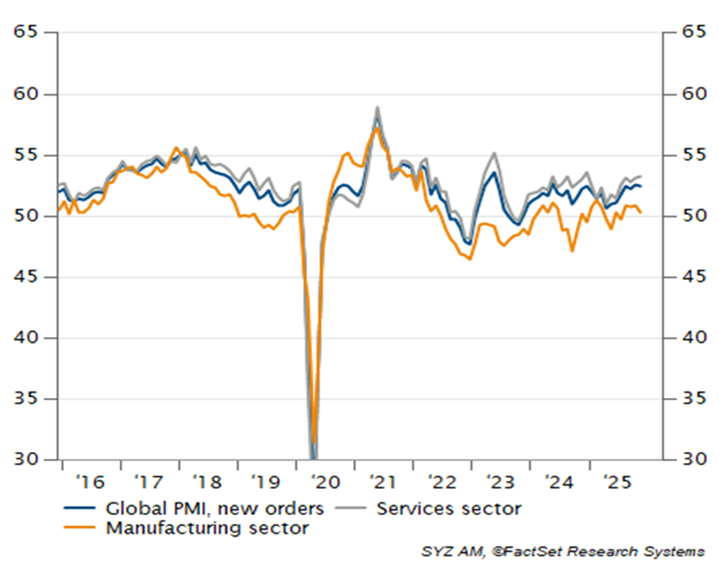

On a global scale, growth looks set to continue its economic recovery. The latest global economic activity indicators are pointing to a further, substantial recovery in the service sector, while manufacturing indicators hint at a modest, likely temporary slump in the pace of activity (see chart 1). We have witnessed some flare ups in trade tensions in the last months but overall, the level of uncertainty in the trade area remains low. However, the US Supreme Court did not yet decide on the legitimacy of the legal basis of the current US tariff regime, and it might well be, according to experts, that the US administration will have to recreate the legal foundation of its trade tariffs. This might cause more uncertainty again, but the potential effect on trade and economic performance remains vague. Over the longer term, a clarification of the legal basis should help reduce uncertainty further and the most important news, so far, is that there is no “tit-for-tat” negative spiral in the trade war, and that, up to date, global trade volumes remain very resilient against the US tariff shock.

Chart 1: Overall global economic activity leading indicators stay strong, but the manufacturing sector is still substantially lagging the service sector

However, the US Supreme Court verdict might be more important for US domestic politics as it could cut off the current administration of a revenue stream and potentially lead to a refund of some of the generated public tariff income. This would likely influence the amount of potential new fiscal stimulus that the government could distribute, including rebate checks–President Trump’s idea of sending a 2,000USD check to the mid and lower income households in the US, which would naturally have spurred consumption. Yet, when looking at the recent economic US data, the so-called purchasing manager indices (PMIs) point to a decent economic performance in the last quarter of 2025. Of course, the shutdown in the US will weigh on the Q4 economic activity—and its main measure, the gross domestic product (GDP)—but, aside from the government sector, we expect the business cycle to have performed well at the end of the year.

We witnessed some weaker data signals from the US labour market recently, particularly the uptick in the unemployment rate from 4.4% in September to 4.6% in November, and also the drop in jobs of more than 100,000 positions in October. However, this drop can be explained by the government job cuts that were already announced during the year—now executed by the DOGE in October. The good news was that the private sector did not experience fewer jobs on average and showed positive growth of more than 60,000 jobs in November, balancing out the negative news from October. We see the US labour market in a cooling-down phase, yet it remains on a solid footing and will likely settle into a new equilibrium with substantially lower labour demand but also reduced supply due to the latest changes in US immigration policies. In the same vein, we expect US household consumption to continue growing in 2026. We anticipate the price pressures in the US to remain elevated due to the solid demand by firms and households for goods and services. Of course, beyond a potential “freeze” in consumption —particularly if middle- and lower-income households in the US reduce their spending—several additional downside risks persist for the US economy: delayed tariff effects on prices and demand, further increases in electricity prices, and the growing debt burden of households and the government amid elevated interest rates.

Chart 2: US job growth took a hit in October, driven by the public sector, but November data was better than what the consensus expected

Source: BLS, FactSet, Syz Group

Source: BLS, FactSet, Syz Group

The Eurozone’s GDP in the third quarter was a positive surprise as it revised further upwards and stands now at +0.4% compared to the quarter before. This is another important indication that Europe’s economy is on its path to recovery. The heavyweight Germany is still struggling with a zero-growth rate while France, which is in a period of political turmoil, posted a decent 0.5% growth rate. Southern countries showed a mixed picture with a GDP growth rate of only 0.1% in Italy but a strong rate of with 0.6% in Spain. Overall, Eurozone’s economic activity indicators hint at the continuation of a recovery. Despite the positive signs and the fiscal stimulus that we expect to filter into the economy in 2026, the Eurozone will still have to overcome the higher US tariffs, the euro strength, and elevated energy prices that slow the economic recovery. The ongoing war in Ukraine, France’s political turmoil, in combination with an uncertain governing coalition in Germany continue to be the main “domestic” risks to the recovery. Yet, in our base case, public spending in combination with a global rebound in the manufacturing cycle, should help to keep Eurozone’s economy on track for a further recovery.

Switzerland received the confirmation from the US that its import tariffs for many Swiss goods will drop down to 15% - the same tariff rate than the Eurozone. Also, this measure will take effect retroactively from mid-November. This is good news for the Swiss export sector and the economy, after the Swiss GDP contracted in the third quarter by half of a percentage point and more than expected. Yet, this negative result was less driven by the US tariff shock and more by increased energy imports following the shutdown of a nuclear power plant in Switzerland, as well as by a sharp downturn in pharmaceutical exports after these had previously been front-loaded. Although the tariff shock will continue to weigh on Swiss economic performance, the reduction in tariff rates and support from the SNB’s accommodative policy rates lead us to anticipate a very gradual but positive rebound of the Swiss economy over the coming quarters.

In China, the new “trade truce” between the US and China seems not to have supported China’s exports to the US while the export figures to the non-US trading partners surprised to the upside. Nevertheless, many Chinese economic data disappointed in the recent weeks. In addition, the government’s “anti-involution” campaign against overcapacities poses a risk to domestic growth, particularly in the industrial sector. The latest business sentiment numbers seem to confirm the uncertainty in the sector. However, we still expect both issues to be addressed by the government with additional fiscal stimulus that should help spur domestic demand. Yet, the ongoing economic and geopolitical rivalry with the US keeps uncertainty elevated and a final trade deal between the two superpowers is still missing, making further trade disputes a key risk factor to growth in China and financial markets in general.

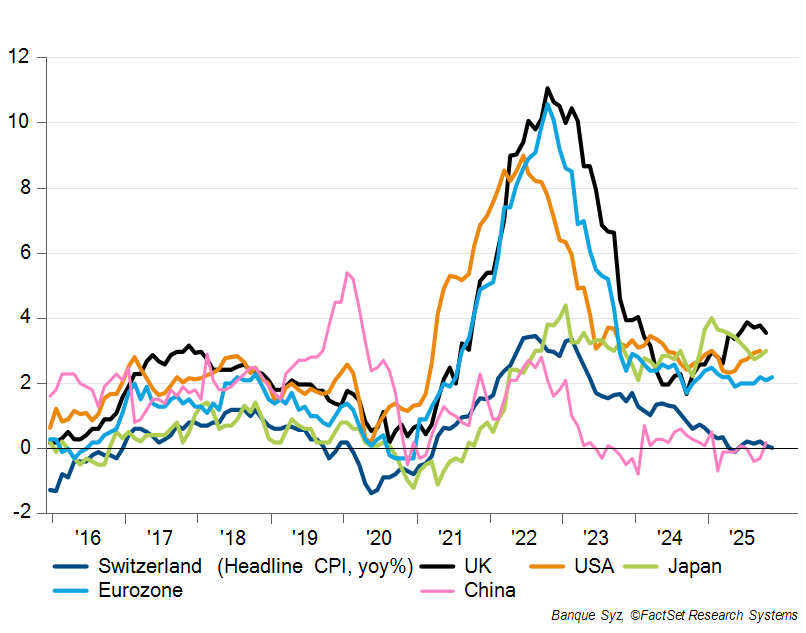

Chart 3: Inflation continues to be a story of two different speeds

Source: BLS, FactSet, Syz Group

Inflation appears to be a story of two different speeds. While the UK has an inflation rate above 3.5%, and the US and Japan at a rate of 3%, the Eurozone stays at slightly above 2% and China and Switzerland see inflation at 0.7% and 0%, respectively. Due to the shutdown, markets are still waiting for the inflation data from November (at the time of writing) while the US government said not to produce the October figures. Latest leading indicators like the ISM and the PMI price measures still point to elevated price pressures that even as the pass-through of tariffs is milder than expected, the underlying pressure in the domestic services sector remains evident.

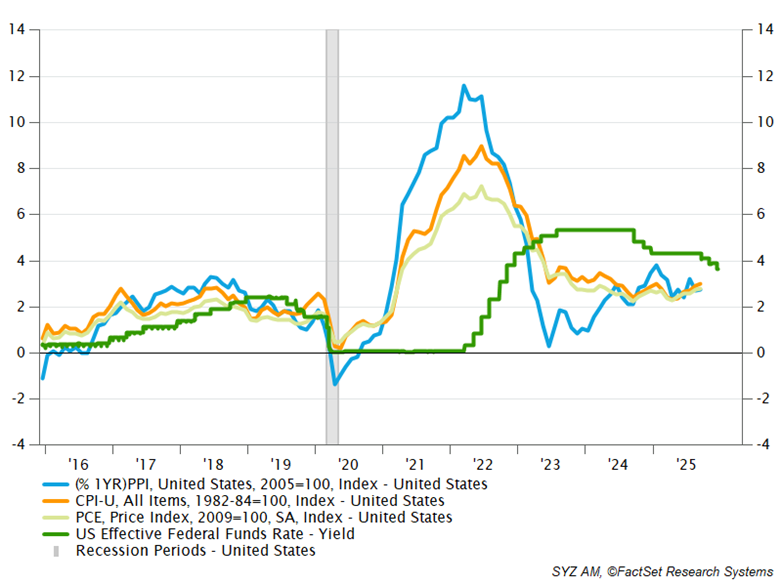

Nevertheless, US Fed delivered its third rate cut in December and Chair Powell delivered a less hawkish Q&A session than expected. Yet in his speech, he indicated that the Fed now views its current monetary policy stance as being at—or very close to—the neutral policy rate, that is, the interest rate that neither stimulates nor restrains the economy. As such, he said, the central bank is now in a “wait-and-see” mode. Accordingly, barring any further deterioration in labour market data or a slump in domestic consumption, we expect no additional rate cuts in the first quarter of 2026 at this stage. That said, it is important to bear in mind that over the coming weeks a significant amount of “new” data from the shutdown period will be released, helping to complete the economic picture for both the Fed and financial markets.

Chart 4: The US central bank cuts rate further despite inflation running at 3.0%

Source: BLS, FactSet, Syz Group

In the Eurozone we keep our view that inflation will remain tempered and float around the ECB’s target of 2%, at least until the economic recovery gains more traction later in the year. Until then, we do not expect the ECB to seriously discuss changing its current key rate of 2.0%. In the UK, inflationary pressures took also a downwards step with the growth and employment outlook appearing fragile, which allows the Bank of England likely to cut its policy rate further. In Switzerland, inflation is likely to remain at the lower end of the SNB's target range of 0% to 2%, but the SNB's Governing Board has made it clear that the hurdle for a move ‘below zero’ remains high. We currently expect the SNB to neither cut nor raise interest rates and expect the key rate to remain at 0% well into 2026. China saw a significant jump from 0.2% to 0.7% in November but still seems to wrestle more with too little inflation. Over the medium term, however, we expect the government’s anti-involution campaign to reduce some overcapacities in the economy and to lead to a higher inflation level. On a global scale, we identify a slow but important shift away from the “cutting cycle” dogma by central banks outside of the US and the UK and expect to see more voices, raising the idea of keeping rates steady or thinking about raising interest rates at some point in 2026.

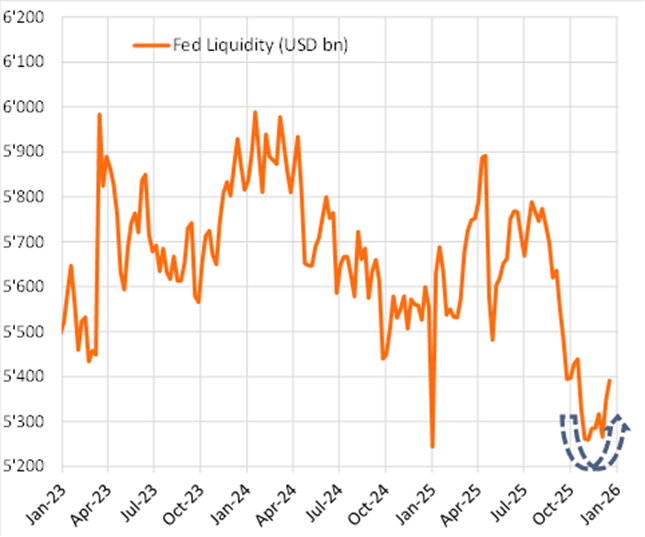

Pillar 2: Liquidity (POSITIVE)

Overall liquidity conditions remain again positive for financial markets during the last month. Support came from the US as the central bank balance sheet of the US Fed increased again. The Fed finally halted quantitative tightening (QT) of its balance sheet at the start of December and announced at its last meeting that it would begin expanding the balance sheet again in order to provide ample liquidity to the US financial system. As shown by the improved liquidity measures below, this shift—together with the ongoing global rate-cut cycle, in which the Fed and the Bank of England cut rates again in December while only the Bank of Japan began to raise rates—and broader global liquidity injections continue to support global liquidity conditions and make liquidity a positive factor for real assets. However, it is important to bear in mind that the global easing cycle may come to an end sooner rather than later, as the BoJ has already increased its policy rate and other central banks, such as the Bank of Canada and the Reserve Bank of Australia, have begun to discuss the possibility of rate hikes in 2026 more seriously.

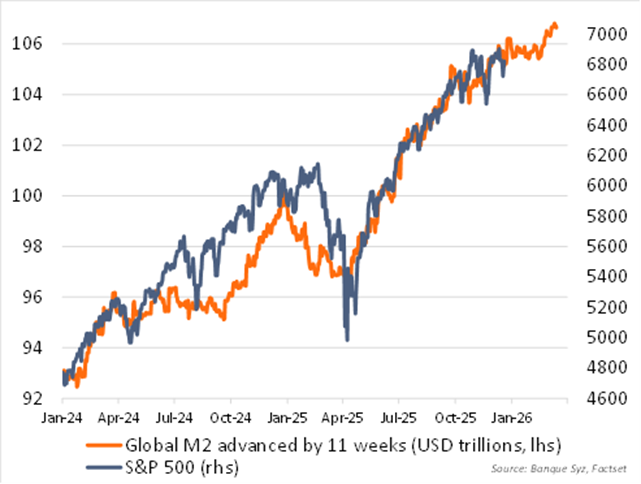

Chart 1: Our liquidity indicator (global M2 measure) did surge further over the last weeks

At the time of writing, our Global M2 proxy still points to a broadly supportive liquidity environment for risky assets through the end of 2025. It suggests a supportive liquidity environment and momentum for the first weeks of 2026.

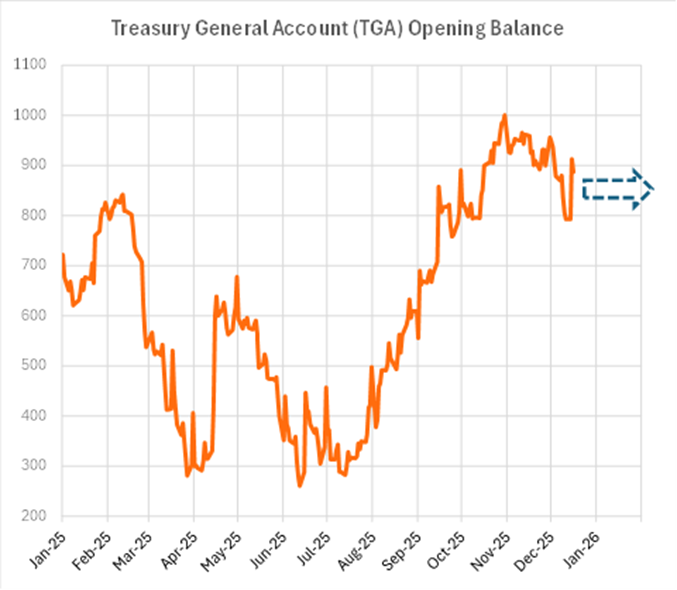

Chart 2: The Fed’s balance sheet is now expanding again

An important indicator we have been watching over the last months was the US Treasury General Account (TGA), which is basically the US government’s bank account at the Fed. When more money is sitting in the TGA, this means less liquidity flowing to the financial markets. As the government reopened after the end of the shutdown in November, the liquidity coming from the expenses of the government was a positive factor for the overall liquidity in financial markets. We saw this indicator to signal more liquidity coming during the last weeks and expect now a sideways trend over the weeks to come–after having been a tailwind in the first half of the year and during the latest US government shutdown.

Chart 3: The US government’s “bank account” at the central bank is expected to stay “neutral” for liquidity in the weeks to come

Overall, the announced expansion of the Fed’s balance sheet in combination with further liquidity likely coming from China’s PBoC we expect the liquidity indicator to stay positive for risky assets at the start of 2026. To us, the relationship between risk assets and our Global M2 proxy remains a useful gauge of one of the important drivers of equity markets, but its impact could be offset by other macro or market factors from time to time.

Pillar 3: Earnings (POSITIVE)

The global earnings outlook for 2026 remains constructive, supporting equities despite elevated valuations. The United States is expected to maintain its position as the world’s “compounding region,” with earnings growth accelerating in 2026. This improvement should be driven by industrials, materials, and energy, alongside continued strength in technology and AI-related sectors.

Europe is likely to enter a cyclical recovery after flat earnings in 2025. The drag from tariffs and currency volatility is expected to ease, while German stimulus should begin to support growth from the second quarter of 2026. Although earnings estimate in Europe were revised lower earlier due to tariffs and a stronger euro, revisions have recently stabilised.

Emerging markets are set to benefit from sustained AI-driven semiconductor demand, particularly in Korea and Taiwan, a more dovish Federal Reserve, and improving conditions in China. Chinese equities have already begun to recover, led by technology, while broader economic activity should improve gradually as stimulus offsets measures aimed at reducing industrial overcapacity. AI-related investment is expected to remain strong as China pushes for greater self-sufficiency.

Japan’s earnings growth should remain steady, supported by AI demand and government stimulus, though yen volatility remains a key uncertainty.

Overall, recent earnings results have exceeded expectations, especially in technology, and companies have largely preserved profitability despite tariffs. Earnings revisions remain strongest in technology and AI, helping U.S. earnings expectations for 2026 outperform other regions. Among the “Magnificent 7”, earnings growth is expected to slow from 28% in 2025 to 17% in 2026 but remain above the broader market, while S&P 500 earnings growth is forecast to accelerate modestly to 13.5%.

Pillar 4: Valuations (NEUTRAL)

Equity market valuations are elevated, largely due to high multiples for US large-cap stocks. However, these valuations are supported by strong growth and profitability.

As global activity improves, other regions with lower valuations offer catch-up potential. We do not expect non-US or non-technology multiples to reach US tech levels, but some convergence is likely.

Concerns about an AI bubble persist, with parallels drawn to the dot-com era. However, unlike 2000, current performance is earnings driven. For instance, Nvidia now trades at a lower PE multiple than Costco or Walmart, which are GDP-like growth companies.

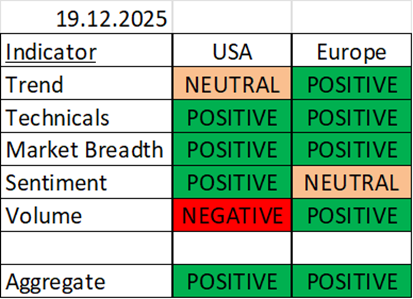

Pillar 5: Market dynamics (POSITIVE)

The US raw score decreased from 91% to 82%, as volume indicator turned negative.

No change in European indicators, with 8 out of 10 are positive. Only the RSI (one of the three technicals indicator) and the put-call ratio are negative.

As a result, the total equity allocation remained at 100%, split equally between the US and Europe.

Indicators review summary - our five pillars

With 4 pillars (macro, liquidity, earnings and market factors) signalling an overweight and 1 in neutral (valuations), the weight of evidence is positive for equities.

TACTICAL ASSET ALLOCATION (TAA) DECISIONS

We remain overweight equities but implemented some regional rebalancing. We are reducing China from overweight to neutral and increasing Global Emerging Markets from neutral to overweight.

Reasons for lowering China allocation:

We were overweight China equities throughout 2025 but now find the risk-reward less compelling. While certain sectors like AI and green tech show promise, the broader case for a reduced allocation centres on three primary pillars: persistent domestic economic headwinds, mounting geopolitical friction, and increasingly complex regulatory risks.

Reasons for increasing EM equities allocation:

As developed market growth moderates and US equity concentration reaches historic levels, EM offers a unique combination of structural growth, favourable macro-tailwinds, and a valuation "margin of safety."

Indeed, EM economies are expected to be the primary engine of global economic activity in 2026. Emerging markets are now contributing roughly two-thirds of total global GDP growth, driven by resilient domestic demand in India, Southeast Asia, and parts of Latin America. Forecasts suggest EM will grow at approximately 4.4% in this year, significantly outpacing the 1.5% projected for advanced economies. Unlike the aging populations in Europe and East Asia, many EM regions possess a "demographic dividend"—a young, expanding workforce that supports long-term consumption and infrastructure development.

The narrative that AI is purely a US large-cap story is dissolving. 2026 marks a deepening of the AI infrastructure rollout. Taiwan and South Korea remain indispensable as the world’s logic and memory chip hubs. As data centre demand surges, EM countries are the primary providers of the "picks and shovels"—from copper and lithium for power grids to the specialised electronic manufacturing services (EMS) found in Vietnam and India. Moreover, EM-based internet giants are increasingly embedding AI into their logistics and e-commerce stacks, driving margin expansion and higher-quality earnings.

The "monetary policy pivot" of late 2025 has created a benign environment for EM assets in 2026. As the Federal Reserve continues its easing cycle, a stable-to-weaker US dollar reduces the cost of dollar-denominated debt for EM governments and corporates, boosting local currency returns for global investors. Many EM central banks—particularly in Brazil and Mexico—entered the cycle with high real rates and have significant room to cut, providing a powerful tailwind for domestic equity markets. Contrary to historical stereotypes, many major EMs (Mexico, India, Brazil) currently maintain lower gross debt-to-GDP ratios than the US or Japan, signalling better long-term fiscal stability.

Finally, EM equities look like a positive contributor to a diversified portfolio in terms of valuation attractiveness and diversification. EM equities continue to trade at a significant discount to historical averages and developed market peers. This "rubber band effect" suggests high potential for a re-rating as capital rotates away from over-concentrated US mega-caps. The S&P 500 is increasingly dominated by a handful of tech names. EM provides access to a broader array of sectors—including financials, materials, and industrials—that are currently underrepresented in global portfolios.

ALTERNATIVES

We stay overweight gold and are increasing commodities from neutral to overweight.

In 2026, the case for commodities has evolved from a simple inflation hedge into a sophisticated "triple-play" on monetary easing, geopolitical security, and the AI-driven industrial revolution.

- The "Material-intensive" AI revolution

The 2026 investment landscape is dominated by the realisation that AI is not just a software story, but a massive physical infrastructure project.

AI data centres and the continued electrification of transport are driving a "copper supercycle." Analysts expect global copper consumption to grow by 2.8% in 2026, with supply struggling to keep pace due to decade-long mining permit delays.

Commodities like silver, aluminium, and tin are seeing unprecedented industrial demand. Silver has hit record highs due to its critical role in semiconductors, solar panels, and EV electronics.

As nations seek carbon-neutral, reliable power for AI, uranium is being repriced as a "national security asset" to fuel the nuclear renaissance.

- Monetary tailwinds & "the great migration"

As of January 2026, we are seeing a significant shift in capital from cash to "hard assets."

With the Federal Reserve in an easing cycle, the opportunity cost of holding non-yielding assets like Gold and Silver has dropped.

Total global sovereign debt has reached levels that make "hard money" a necessity. Gold has surged (surpassing $4,300/oz in recent peaks) as central banks—particularly in Emerging Markets—continue to diversify away from the U.S. dollar at record rates.

Historically, commodities tend to "catch fire" when real interest rates fall, a trend that is gathering momentum in the 2026 macro environment.

- Geopolitics and "just-in-case" stockpiling

The era of "just-in-time" global logistics has been replaced by a "just-in-case" strategic mindset.

Major economies (US, China, India) are aggressively stockpiling critical minerals to insulate themselves from trade wars and supply chain disruptions.

Ongoing tensions in the Middle East and South America create a permanent "risk premium" in energy prices. While oil supply remains high, any sudden disruption can cause violent price spikes that commodities are uniquely positioned to capture.

Refining capacity for critical metals remains highly concentrated, making broad commodity exposure a vital insurance policy against localised trade sanctions.

FIXED INCOME

Within fixed income, we are reducing the allocation to Government by reducing further the allocation to Govies 1-10 (already underweight) and increasing the allocation to Corporate Investment Grade (still neutral). We stay neutral High Yield and EM debt.

FOREX

We are neutral the dollar against all currencies.

The greenback is currently facing several headwinds.

Concerns over the massive US debt and government spending are weighing on the dollar's long-term "store of value" appeal. In 2025, we saw a sharp sell-off due to these structural worries, and those clouds remain in 2026.

Despite recent drops, the dollar is still considered overvalued by many metrics (like the Big Mac Index or CAPE ratios) compared to emerging market currencies

However, several factors provide a strong floor for the dollar, preventing further weakening.

First, the US economy continues to be a leader in the AI-driven industrial revolution. This technological dominance attracts "foreign direct investment" (FDI), as global firms must buy dollars to invest in US tech infrastructure.

Second, high yields on long-term US Treasury bonds, driven by the need to fund the deficit actually attract buyers, ironically providing a support level for the currency.

ASSET ALLOCATION GRID

TACTICAL ASSET ALLOCATION (TAA) – 17.12.2025

(Arrows show our latest TAA moves).

INVESTMENT CONCLUSIONS

Markets are entering 2026 with a solid foundation:

✅ We are observing a healthy rotation across sectors and commodities, indicating that earnings growth is finally decoupling from a narrow group of leaders.

✅ This outlook is further bolstered by a supportive policy mix: expanding fiscal stimulus, easing monetary constraints, and a stabilisation of the political climate.

✅ Regime change in Venezuela can increase market volatility and geopolitical uncertainty in the short run. In the long run, more barrels in an already oversupplied market could mean lower oil prices which is bullish for risk assets.

✅ Given that institutional positioning is not yet overextended and seasonal tailwinds remain favourable, the technical setup remains positive.

✅ While we anticipate some volatility, the fundamental pillars of broadening participation and accommodative policy support a constructive stance for Q1 2026.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)