The regain of interest in uranium is not merely a consequence of market dynamics but is deeply intertwined with the global pursuit of sustainable and clean energy solutions. The contemporary narrative around uranium is characterized by a juxtaposition of its historical stigma, primarily due to nuclear disasters such as Fukushima, and its newfound prominence as a green energy alternative. The shift in perception is fueled by a collective realization of the vital role nuclear energy can play in mitigating climate change and achieving carbon neutrality. Governments, investors, and energy enthusiasts are recalibrating their strategies and outlooks to incorporate uranium as a central element of the energy transition narrative. This article aims to explore the multifaceted dimensions of uranium as a commodity and asset, delving into its market dynamics, geopolitical landscapes, investment landscapes, and future prospects.

Uranium Market Dynamics

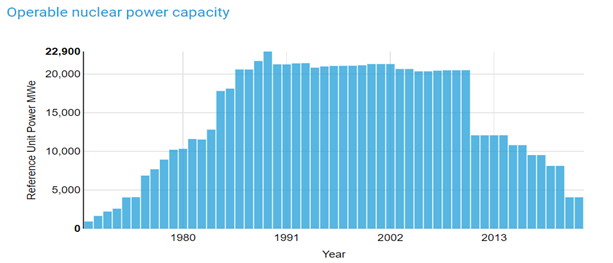

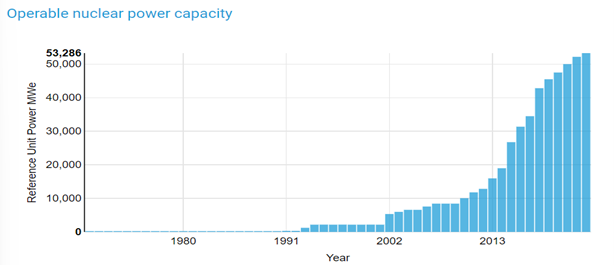

The trajectory of uranium as a commodity has been marked by periods of highs and lows, with infamous events such as the Fukushima disaster in 2011 casting a long shadow over the uranium market. The catastrophe led to a global reevaluation of nuclear energy, causing a substantial dip in uranium prices and a shift in market sentiment and public perception. Countries around the world scaled back their nuclear pro-grams, and the demand for uranium experienced a significant contraction. A notable example of actions taken to wean the country from its dependance on nuclear energy is Germany. Germany, following the 2011 Fukushima disaster in Japan, resolved to phase out nuclear power, initiating a systematic shutdown of its 17 reactors with the aim to complete the process by 2022. The country has since decommissioned several plants, including those located in Brokdorf, Grohnde, and Gundremmingen, and had planned to cease operations in the remaining three —Emsland, Isar 2, and Neckarwestheim 2— by the end of 2022. However, amidst energy crises and geopolitical tensions, namely the war in Europe, the German government has decided to maintain Isar 2 and Neckarwestheim as backup, reflecting the significant role nuclear power once held in the nation, contributing to 30% of its power generation in 2000, a figure that sharply declined to 6% in 2022. The reduction in nuclear power has led to an increased reliance on coal, energy imports, and a substantial investment in renewable energy sources, which now account for approximately 10% of Germany’s electricity production. If you are thinking this seems counterproductive, you would be right; nuclear power emits approximately 70 times less CO2 than coal and requires a minimal amount of material to power the plants. For context, one single pellet of uranium, just six grams in weight, can generate as much energy as 120 gallons of crude oil, as much as a ton of coal, and as much as 17,000 cubic feet of natural gas. It is undoubtably the most energy dense and efficient fuel source available to us. Just ten of these uranium pellets can power the average household for an entire year.

Despite the ongoing phase-out, in recent years the market has gradually rebounded as the global community has started to re-embrace nuclear energy as a viable and necessary component of a diversified energy mix. The realization of nuclear energy's potential to combat climate change and contribute to energy security has resurrected discussions and investments in the uranium sector. China serves as a prime example with 24 nuclear power units currently under construction, and more than 70 already planned. The country plans on generating 10% of its total electricity with nuclear power by 2035 and is constantly approving new nuclear plants in various provinces.

In the current landscape, the uranium market is experiencing dynamic shifts in supply and demand.

Operable nuclear power capacity Germany (top) vs. China (bottom) Source: World Nuclear Association

The demand for uranium is on an upward trajectory, driven by the increasing number of nuclear reactors coming online globally, while the supply side remains constrained due to previous underinvestments in uranium exploration and mining. These supply-demand imbalances have resulted in upward pressure on uranium prices, with projections indicating a sustained trend in the coming years. As with anything else, government policies and support have also played a crucial role in shaping the uranium market. Legislative frameworks, subsidies, and regulatory approvals are facilitating the development of nuclear projects and enhancing the attractiveness of uranium as a commodity. This supportive policy environment is fostering investments and innovations in the nuclear sector, further inflating the demand for uranium.

One such innovation is the FLEX reactor by moltexFLEX. This is a small and modular reactor, meaning the components can all be factory produced and easily transported, which reduces on-site work, increases significantly the speed of construction, and minimizes overall costs. Having no moving parts, these reactors are designed to run with minimal operator input and very low ongoing costs, being refueled just once every 5 years.

Geopolitical Landscape and Supply Chain

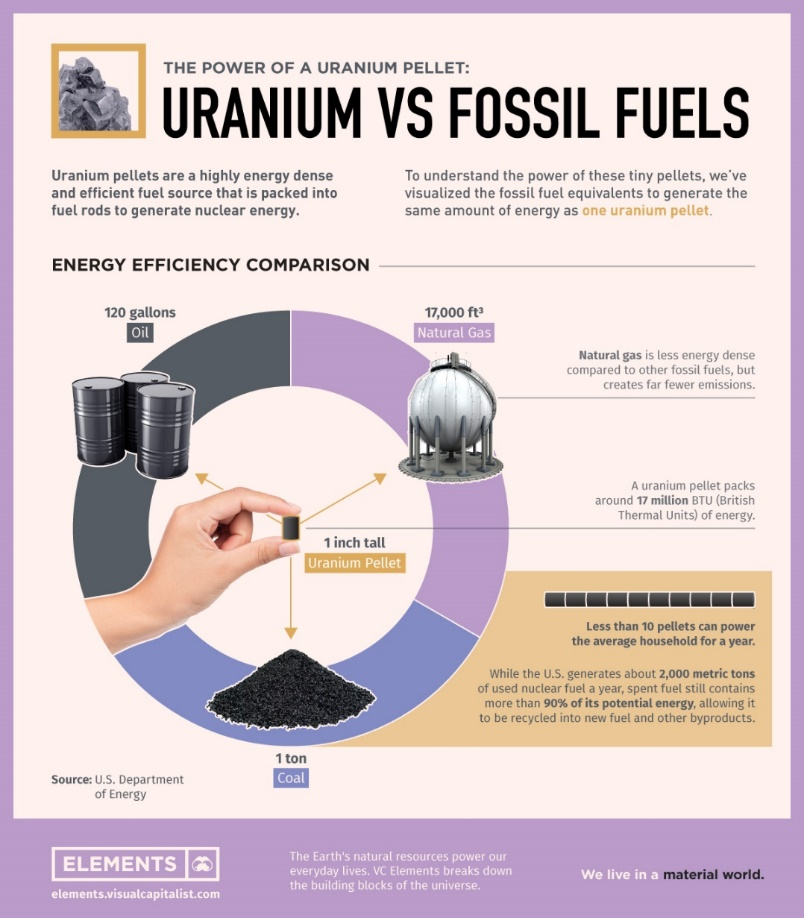

The global uranium supply chain is concentrated around a few key producing countries, each contributing significantly to the world’s uranium output. Kazakhstan, Canada, Namibia, and Australia are the leading producers, collectively accounting for approximately 77% of the global uranium production in 2022. These countries possess vast uranium reserves and have established extensive mining operations, positioning them as pivotal players in the uranium market. While Uranium is among the more common elements in the earth’s curst, approximately 500 times more common than gold, it’s these few countries where its extraction is the most economically viable, and where regulations allow it, and thus why they control the vast majority of its production.

The stability and productivity of uranium supply chains are often susceptible to the political climates and operational intricacies of the producing countries. For instance, Niger, the 7th largest uranium producer last year, has recently experienced political upheavals, raising concerns over its uranium production and, consequently, impacting global supply chains. The political instability in such regions poses risks to the continuity and reliability of uranium supplies, necessitat-ing close monitoring and strategic planning by stakeholders.

Operational challenges are also prevalent in the uranium production landscape. Issues such as diminishing stocks of chemical products have led to the temporary halt of operations in uranium sites in Niger. These operational intricacies underscore the complexities involved in uranium production and emphasize the need for robust operational frameworks and even more importantly, contingency plans. In light of all the ongoing geopolitical and operational challenges, there is a growing emphasis on diversifying uranium sources to mitigate reliance on specific countries. Efforts are underway to explore alternative uranium sources and develop new supply chains, reducing vulnerabilities to geopolitical uncertainties. The diversification strategies are aimed at ensuring a stable and secure supply of uranium, fostering resilience in the face of geopolitical disruptions, and facilitating the sustained growth in the nuclear energy sector that countries are after once more.

Investment Landscape

The revitalized interest in uranium has opened a plethora of investment opportunities for those looking to capitalize on the uranium upswing. One prominent avenue is investing in uranium stocks, which include companies involved in uranium mining, exploration, and production. These stocks offer investors exposure to the uranium industry’s growth potential and are a way to leverage the increasing demand for nuclear energy. ETFs (Exchange Traded Funds) focused on uranium are another viable investment option. Uranium ETFs provide diversified exposure to a basket of uranium-related stocks, mitigating the risks associated with individual company performance. This diversification makes ETFs a preferred choice for investors seeking balanced and risk-averse investment, reducing the impact of a sudden blow to any one particular stock in the uranium sector. It’s worth mentioning however that there is still some stock specific risk within these ETFs as their main holding is usually the Canadian leader Cameco Corp.

While the uranium market presents lucrative opportunities, it is also fraught with risks that investors need to consider meticulously. Political and regulatory risks are paramount, given the stringent regulations governing the nuclear industry and the geopolitical intricacies of uranium-produc-ing countries. Changes in government policies, regulatory frameworks, and political instability in producing regions, such as Niger, can significantly impact uranium supply chains and market dynamics. Another aspect to consider is the market volatility and price fluctuations which are an inherent risk in commodity investments, and uranium is by no means an exception. The uranium market has experienced substantial price swings in the past, incurring drawdowns of 75% at times, influenced by supply-demand imbalances, operational disruptions, and macroeconomic factors. Just three years ago an investor could theoretically have purchased all the shares in every listed uranium company in the world for under $12bn. It’s these drastic fluctuations that demand investors to be aware of these market dynamics and adopt prudent investment strategies to navigate the volatility inherent in the uranium market.

The Future of Uranium

The lifting of numerous nuclear moratoriums, instituted in the wake of the meltdown at the Fukushima Nuclear Power Plant, has catapulted uranium to a pivotal role in the global pursuit of carbon neutrality. We know that nuclear can greatly help reduce carbon emissions, and while that is great, renewable energy sources are also judged on their land footprint.

In this category nuclear beats out other renewable sources of energy yet again, with one of the lowest land footprints of 1,000 megawatts of electricity per year in just over a square mile. Solar, for comparison, would need a surface area of approximately 75 times that size and wind an area approximately 360 times that of nuclear. Nuclear power is also

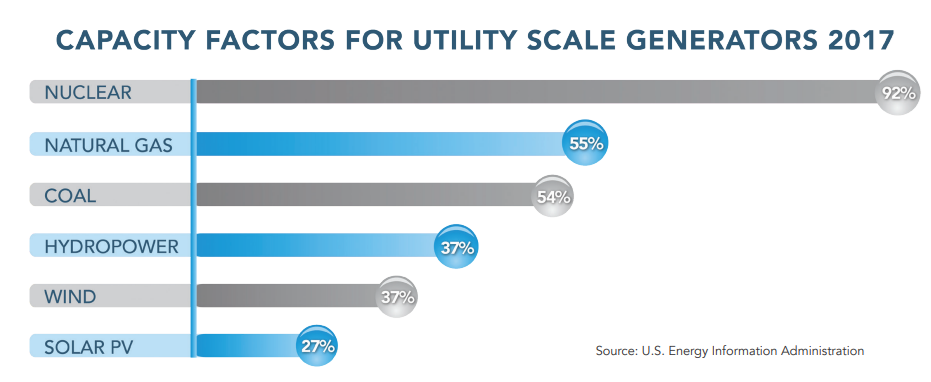

the most reliable energy source by a long stretch, with an impressive capacity factor of 92%. The capacity factor is a key metric in the energy sector. It gauges the efficiency and consistency of a power plant by comparing its actual output over a period to its potential output if it operated at full capacity throughout that period. This astoundingly high percentage for nuclear energy highlights its unparalleled reliability in the energy mix. For context, while nuclear consistently operates at near its maximum potential, other sources lag significantly behind. Natural gas and coal have capacity factors of 55% and 54% respectively, almost half of nuclear, and solar, often affected by its intermittent nature, trails with a capacity factor of just 27%. This disparity underscores the consistent and steady electricity supply that nuclear energy offers.

Research and development efforts are underway to explore new reactor technologies like the FLEX reactor, enhance safety protocols, and optimize the utilization of nuclear fuel. These innovations hold the promise of making nuclear energy more accessible, sustainable, and economically viable, further elevating the significance of uranium in the energy sector. The long-term outlook for uranium appears promising, with increasing recognition of its strategic importance in the energy transition and sustainable development. Morgan Stanley’s insights highlight the nuclear revival and the integration of ESG considerations in nuclear investments, emphasizing the alignment of nuclear energy with sustainability goals. This convergence of environmental imperatives and market dynamics is likely to sustain the demand for uranium for the foreseeable future, offering enduring investment opportunities for those in tune with the evolving energy landscape. Investors and stakeholders are optimistic about the sustained growth and investment potential in the uranium market. Overall, the investment landscape is teeming with potential, offering diverse avenues for participation, from uranium mining stocks to exchange-traded funds (ETFs) to investments in new technologies within the production and harnessing of nuclear power. The prudent investor, aware of the risks and rewards inherent in commodity investments, can leverage the dynamic uranium market to optimize portfolio performance and capitalize on the green energy revolution. In conclusion, the decisions made today in the uranium sector will have impacts through decades, influencing the trajectory of energy policies, environmental outcomes, and global economic stability.

Source: World Nuclear Association

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)