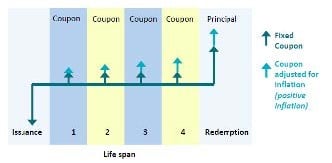

In simpler terms, as inflation ascends, the principal value of TIPS grows, and conversely, in times of deflation, it contracts. Crucially, TIPS come with a guarantee: investors will receive at least their initial principal at maturity, irrespective of persistent deflation. This innate safeguard positions TIPS as an attractive choice for safeguarding capital in the face of economic uncertainties.

Is it time to consider tips for your investment strategy?

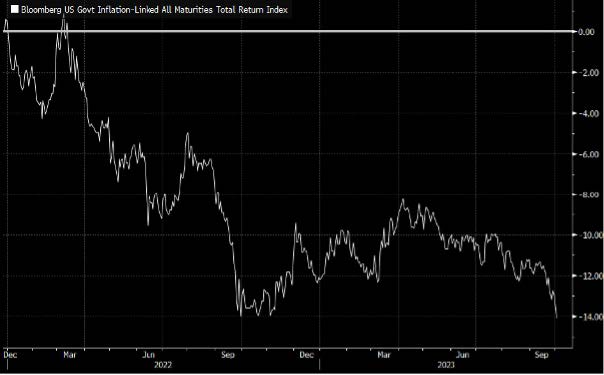

Despite a recent double-digit decline, TIPS now present an attractive valuation due to a significant rise in real rates. This asset class, with $3.5 trillion in the US, has experienced a significant double-digit decline since the beginning of 2022, despite high inflation. While the inflation-linked component provided a cushion of around 10% over 20 months, the surge in the 10-year real rate from -1.0% to 2.45% over the same period had a pronounced and negative impact on TIPS' total return, resulting in a decline of -15% (chart 1). Now, following the substantial increase in real rates, TIPS investments have reached attractive valuation levels.

A 10-year TIPS now offers a real rate of 2.4%, a level not seen since 2008. This is historically appealing, particularly when adjusted for the size of the Fed's balance sheet (chart 2).

Additionally, TIPS exhibit a lower beta compared to U.S. Treasuries, currently standing at 0.8 (beta duration to nominal bonds). This characteristic is valuable in the context of significant volatility in U.S. interest rates, with the MOVE index still exceeding 100. It also becomes important in the event of global economic deterioration, implying lower real rates. This consideration is increasingly significant as uncertainties surrounding inflation persist, driven by factors such as deglobalisation, supply shocks, increased fiscal spending, and the ongoing transition to renewable energy sources.

Furthermore, long-term breakeven rates, reflecting the market's expectations of long-term inflation, have remained remarkably stable at 2.35% (chart 3), only 5bps higher than at the start of the year, while the 5y5y inflation swap rate in the U.S. has surged to 2.8%. This reflects the market's structural concerns about sustained higher inflation.

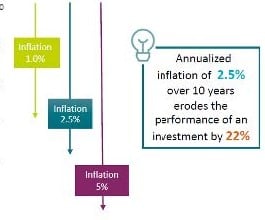

This, coupled with the cushion of almost 2.5% in real rates, underscores the compelling nature of TIPS as a vital addition to long-term investment strategy.

1. Performance of US TIPS since the beginning of 2002

2. 10-year US real yield (%) vs the Fed's balance sheet as a % of GDP

3. 10-year US breakeven rate (%)

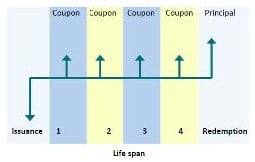

Unraveling the mechanism

TIPS function on a unique mechanism (chart 4) that distinguishes them from traditional bonds. Semi-annual adjustments to the CPI ensure their value remains aligned to real-world economic conditions. In contrast to conventional bonds that pay interest on the original principal, TIPS recalculate their interest payments according to the adjusted principal. Yet, the most remarkable facet of TIPS is their built-in protection against deflation. If, by maturity, the adjusted principal drops below the bond's original value due to prolonged deflation, the U.S. Treasury steps in to ensure investors receive at least their initial investment. This feature effectively shields an investor's capital from economic downturns.

Dispelling misconceptions about TIPS

TIPS are often subject to misconceptions that can influence investor decisions. Firstly, some believe they are only suitable for retirees or conservative investors. However, their inflation-protective feature is valuable for investors of all ages and risk profiles, especially in inflationary environments. Another misunderstanding is that TIPS offer absolute protection against all forms of inflation. In reality, TIPS are indexed to the CPI, which may not capture all inflationary pressures, such as asset inflation in stocks or real estate, which isn't fully reflected in the CPI. Additionally, many believe that the interest rate on TIPS adjusts for inflation. While the principal is adjusted, the interest rate remains fixed. However, interest payments vary due to the adjusted principal, leading to the misconception of a fluctuating rate.

Navigating real rates with TIPS

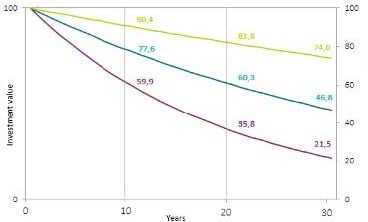

To understand TIPS, one must first grasp the concept of real rates. Real rates represent the rate of return on an investment after accounting for inflation. It's the rate that reveals the true purchasing power of your money after considering the effects of inflation. By design, TIPS are closely tied to real rates. Their yield which is often referred to as the "real yield," is essentially the return an investor can expect after inflation adjustments. The dynamics of the financial markets mean that real rates can fluctuate, and, in some cases, the fluctuations are dramatic. A recent example of this was in 2022.

Despite being in a period of high inflation, where one would expect TIPS to perform well, many investors in TIPS experienced negative returns. The primary reason for this being a sharp rise in real rates. Even as TIPS adjusted for inflation, the rapid jump in real rates offset those adjustments, leading to diminished returns. This scenario was a critical lesson for investors that while TIPS offer a hedge against inflation, they are not immune to the broader movements in real rates, and understanding this interplay is crucial for informed investment decisions.

Historical Performance of TIPS

Since their introduction in 1997, TIPS have etched a prominent space in the fixed income market. Historically, they have demonstrated their resilience during periods

of heightened inflation, acting as a reliable hedge. Even during the 2008 financial crisis, while they experienced volatility, TIPS rebounded quickly, underscoring their defensive characteristics in diversified portfolios.

In lower inflation environments, they may have occasionally underperformed nominal bonds, but they consistently provided a real, inflation-adjusted return, preserving purchasing power. Over the years, TIPS have stood as a stabilising force in investment portfolios, especially in the face of unpredictable inflation trends.

The appeal of TIPS in today's economic climate

With current real interest rates, TIPS hold strong appeal. Growing consensus among economists and market analysts hints at potential structural changes in inflation dynamics. Factors like global supply chain disruptions, stimulus measures, and robust labour markets suggest the possibility of higher inflation. In such an environment, TIPS' value proposition becomes more pronounced.

Its ability to adjust both principal and interest payments in line with inflation ensures investors stay ahead of rising prices. TIPS aren't confined to fixed income portfolios; in multi-asset contexts, they enhance diversification by offering unique correlations with other asset classes and formidable inflation-hedging properties. All these factors, coupled with a cushion of nearly 2.5% in real rates, position TIPS as a compelling addition to long-term investment strategy.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)