Vietnam’s economic development

Vietnam's journey from a centrally controlled economy to one of the most dynamic emerging countries in the East Asia region is an economic success story. Since the launch of Đổi Mới (renovation) in 1986, a series of economic reforms, coupled with beneficial global trends, propelled Vietnam from one of the world's poorest nations to a lower middle-income country within a generation. This transformation has seen Vietnam's GDP per capita increase 3.6 times between 2002 and 2022, reaching nearly $4,200. Poverty rates have seen a significant decline, from 14% in 2010 to 5.7% in 2023.

After lifting health restrictions, the economy rebounded strongly with an 8% growth rate in 2022. However, by 2023, growth had slowed to 3.1%. This deceleration was due to a combination of external shocks, such as declining global demand and US monetary tightening, and internal factors, including a property sector crisis and a confidence shock in the financial sector. These issues highlighted Vietnam's macro-financial vulnerabilities, notably its low foreign exchange reserves, and banking system weaknesses.

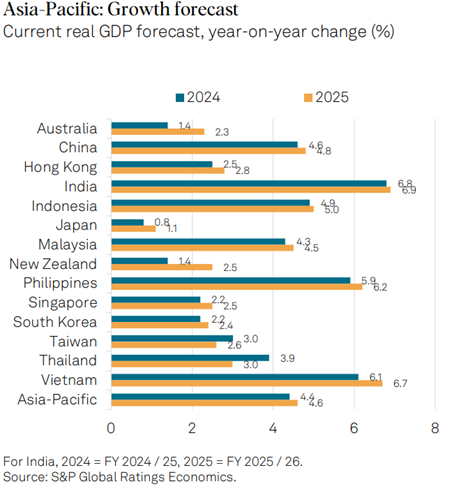

Despite these challenges, Vietnam's economic outlook remains strong, supported by the burgeoning export manufacturing sector and substantial foreign direct investment (FDI) inflows. Vietnam is anticipated to experience the highest growth in Southeast Asia, with projections of 6-6.5% in 2024, driven by exports, services (including tourism), robust imports, and stronger manufacturing activity. The economy's growth momentum is expected to maintain an annual rate comfortably above 6% in the subsequent quarters.

Source: S&P Global Ratings Economics

The economic expansion has also benefited from a favourable interest rate environment, with the State Bank of Vietnam cutting interest rates by 150 basis points to 4.5% in 2023. This adjustment encouraged companies to borrow at around 4-5% (7-8% at the beginning of 2023) for working capital and capital expenditure, further supporting economic growth. Inflation is forecasted to be at 3.5% in 2024, enabling the Vietnamese government to continue its accommodative monetary and fiscal policies.

Why Invest in Vietnam?

Strategic location, young demographics, and favourable business environment

Vietnam's appeal to investors is clear: a prime location in Southeast Asia, a youthful and educated population, and a business-friendly environment. Situated at the centre of ASEAN, it offers direct access to nearby countries such as China, Thailand, and Malaysia, making it a key hub for regional operations. Vietnam boasts a young (median age 33 years) and educated (literacy rate of 97%) nation of 100 million people.

Actively engaging in significant trade deals, Vietnam is part of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the EU-Vietnam Free Trade Agreement (EVFTA), and the ASEAN Free Trade Area (AFTA), which collectively grant Vietnamese exports preferential access to a market of over 500 million people. Moreover, Vietnam is undertaking substantial efforts to enhance its business environment, streamline bureaucratic processes, and attract foreign investment, all of which have contributed to the expansion of its industrial sector in recent years.

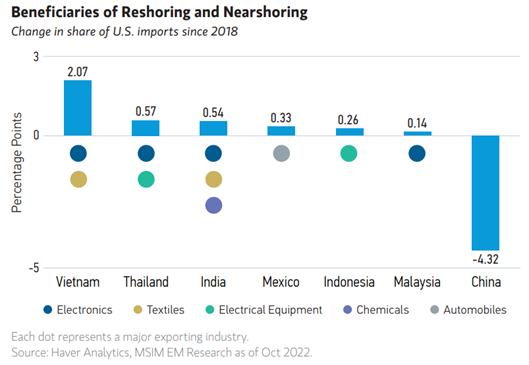

ChinaPlusOne Strategy

Against the backdrop of ongoing trade tensions between the US and China, exacerbated by rising labour costs and geopolitical challenges, companies are actively seeking alternative manufacturing destinations. In this context, Vietnam emerged as increasingly appealing destination for foreign investment and a viable alternative to China as a manufacturing hub.

Vietnam's strategic location, abundant natural resources, and a burgeoning skilled workforce make it an attractive prospect for companies looking to move away from China. Tech giants including Apple, Dell, Google, Microsoft, and Intel, all diversified their supply chains through investments in Vietnamese facilities in recent years, as part of a “ChinaPlusOne” strategy. Vietnam's manufacturing sector remains highly attractive to both international and domestic investors, particularly in the smartphone supply chain and consumer electronics., This was evidenced by Apple’s supplier Luxshare Precision Industry, $504 million investment in a Vietnamese facility. Its rival, Samsung Electronics, produces half of its smartphones in Vietnam and has invested a total of $22.4 bn in the country. Dutch chipmakers are also joining the trend, with BE Semiconductor Industries planning a $5 million investment in factory space. Looking ahead, Vietnam aims to expand its semiconductor manufacturing capabilities, with plans to train 50,000 engineers by 2030, indicating its commitment to become a key player in the global semiconductor industry.

Source: Morgan Stanley March 2023

FDI to transform the economy

Since joining the World Trade Organisation in 2007, Vietnam has seen a remarkable influx of foreign direct investment (FDI), which has been pivotal in transforming its economy into a significant manufacturing and export hub.

This period marked a notable shift towards an export-driven model, with goods exports leaping from 57% of GDP in 2011 to an impressive 91% in 2022. During this time, Vietnam's share in global exports tripled from 0.5% to 1.5%, with the share of sales of telephones, computers, and other electronic goods accounting for 32% of total exports.

Despite a temporary setback during the COVID-19 pandemic, where net FDI inflows averaged $15.3 billion annually, down slightly from the pre-pandemic average of 4.7% of GDP, Vietnam's FDI inflows have shown resilience and growth. In 2023, inbound FDI inflows rebounded significantly to $36.6 billion, up 32% year-on-year, with half originating from Greater China

This wave of FDI is not just numbers on a balance sheet, it is manifesting in substantial projects, particularly in the manufacturing sector ($62bn invested in over 4600 projects) and in major infrastructure investments like the construction of Long Thanh International Airport.

Source: Le Toan

Source: Le Toan

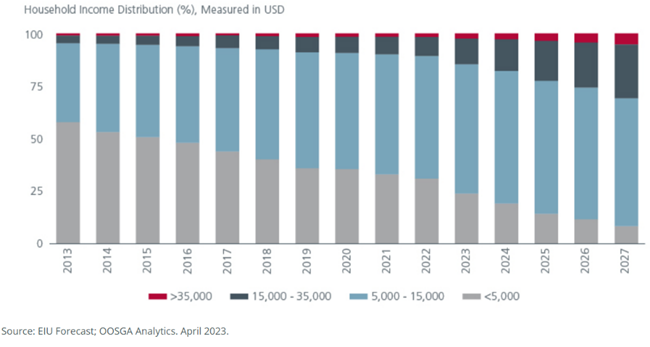

Rising middle class in Vietnam driving new trends of consumption.

The Vietnamese economic growth is accompanied by a steady expansion of the middle class (daily expense higher than $12 as defined by World Data Lab), a demographic segment with major impact on the consumer market. Based on this definition, the middle class in Vietnam is estimated to comprise around 13 million people, representing about 13% of the total population and is expected to double (30%) by 2026. This demographic shift signifies not just an upturn in disposable income but also a heightened demand for diverse goods and services, offering investors and businesses a lucrative opportunity to penetrate the Vietnamese market.

Source: Eastspring investments

The rapid expansion of Vietnam's youthful middle class is significantly enhancing its appeal to international brands. Coupled with an increase in the average income, this demographic evolution aligns with a rise in smartphone usage and internet access, thus fuelling a surge in e-commerce. With the country's online market value expected to hit $39 billion by 2025, Vietnam is positioned to become Southeast Asia's second-largest e-commerce market after Indonesia.

Upgrade into MSCI Emerging markets index to be expected

Vietnam remains excluded from the MSCI Emerging Markets Index, despite demonstrating qualities commonly associated with emerging market economies. This absence can be attributed to its historical conflicts, including colonial rule and communist governance, which hindered its ability to embrace foreign investment and establish robust corporate governance systems.

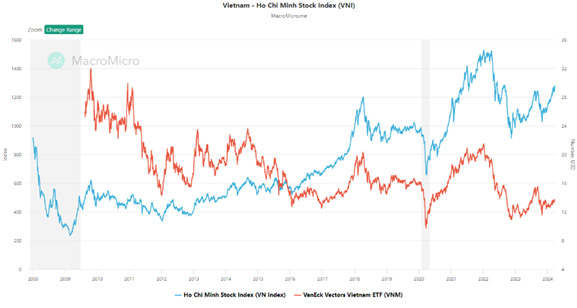

After losing over 30% in 2022, the Vietnam Ho Chi Minh Stock Index (VN-Index) recovered by around 12% in 2023. Average daily trading volume also increased, from $500 million in 2022 to $1 billion a day in 2023, according to Andy Ho, chief investment officer of VinaCapital, one of the country's largest investment management companies. " Now is the right time for investors to enter Vietnam stocks" he suggested on CNBC, pointing to inexpensive valuations (11 to 12 times earnings for 2023, a 20% discount to the regional average). The Vietnamese stock market is also becoming more diversified, with the top five stocks accounting for 23% of the VN-Index, compared with 53% ten years ago.

Source: MacroMicro

Source: MacroMicro

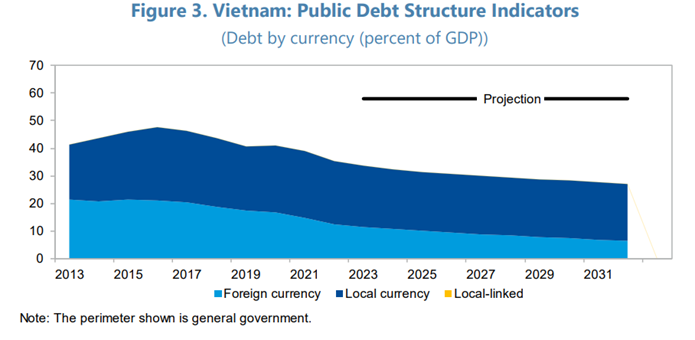

Vietnam’s trade surpluses strengthen its external solvency

With imports of goods experiencing a sharper decline compared to exports in 2023, coupled with improvements in the balances of services and income, Vietnam witnessed a substantial current account surplus exceeding $22 billion, equivalent to over 5% of GDP. This surplus, a record level for Vietnam, indicates a strengthening of its external solvency and liquidity position. Thanks to these surpluses, the external debt is moderate, estimated at 36% of GDP and 44% of goods export receipts in 2023.

Souce: IMF

Souce: IMF

However, Vietnam's foreign exchange reserves remain a point of concern. Although they slightly recovered in 2023, following a decline in previous years, they still cover just over three months of imports of goods and services, raising the need for sustained efforts to stabilise and enhance reserves in the face of significant capital outflows observed in recent years.

Bumps in the road…

Investing in Vietnam can be gratifying, but it also carries its share of challenges.

Firstly, Vietnam’s real estate sector, once buoyed by rapid growth, now exacerbates the nation’s debt burden through escalated bond issuances from US$12 billion in 2020 to US$26 billion by the end of 2021. This surge in financing was a reaction to liquidity crises faced by overleveraged firms during the COVID-19 pandemic downturn, leading to a massive jump in bond issuances connected to real estate. The sector's struggles were further highlighted by regulatory scrutiny following global market tremors caused by the Evergrande default and exacerbated by geopolitical tensions and inflationary pressures, which led to regulatory reforms and increased interest rates, tightening liquidity further.

Additionally, multinationals dominate the export sector, accounting for 75% of foreign sales. The domestic stock market is therefore overly exposed to banks and real estate developers (50% of equity market), who in turn are exposed to currency risks. It is worth mentioning that the Vietnamese Dong is not a freely convertible currency and may not always be taken out of Vietnam.

Moreover, Vietnam is the third-most exposed country to flooding in the world. Urban centres like Ho Chi Minh City and Hanoi confront persistent flooding, magnified by climate change and infrastructural deficits. This poses significant risks for investments and requires risk mitigation strategies. More than 4,000 flood-proof houses have been built since 2018 by the joint efforts of United Nations Development Programme and the national government.

Conclusion

Vietnam's strategic location, skilled workforce, rising middle class, balanced foreign policies, robust FDI climate, and status as a manufacturing hub justify its investment appeal. The land of the rising dragon must harness its strategic advantages to achieve its ambitious 2045 vision.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

For as long as markets have been open, traders have been exploring different techniques to earn quick profits on the financial markets. Among the various strategies pursued is the "Turtle Trading" system. Developed in the early 1980s by commodity traders Richard Dennis and William Eckhardt, this system was at the heart of an experiment to determine whether anyone could be trained to become a successful trader. They formed a group nicknamed the "Turtles", who generated over $175 million in combined profits over five years, proving the effectiveness of this method. This article provides an overview of the "Turtle Trading" programme, illustrating its origin, principles, and current relevance.

At the end of the week, a major event will take place in the cryptocurrency world. It's called the bitcoin halving. Scheduled 15 years ago, this process occurs approximately every four years, making bitcoin rarer over time. Preview below.

Why the end of negative interest rates is no obstacle to the continued bull market in Japanese equities?

.png)