THE GREEDFLATION PHENOMENA

Since 2021, the global economy has been experiencing inflationary pressures from both supply and demand. First there were the supply chain disruptions associated with the pandemic, then those caused by the war in Ukraine. On the demand side, high-income households used their savings during the lockdowns to spend lavishly in the post-covid era, which stimulated demand and de facto pushed up prices.

However, there is another inflationary factor that is not found in the traditional economic model of supply and demand. This factor could be at the origin of at least half of the price increases observed in developed countries: it is "greedflation", i.e., the tendency of companies to take advantage of rising prices to generate excessive profits.

The idea is simple: when world prices rose because of supply and demand, companies raised their prices. But they didn't just raise them to cover higher costs. They have fueled inflation with price increases that go beyond the rise in raw material costs and wages, pushing their revenues to record levels.

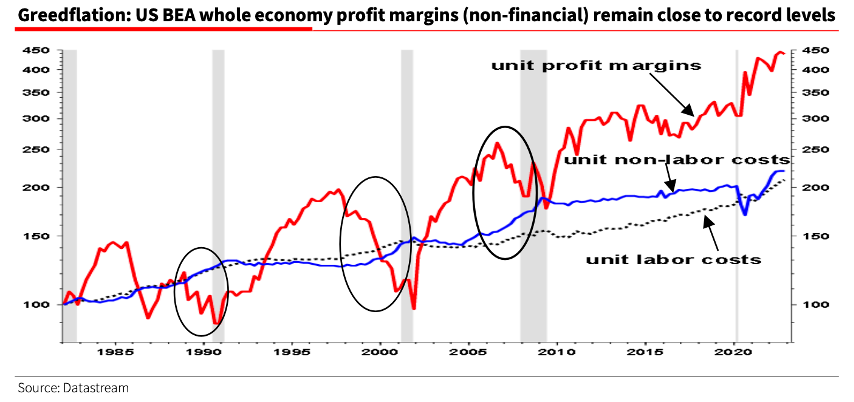

Across the world, corporate profits have surprised with their strength and resilience. In the U.S., profit margins are the highest they have been in 70 years, despite rising costs (wages, raw material prices, etc.). In the UK, margins for the 350 largest publicly traded companies are 74% higher than before the pandemic and in Spain, profit margins in 2022 were 60% higher than in 2019.

According to economic theory, the high prices charged by these companies will eventually weigh on demand, causing prices to fall. On the other hand, a competitive market allows other companies the opportunity to gain market share by lowering their prices. However, some sectors have become so concentrated that competition is not able to play a deflationary role.

Indeed, the phenomenon of "greedflation" is particularly visible in sectors that are in a quasi-oligopoly situation. Let's take the example of the energy and food sectors. Six oil giants dominate global energy production. In the United States, four companies control 55-85% of meat sales.

According to an analysis by Unite of about 100 company accounts in the U.K., the increase in profit margins is the result of "tacit collusion" among large companies.

Unite said it also looked at the accounts of international companies that sell services and materials that directly affect inflation figures in the U.K.

"The four global agribusiness giants that dominate crucial crops such as grains - ADM, Bunge, Cargill and Louis Dreyfus - saw their profits jump 255 percent to a total of USD10.4 billion in 2021. The world's top 10 semiconductor manufacturers alone made GBP44 billion in profits, 96 percent more than in 2019," the report said.

The energy and food sectors made staggering profits in 2022. 95 companies made USD306 billion in windfall profits. But what is most striking are the profit margins. Some argue that the windfall profits are simply the product of companies passing on rising costs to consumers. However, the increase in margins suggests that companies are taking advantage of the crisis to increase their profits. In other words, there is more inflation observed on the top line than on costs. A study by Equals found that 76% of companies increased their net profit margins in 2022. In the energy sector, 71% of companies increased their profit margins. According to the same study, 85% of food companies increased their margins. Some subsectors saw particularly notable profit increases: synthetic fertilizer manufacturers increased their profits by an average of 10 times, meat companies by five times, while agricultural equipment and raw material traders increased their profits by almost two times.

Not surprisingly, some of these industries are in the crosshairs of regulators: the U.S. meat industry has been targeted by the Biden administration's plans to boost competition in the industry.

In the U.S., government statistics highlight "greedflation". A study by the Economic Policy Institute in the U.S. calculated that 54% of the price increase could be attributed to increased profit margins, while labor costs accounted for less than 8%. This clearly shows that not only do companies benefit from inflation, but their excess profits fuel inflation. While a wage-driven inflationary spiral was discussed in the 1970s, it is a profit-driven inflationary spiral that is now occurring.

According to Equals magazine, a USD100 grocery bill in 2021 would have cost USD110 in 2022. If grocery companies had maintained their previous margins, that 2022 bill would have been USD106 instead.

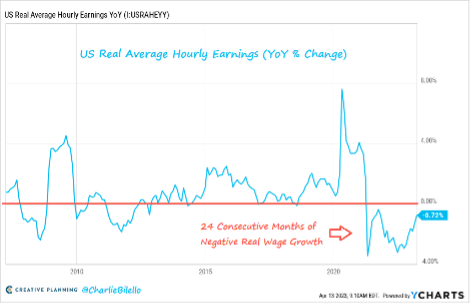

The phenomenon of greedflation calls into question the wisdom of central banks fighting rising wages at all costs. The above analyses show that greedflation has played a much more important role than rising wages. In fact, it is the inflationary spiral caused by greedflation that threatens to lead to an inflationary spiral in wages, not the other way around.

.png)