Who is Nvidia ?

Nvidia Corporation is a technology company specializing in the design and manufacture of graphics processing units (GPUs), systems-on-a-chip (SoCs) and other related products. Like electrical switches, the electronic chips marketed by Nvidia contain billions of switches that simultaneously process complex information. Today, they are an integral part of many AI functions, from OpenAI's ChatGPT to image generation. In all, 65,000 companies worldwide use the company's chips for a wide range of functions. Nvidia's main competitors are AMD, Intel and Qualcomm.

Founded in 1993 by Jensen Huang (current CEO), Chris Malachowsky and Curtis Priem, Nvidia is headquartered in Santa Clara, California. Nvidia GPUs are widely recognized for their high-performance capabilities and are used in a range of applications beyond gaming (Xbox, PlayStation 3, Nintendo Switch), including scientific research, artificial intelligence (AI), deep learning, autonomous vehicles, and other fields. These graphics chips have become a crucial element in the acceleration of computing tasks that require massive parallel processing power.

Nvidia is a "fabless" company, i.e. it does not manufacture its own graphics cards, focusing solely on graphics chips (GPUs). It supplies manufacturers (MSI, Asustek, Gigabyte, EVGA, XFX, etc.) with its GPUs, providing them with a reference model and giving them the choice of keeping this design or applying their own.

At the start, Nvidia initially targeted the video game industry and its graphics cards. Six years later, the company created its flagship product, the GeForce, the first graphics processor in history, which would power Microsoft's Xbox console.

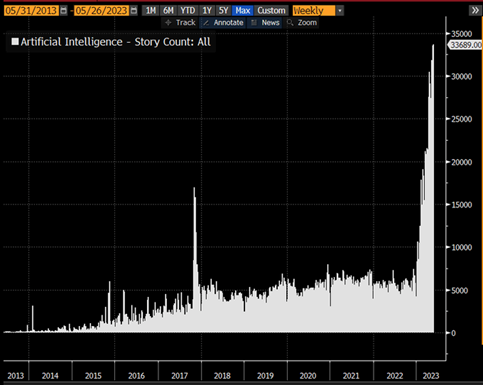

Nvidia waited until 2012 to really take the plunge into artificial intelligence, taking part in the AlexNet network, a pioneer in facial recognition. Ten years later, Nvidia AI Enterprise is one of the market leaders with its platform for generating images, text and computer code, the source of ChatGPT's digital language.

The chipmaker has already launched production of a new AI supercomputer platform called DGX GH20. Google Cloud, Meta and Microsoft are the first companies in the world to have access to it. According to Nvidia, this platform is intended for research into areas not yet explored by artificial intelligence.

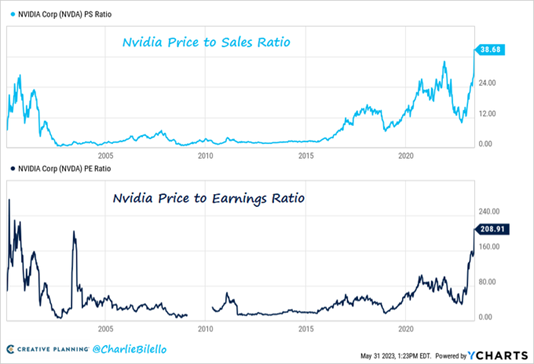

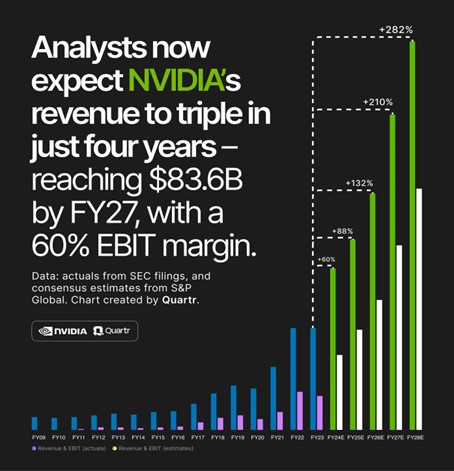

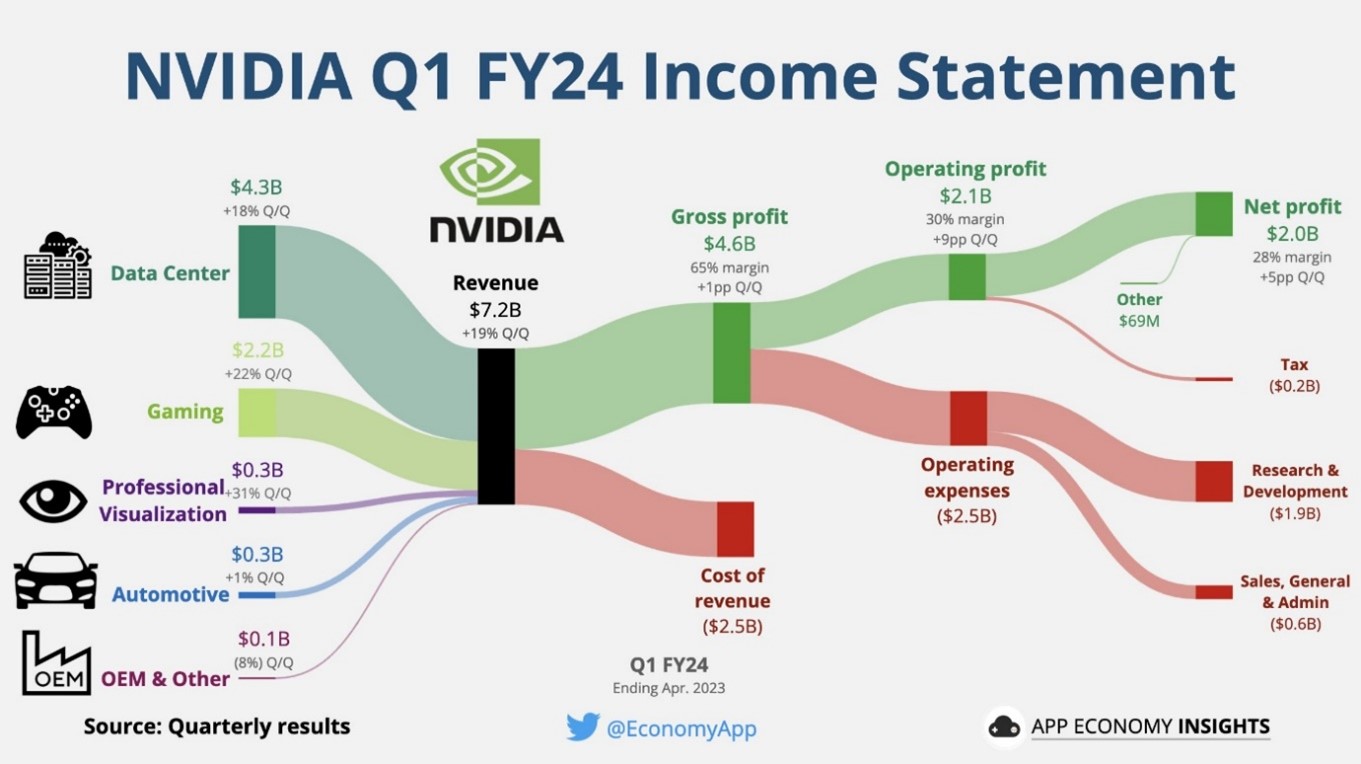

In Q1 of its fiscal year 2024 (end of April 2023 in calendar year), Nvidia generated sales of $7.2 billion. The data centre division was by far the largest, with $4.3 billion versus $2.2 billion for the gaming division.

In terms of profitability, Nvidia has a gross margin of 65% and a net margin of 28%. In Q1, Nvidia generated net income of $2 billion. Growth prospects for the rest of the fiscal year have been revised upwards considerably.

Source: App Economy Insights

.png)