The rise, the hype and the fall

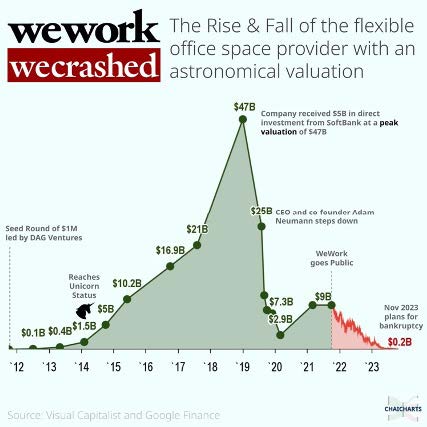

Founded in 2010 by Adam Neumann and Miguel McKelvey, WeWork initially positioned itself as a disrupter in the office space sector. The company offers short-term rental solutions for collaborative workspaces to individuals and companies. WeWork's offices are characterised by a vibrant yet relaxed atmosphere, with bright, modern décor, and the unique offer of unlimited (!) alcohol in its offices. WeWork has deliberately positioned itself as more than just a provider of cheap office space and technology, but as a company striving to fulfil a "mission" to "raise the consciousness of the world". In 2019, Masayoshi Son's SoftBank valued WeWork at $47 billion, sparking an unprecedented buzz around the company.

However, signs of trouble began to appear as WeWork prepared for its 2019 IPO. In urgent need of funds, the company sought to go public that year. Nevertheless, the IPO was halted due to governance issues and poor financial performance within the company. This led to Mr. Neumann's resignation as CEO, following criticism of his unconventional management style. SoftBank stepped in and took WeWork public in 2021 with a valuation of $8 billion.

The COVID-19 pandemic exacerbated the situation, dramatically reducing demand for shared office space as remote working became more widespread. Many companies abruptly terminated their leases, while the ensuing economic downturn prompted more customers to go out of business.

"First, and most obviously, there was the pandemic. Who foresaw that nobody would be allowed to go into the office like in the good old days? The pandemic didn't just increase the number of vacant offices, it literally decimated the office space market," said Anthony Sabino, an expert in the bank-ruptcy field.

WeWork has long struggled with financial instability. In September, the company carried out a 1-for-40 reverse split to bring its shares back above the $1 mark, an essential condition for maintaining its listing on the New York Stock Exchange.

Last month, WeWork revealed its inability to meet interest payments amounting to $95 million. In the first half of this year, WeWork posted a loss of over $1 billion, mainly due to the considerable expenses associated with running its offices and additional operational costs. According to the FinShots report, by the end of 2022, WeWork had $15 billion in rent payable and over $3 billion in short-term loans.

The company's considerable financial losses and internal transactions were widely covered by the media, notably in the Apple TV series "WeCrashed”. The series illustrated several scenes showing the charismatic co-founder's exuberant life-style as he built the symbol of the "cool office" from a simple property in New York City.

Life after Chapter 11

Plagued by long-standing financial difficulties, WeWork Inc. and certain of its entities filed for Chapter 11 bankruptcy protection in New Jersey federal court on Monday, Novem-ber 6, 2023. WeWork's market capitalisation is now less than $50 million. As stated in the company's press release, the bankruptcy filing concerns only its U.S. and Canadian oper-ations. Currently in the red, WeWork faces billions of dollars in debt. Former co-founder and CEO Adam Neumann, while acknowledging the disappointment of the filing, remains opti-mistic about the possibility of a successful recovery through reorganisation.

The key aspect of the bankruptcy is that it is placed under Chapter 11, which allows the company to continue operations and restructure its assets, as opposed to Chapter 7, which would involve liquidation and a forced sale of its assets at discounted prices. WeWork has committed to a restructur-ing support agreement, backed by major financial players including SoftBank, aimed at significantly reducing its existing debt as part of the restructuring process. "They need to raise capital and resize their real estate portfolio, negotiating more favourable lease terms or rejecting lease terms. These are often the two drivers of a Chapter 11 bankruptcy filing," said Sarah Foss, global head of legal at Debtwire.

Around 92% of the company's lenders have agreed to convert their debt into equity. The conversion is expected to eliminate around $3 billion of the company's total debt, which exceeds $18 billion. While significantly altering its operational structure, WeWork has not lost the support of key stake-holders such as SoftBank, which owns around 71% of the company, as well as hedge funds such as King Street Capital Management and Brigade Capital Management. These enti-ties have expressed their interest in taking control of WeWork during the bankruptcy proceedings and eventually becoming owners upon its emergence from bankruptcy.

The restructuring plan will also enable WeWork to reduce its portfolio of office leases. Tenants should see a strate-gic rebalancing of the company's office lease agreements. WeWork has defined a comprehensive lease rejection plan aimed at optimising value and operational efficiency, spe-cifically targeting leases deemed "largely non-operational". This intentional approach also serves as leverage to negoti-ate more favourable terms for retained leases. Although the specific offices to be retained remain uncertain, WeWork has communicated advance notices to relevant members in cases where lease rejection is being considered.

For tenants outside the USA and Canada, WeWork is commit-ted to business as usual. Franchises worldwide are expected to operate as usual in the majority of the more than 700 loca-tions worldwide and around 730,000 members.

Impact on the coworking sector industry

After studying WeWork's accounts since its IPO, Rett Wallace, CEO of Triton Research Inc. pointed out that WeWork's business model was designed for long-term growth, which implied losses over several years. However, the real estate market has faced significant challenges, marked by interest rate hikes and disruptions caused by the pandemic. Although companies are advocating partial returns to office space, the overall vacancy rate remains high. This translates into signif-icantly lower prices, higher tenant turnover and weak rental demand across the office property market. Wallace points out that even with a compelling consumer value proposition, when faced with adverse economic conditions, economic factors "inevitably take over", shaping the trajectory of com-panies such as WeWork.

Tobias Kollewe, President of the German Federal Association of Coworking Spaces (BVCS), takes a different view, calling WeWork a clear case of mismanagement and arguing that the company's difficulties should not be attributed to the general state of the coworking industry. According to Kollewe, "coworking is a success story". Surveys conducted in the sector point to a notable increase in demand for short-term office rentals, reflecting a growing acceptance of hybrid working practices among businesses. A study carried out in June by CBRE, a global leader in commercial real estate and investment services, showed that European companies are increasingly keen on flexible workspaces. The results indicate that some companies are now willing to allocate more space to flexible offices than in previous years.

In addition, a recent study by Market Reports World estimates the current value of the coworking space market at $19 billion and forecasts an annualised growth rate of almost 17% to 2028. Mark Dixon, founder of IWG, WeWork's competitor, points to the acceleration of his company's global growth due to the rise of hybrid working trends.

"Today, companies of all sizes are terminating their long-term commercial leases and replacing them with shorter-term agreements with flexible workspace providers such as IWG," said Dixon (DW).

"Today, companies of all sizes are terminating their long-term commercial leases and replacing them with shorter-term agreements with flexible workspace providers such as IWG," said Dixon (DW).

The Swiss-headquartered company, which enjoys an exten-sive global presence with almost 3,500 sites in over 120 countries, reached a historic milestone by posting the highest quarterly sales in its 30-year history on Tuesday, November 7, 2023. Dixon has confirmed that the company is actively studying the possibility of acquiring additional premises from WeWork. This strategic move demonstrates IWG's interest

in expanding its presence and potentially capitalising on the challenges facing WeWork.

Can WeWork rise from its ashes?

Despite the current challenges, the prospect of a WeWork renaissance seems plausible, albeit within a more stream-lined framework. Analysts expect the company to survive by downsizing or merging with a competitor. The WeWork brand should survive even in the event of a merger. Thanks to the involvement of numerous stakeholders, including tenants and employees, the likelihood of WeWork disappearing altogether is considered low.

Moreover, it is quite possible that Soft-Bank will inject additional funds into WeWork to survive the bankruptcy proceedings and avoid any legal action. Accord-ing to Hynes, Debtwire's Global Head of Credit Research, this probability stands at 99% and plays a crucial role in WeWork's financial restructuring. Nonetheless, it is to be expected that the restructuring will give rise to a significant amount of litigation, pointing to a complex and rocky road ahead for WeWork's resurrection.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)