The Grayscale Bitcoin Trust

Founded with the aim of bridging the gap between traditional investment vehicles and the burgeoning world of digital assets, Grayscale Investments has rapidly established itself as a disruptive player in the financial sphere. The Grayscale Bitcoin Trust, listed on the US OTC market (Ticker: GBTC), has quickly become a go-to investment vehicle for investors seeking exposure to bitcoin without the complexities associated with direct ownership of cryptocurrencies.

Grayscale's ambition has always been to one day convert the Bitcoin Trust into a 'spot' bitcoin ETF. Indeed, the Grayscale Bitcoin Trust is a closed-end fund that currently holds the equivalent of $16 billion in Bitcoin currency (BTC). As GBTC is a closed-end fund, it trades at discounts and premiums to the Trust's Net Asset Value (NAV). At the beginning of last week, GBTC was trading at a 25% discount to its net asset value (NAV).

Why such a discount? Quite simply because there are more shares on the market than people want to buy, which has created this perpetual discount. What's more, the GBTC's fiduciary structure makes it inflexible in the face of constantly changing supply and demand.

Thus, when GBTC was the only vehicle for gaining exposure to bitcoin via a listed instrument on a traditional exchange, market demand outstripped supply and GBTC shares traded at a premium, in other words, at a higher value than the bitcoins held by the Trust. This premium was observed for most of the 2015-2019 period. But when supply outstripped demand, around the time bitcoin futures ETFs became available, the premium disappeared and turned into a relatively large discount.

Several years ago, Grayscale asked the SEC to convert its closed-end fund into an ETF so that it could create and redeem shares. This mechanism would make it possible to maintain the price and net asset value at virtually the same level. To date, this conversion has not been approved, as the SEC has so far rejected all requests for a 'spot' bitcoin ETF.

Source: Bloomberg

Court of Appeal rules in favor of Grayscale

Like other cryptocurrency players, relations between Grayscale and the SEC have always been complicated. Tensions escalated when Grayscale pushed to convert the GBTC into an ETF. As expected, the initial proposal was rejected by the SEC, given its hesitancy towards ETFs based on cryptocurrencies. The main point of contention was "concerns about market manipulation and the perceived inability of the ETF to meet standards preventing such manipulation".

Grayscale's reaction was not long in coming, however, and made its intentions clear. It took the SEC to court, arguing that the regulator's decision was arbitrary and inconsistent.

Grayscale pointed out that the SEC had already approved ETFs investing in bitcoin futures. If these futures-based ETFs were acceptable, how could it be otherwise for an ETF to hold bitcoin directly? Grayscale argued that the SEC had not provided a clear justification for this differentiation.

Last Tuesday, the Court of Appeal ruled in favour of Grayscale. The court ruled that the SEC had not adequately explained its reasons for refusing Grayscale's proposal and that it should reconsider its decision.

This decision could pave the way for the first bitcoin cash ETF and considerably reduce the massive discount to net asset value. In fact, the GBTC's discount to its net asset value was partially reduced as soon as the Court of Appeal announced its decision.

The path to a spot Bitcoin ETF remains full of pitfalls.

The Appeals Court's decision is not just a victory for Grayscale; it could reshape the US financial landscape by allowing the launch of several bitcoin cash ETFs.

Indeed, the court's decision is very clear: the SEC's concerns about market manipulation were not sufficiently well-founded. The three judges of the DC Circuit Court of Appeals emphasized that the SEC needed to provide a stronger justification, particularly when Grayscale demonstrated that the bitcoin cash and futures markets are 99.9% correlated.

It should also be noted that the precedent set by this decision has wider implications, not just for Grayscale, but for the cryptocurrency industry as a whole and for other asset managers considering the lucrative prospect of launching their own Bitcoin ETFs. Indeed, financial giants such as BlackRock, Fidelity and Invesco, whose applications for Bitcoin ETFs are pending, are watching developments closely. A favorable outcome for Grayscale could mark a turning point in regulation, paving the way for a new era where traditional financial products are based on cryptocurrencies.

But while the court's decision is a monumental step forward, it does not guarantee an outright victory for Grayscale, and the battle is far from over. Uncertainty remains over what strategy the SEC might adopt. It could still reject the proposal, albeit for different reasons. The SEC does have the option of counterattack, taking the case to the US Supreme Court or re-examining Grayscale's application.

Coincidentally, the SEC dampened hopes of an imminent launch of a 'spot' bitcoin ETF two days after the Appeal Court ruled in favor of Grayscale. On Thursday, the SEC said it needed a "longer period" to evaluate the various applications to launch a Bitcoin ETF, including those from BlackRock, Wisdom Tree Funds, Invesco & Galaxy Digital, and Valkyrie Funds.

One by one, the SEC has announced the postponement of its decision on almost all pending Bitcoin ETF applications, except for Global X. According to documents filed by the financial market’s regulator, it will take at least until 17 October to decide whether to approve or reject most of the applications. The SEC has set a new deadline of 16 October for Bitwise's application, while Valkyrie has been given a deadline of 19 October (see below). We will probably have to wait until next year to see the first launch of a bitcoin cash ETF - if there is one...

Conclusion

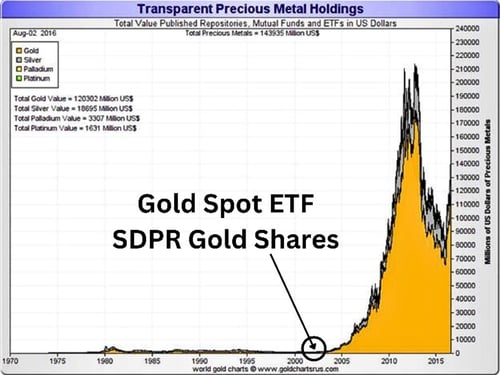

This legal battle highlights the dilemma facing regulators: investor protection on the one hand and financial innovation on the other. This case could force regulators to clarify their position on cryptocurrencies. Investor sentiment, always a volatile and crucial factor, will play an important role in the weeks ahead. A possible green light from the SEC for Grayscale's ETF could trigger a surge in institutional and retail investment. Many analysts are quick to draw parallels with the role played by the launch of a gold ETF in driving up the price of the yellow metal.

However, any regulatory hesitation or setback could dampen the market's ardor and have a negative impact on crypto-currency prices. Finally, it is essential to recognize the global implications of this battle. The US, with its influential financial market, often sets the tone for international trends. A positive trajectory for Grayscale and Bitcoin ETFs in the US could prompt regulators around the world to adopt a more receptive stance towards crypto innovations, which could accelerate the adoption of digital currencies globally. What seems to be becoming clear to all is that the coming months will be pivotal, not just for Grayscale, but for the future of cryptocurrencies as a whole within the traditional financial world.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

President Donald Trump signed an executive order relating to cryptocurrencies. The US is now one step closer to the creation of a strategic bitcoin reserve. Overview below.

"There are decades where nothing happens; and there are weeks where decades happen." - Vladimir Ilyich Lenin

Solana and Ethereum are two dominant blockchains in the crypto sector, each boasting robust DeFi ecosystems and a plethora of diverse applications. The two blockchains are often seen as competitors. How do they compare?

.png)