An increasingly fragile dollar peg

In response to the Black Saturday crisis in 1983, the peg exchange rate system was adopted in Hong Kong on 17 October 1983. Since then, the Hong Kong Monetary Authority (HKMA) has been mandated to maintain the currency at a relatively fixed rate against the dollar. The current band (between HKD 7.75 and 7.85 per US dollar) was set in 2005 and has never been breached since. When the HKD gets too close to either end of the range, the HKMA intervenes, either by buying or selling the Hong Kong dollar.

As the chart below shows, the currency traded at the low end of the range (7.85) for most of the year, due to the rising US dollar. This pressure has eased somewhat recently as expectations of a US interest rate hike have eased somewhat.

But this may only be a short-term respite.

The Hong Kong dollar has been testing HK$7.85 for most of the year

Source: Bloomberg

Source: Bloomberg

Because of the peg to the US dollar, Hong Kong has no independent monetary policy; it has to follow the US Federal Reserve. Even if it means tightening its monetary policy at a time when it should be doing the opposite. Indeed, the Chinese economy as a whole is experiencing a growth breakdown, notably because of its "zero-covid" policy and its property crisis. The situation is even more complicated in Hong Kong, where the economy contracted by 4.5% in the third quarter compared to the previous year. The benchmark Hang Seng Index is down nearly 50% from its 2018 highs.

Hong Kong is facing structural problems that are not likely to reassure international investors. China's political interference is only increasing. A part of the working population, in particular the high earners in the financial sector, is leaving the island. Hong Kong's tax base is thus being eroded even though Hong Kong is a massively indebted economy.

Indeed, while the government's debt ratio is close to zero (as published by the IMF), the private sector's is much higher. According to some economists, the external debt is almost $500,000 for every person working in Hong Kong. Domestic debt levels have doubled since 2007, according to the World Bank. Real estate debt has been rising at a staggering rate, despite a decline in prices that appears to be accelerating (-8% year-on-year according to the latest figures), even though Hong Kong's real estate remains among the most expensive in the world.

It is this huge surge in debt, falling asset prices and the increasingly bleak outlook for Hong Kong's economy that makes defending the peg much more problematic than during the Asian crisis of the late 1990s.

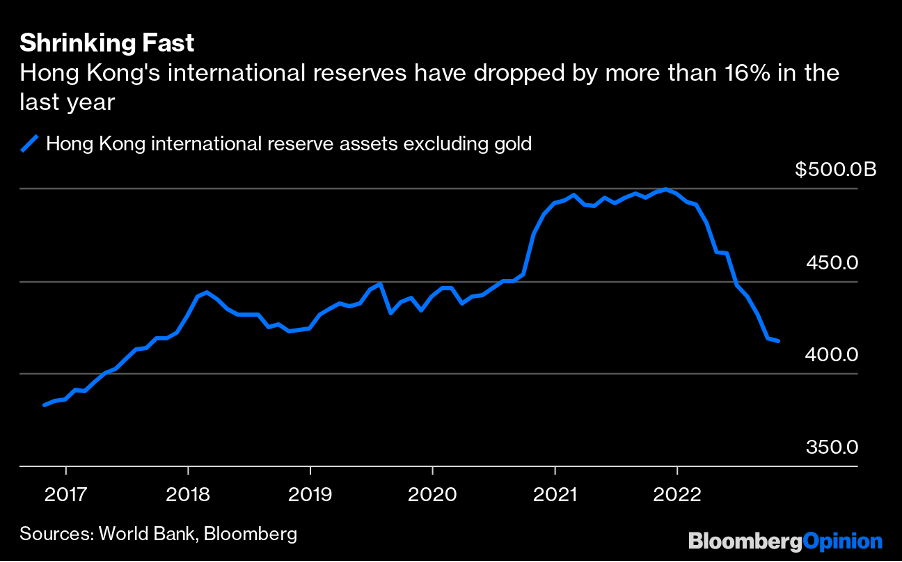

Another warning sign is that Hong Kong's foreign exchange reserves have fallen by more than 16% since the end of 2021, from $500 billion to $417 billion, the biggest drop on record.

Hong Kong foreign exchange reserves (excluding gold)

Source: World Bank, Bloomberg

Source: World Bank, Bloomberg

.png)