The flip side however, is that this massive acceleration in demand challenges production capacities, supply chains and job market flexibility. Shortages and scarcity are becoming visible in many areas of the economy, from computer chips to building materials, labor to transport capacity. This is driving prices higher and reigniting inflationary concerns. After being warmly welcomed last year as a way to dampen an historical collapse in economic activity, ultra-supportive monetary and fiscal policies are increasingly seen as driving a possible overheating that may threaten future economic stability. Central bankers and governments, while wary of removing support too soon, are now looking toward the next step that will be the withdrawal of the exceptional pandemic-related policies. As such, the peak in central bank and government support is most likely now behind us.

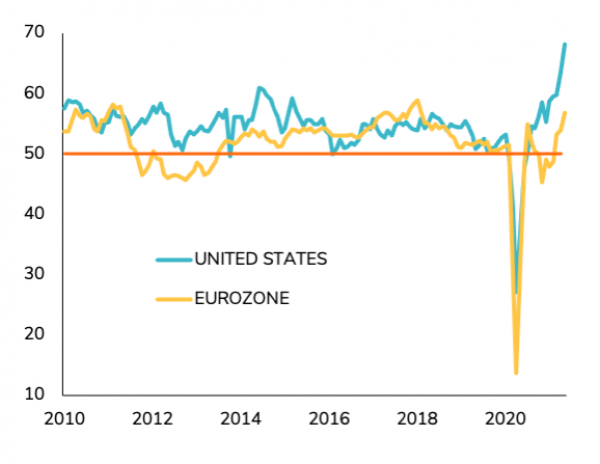

In parallel, the peak ineconomicgrowth has probablyalready been reached in the US. We cannot reasonably expect a continuation of the breakneck pace of improvement seen since the beginning of the year. Maintaining the current economic growth rate in the US would already be very positive in this environment.

The rest of the world is not there yet. Europe is still in the “acceleration” phase, thanks to the easing of pandemic restrictions and vaccine roll-outs, and this will drive global momentum in the coming months. Some large emerging economies face an unpleasant combination of Covid-19 resurgence and accelerating inflation, and are lagging in the positive global economic cycle.

This environment continues to be positive for assets linked to global growth. Equities, in particular, are supported by the combination of positive economic momentum and low interest rates, and remain the most attractive asset class at the moment. However, in the US, the peak in stimulus and growth, with valuations already reflecting this economic improvement, leaves only limited upside in the short run. It therefore makes sense to take profits on some exposure to partially lock-in what have been impressive returns since the trough of March 2020. On the other hand, cyclical markets such as the Eurozone and the UK, or sectors such as financials or materials, still have some upside potential as global growth continues its recovery. They will benefit from the rise in growth and inflation expectations that should run through the next three months. The euro and the pound will also both enjoy favorable relative dynamics versus the US dollar in the months ahead.

Growth and inflation dynamics, conversely, remain headwinds for fixed income assets in general, with long term rates likely to rise further across the board. Pockets of value still exist in the bond universe, such as subordinated bonds or emerging market debt in US dollars, but generally speaking, it is too early to raise our current low exposure to fixed income assets. As bond yields extend their upward adjustment, gold appears to be a more attractive alternative in portfolios, with the potential to benefit from the rise in inflation fears… as long as the Federal Reserve maintains its current dovish stance.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

.png)