3 Dec 2025

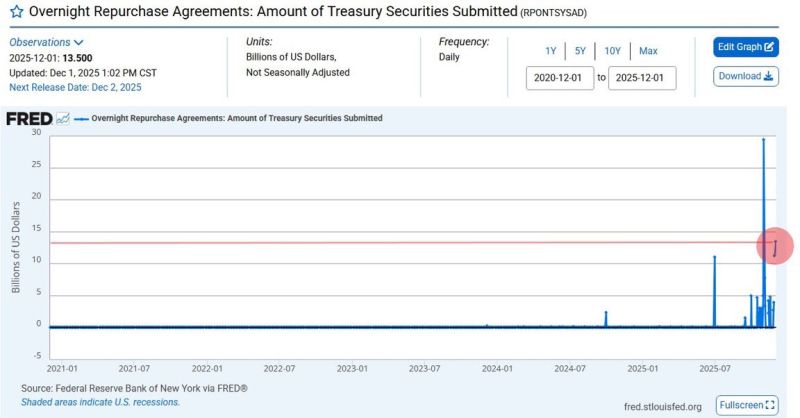

The headlines are running wild, calling the massive overnight liquidity injection "The Biggest Since COVID!" and predicting the return of Quantitative Easing (QE).

Here is the objective truth:

➡️ The Problem: Banks ran into simultaneous, acute, and unexpected shortfalls of overnight cash. This created an immediate, sharp spike in inter-bank borrowing rates (liquidity stress).

➡️ The Fed's Role: The Federal Reserve stepped in not as an asset purchaser (QE), but as the essential backstop. The $13.5B was a tactical operation to stabilize the overnight lending market and prevent a systemic spike in financing costs.

➡️ The Historical Precedent: This scenario is not a predictor of a new bull cycle. It happened in 2019 after Quantitative Tightening (QT) ended. It's a structural issue in the funding markets, not a macroeconomic pivot.

👉 Conclusion: This is not QE. This happened when QT ended in 2019 as well. This is a clear indication of financial plumbing stress. Treat it as a warning light within the system, signaling potential underlying friction.

Source: FRED, Brett