9 Jan 2026

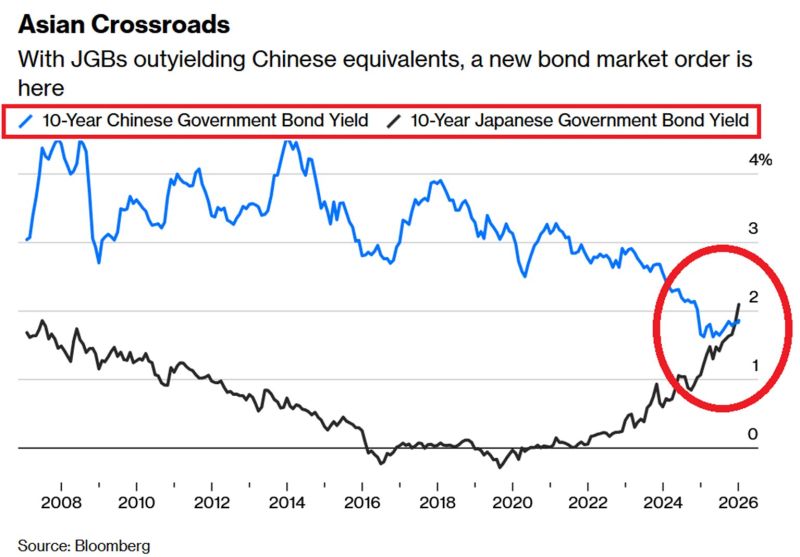

For 15+ years, one rule dominated the macro landscape: Chinese yields stay higher than Japanese yields. China was the growth engine; Japan was the land of "Lower for Longer."

That world just ended. 🌏

For the first time in decades, Japanese 10-year yields have officially overtaken China’s. We are witnessing a total regime shift in real-time.

📈 The Great Divergence: By the Numbers

JAPAN: 10-year JGB yields have skyrocketed from -0.28% (2019) to 2.10%—a level not seen since 1999.

CHINA: 10-year yields have plummeted from 3.05% to 1.86%, hovering near record lows.

Why is this happening?

It’s a tale of two opposite crises:

🇯🇵 In Japan: The BoJ is hiking to 30-year highs. Prime Minister Takaichi is pushing a record FY2026 budget with massive military spending. Fiscal expansion + Rate hikes = A bond market under siege.

🇨🇳 In China: The real estate downturn is biting hard. Deflation risks are mounting, and the central bank is forced to keep easing just to keep the lights on.

The "Lose-Lose" Trap for JGB Investors 🪤

If you're holding Japanese bonds, where is the exit?

Scenario A (Growth Re-accelerates): The BoJ is forced to hike faster than anyone expects. Bond prices tank. 📉

Scenario B (Growth Slows): JGBs underperform higher-yielding peers like US Treasuries. Investors flee for better returns elsewhere.

⚠️ The Contagion Risk

This isn't just a Japan problem. This is a Carry Trade Nightmare.

For years, traders borrowed "cheap" Yen at 0% to bet on global assets. Now, the cost of that debt is exploding. If the Yen strengthens and yields keep climbing, the "unwind" could send shockwaves through global markets.

The era of free money in Japan is officially dead.

Is your portfolio prepared for a world where Japan is no longer the "anchor" of low rates? 💬👇

Source: Global Markets Investor