28 Jan 2026

Shares jumped 7%, and it’s not hard to see why. While the world was debating an "AI bubble," ASML’s customers just placed a record-breaking bet on the future.

The headline? A massive demand explosion. 🚀

The Numbers You Need to Know:

Net Bookings: €13.2B (Massive beat vs. €7B estimate). The demand isn't just there; it’s doubling expectations.

Revenue: €9.7B (Beating the €9.58B estimate).

Backlog: A staggering €38.8B. ASML has years of work already sold.

2026 Guidance: Revenue projected between €34B - €39B (Top end well above the €35B consensus).

The "AI Realism" Shift 🧠

CEO Christophe Fouquet’s statement is the real kicker. He noted a "notably more positive assessment" from customers regarding the sustainability of AI-related demand. This isn't hype. This is capacity planning. This is the "picks and shovels" of the AI revolution being bolted into factories right now. Two High NA systems (the most complex machines humans have ever built) were officially recognized in Q4 revenue. The future is being shipped.

Shareholder Value 💰

ASML isn't just growing; they are rewarding. A new €12B share buyback program through 2028 shows massive confidence in their long-term cash flow.

The Verdict: ASML remains the ultimate bottleneck of the digital age. If you want AI, you need chips. If you want chips, you need ASML. Period.

Is the semi-cycle just getting a second wind? 🌬️

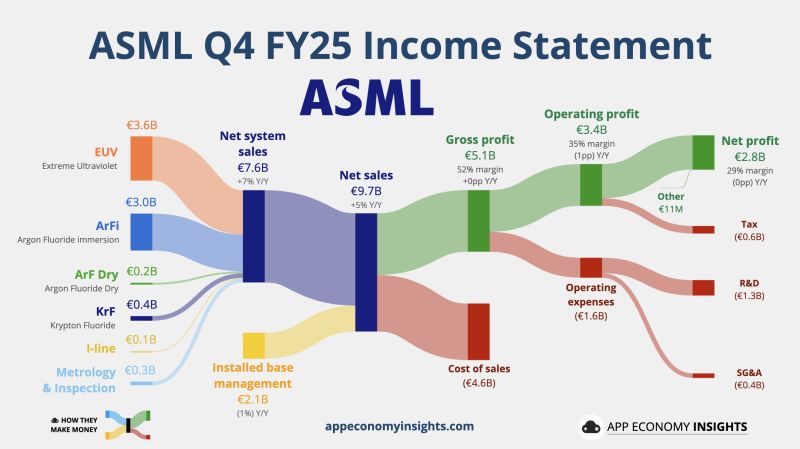

Below the numbers and breakdown by App Economy Insights

@EconomyApp

·

$ASML ASML Q4 FY25:

• Net bookings €13.2B (€6.9B beat).

• Net sales +5% Y/Y to €9.7B (€0.1B beat).

• Gross margin 52% (+0pp Y/Y).

• Operating margin 35% (-1pp Y/Y).

• EPS €7.35 (€0.23 miss).

• FY26 Net sales ~€36.5B (€1.4B beat).