16 Feb 2024

After the crypto-trading platform swung to a quarterly profit and reported revenue well above Wall Street expectations, saying it benefited from “risk on” activity in the markets.

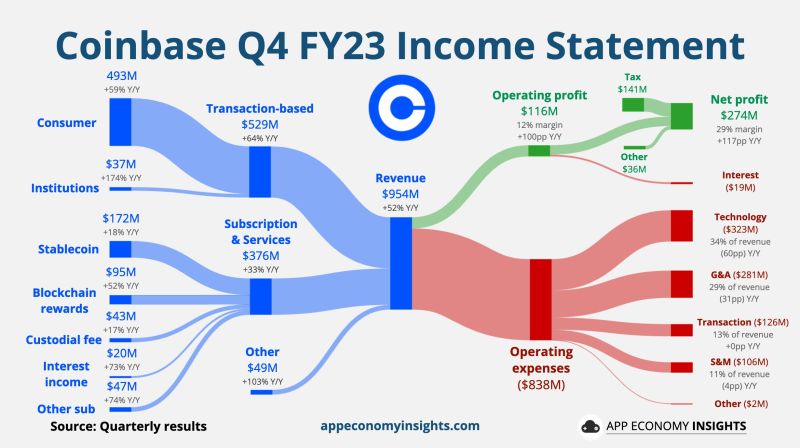

Coinbase $COIN earned $273 million, or $1.04 a share, in the fourth quarter, versus a loss of $557 million, or $2.46 a share, in the year-ago quarter. Sales rose to $954 million from $629 million a year ago. Analysts polled by FactSet expected Coinbase to report earnings of 2 cents a share on sales of $826 million.

In a letter to shareholders, Coinbase executives said that they saw “a sharp increase in crypto asset volatility,” akin to early 2023, and in crypto asset prices.

That was mostly thanks to around approvals for a bitcoin spot ETF and “broad expectations around improving macroeconomic conditions in 2024, which contributed broadly in the capital markets to ‘risk on’ activity,” it said.

COIN Coinbase Q4 FY23:

• Trading volume +6% Y/Y to $154B.

• Bitcoin 31% of volume (-4pp Y/Y).

• Revenue+52% Y/Y to $954M ($135M beat).

• EPS $1.04 ($1.03 beat).

Q1 FY24 Guidance:

• Subscription & Services $410-480M ($373M expected).

Source: App Economy Insigths, Market Watch