3 Apr 2024

📈 In recent months, the surge in oil prices has played a pivotal role in the noticeable increase in US Long Term breakeven rates, with a significant rise of 20 bps since the end of December. This trend underscores the nuanced dynamics that influence US Treasury nominal rates, which are comprised of the sum of real yields and inflation expectations (as captured by breakeven rates), alongside the impact of the term premium on longer maturities.

Traditionally, long-term US breakeven rates have closely mirrored the Federal Reserve's inflation target of 2%, maintaining a 25-year average of 2.05%. This long-term alignment has served as a benchmark for inflation expectations and a guide for monetary policy. However, the aftermath of the pandemic has ushered in an era of elevated breakeven rates, with the 10-year US Breakeven rate averaging 2.33% since September 2020. This elevation signals market anticipations of persistently higher inflation over the next decade, influenced by factors such as deglobalization trends, sustained supply chain challenges, and increased commodity prices, notably oil.

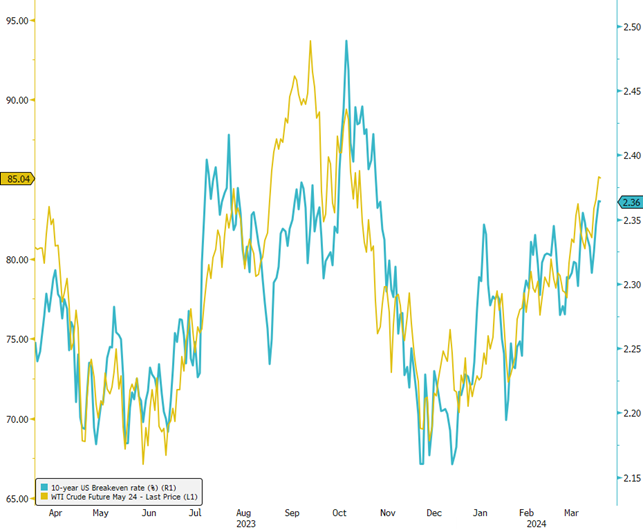

The correlation between rising oil prices and the uptick in US Long Term breakeven rates is stark, highlighting how energy costs can act as a bellwether for inflation expectations. The accompanying chart illustrates this relationship, with oil prices' sharp rebound since December propelling breakeven rates upwards, suggesting a potential for continued increases.

This resurgence in oil prices coincides with a broader recovery in global economic activity, posing significant considerations for the Federal Reserve's approach to monetary policy. The crucial question now is whether the Fed will adjust its easing policy plan in response to these inflationary signals.

Source: Bloomberg