12 Dec 2025

Forget the hype. Look at the numbers.

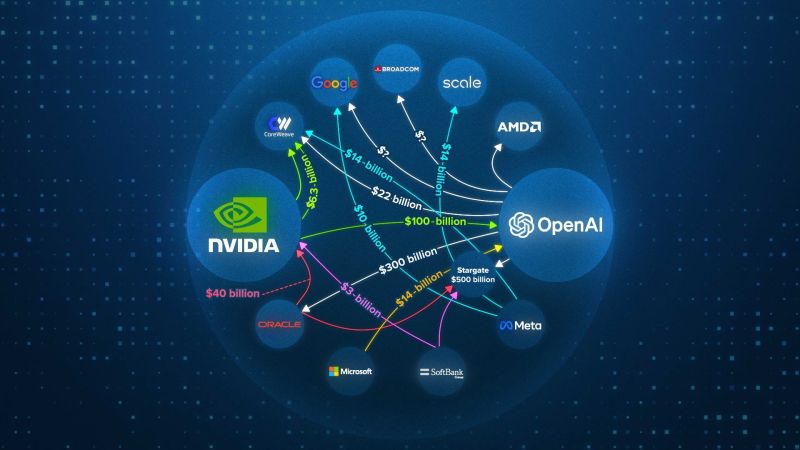

The AI sector will spend $400 BILLION this year. Revenue? A measly $60 BILLION.

That $340 BILLION gap? It's filled with circular financing and off-balance sheet debt 💣

🔴 The CoreWeave Trap: Circular Financing 🔄

The Play: CoreWeave uses NVIDIA’s money to buy NVIDIA’s chips, then rents them back to NVIDIA.

The Math: They are spending $20 BILLION to make $5 BILLION in revenue.

The Debt: They have $14 BILLION in debt due next year and a staggering $34 BILLION in lease payments starting in 2028.

🔴Debt & Leverage 🧊

OpenAI's Burn Rate: They make $10B but need $50B just for their Oracle deals! They're projected to lose $15 BILLION this year. The only one making money? NVIDIA. Everyone else is buying chips on credit, praying for a future payoff. 🙏

🔴SPVx

Meta hid a $27 BILLION data center build off their balance sheet using Special Purpose Vehicles (SPVs).

🔴The New CDO? Companies are taking GPU-Backed Loans, posting chips as collateral. What happens when the chip bubble pops?

It’s a cascade risk

Will we see something similar to the housing collateral crisis, but with sthis time with silicon ??? 📉

🔴Private Credit: The $1.25 TRILLION Blind Spot 🚨

The riskiest part is happening in the shadows: Private Credit.

Private Equity firms have already lent $450 BILLION to tech and plan to lend another $800 BILLION in two years.

Zero Disclosure. They operate outside of traditional banking scrutiny.

Life Insurers (who hold your policies!) have $1 TRILLION tied up in this private credit gamble.

If AI loans fail, private credit fails. If private credit fails, banks and insurers are at risk because everyone is connected.

To make a long story short, the leverage is building...

Source: Hedgie on X