11 Jun 2025

Owing to its pro-business policies and lower cost of living, Texas is attracting scores of corporate headquarters, particularly from California. As a result, states are losing billions in tax revenues as the corporate landscape shifts south.

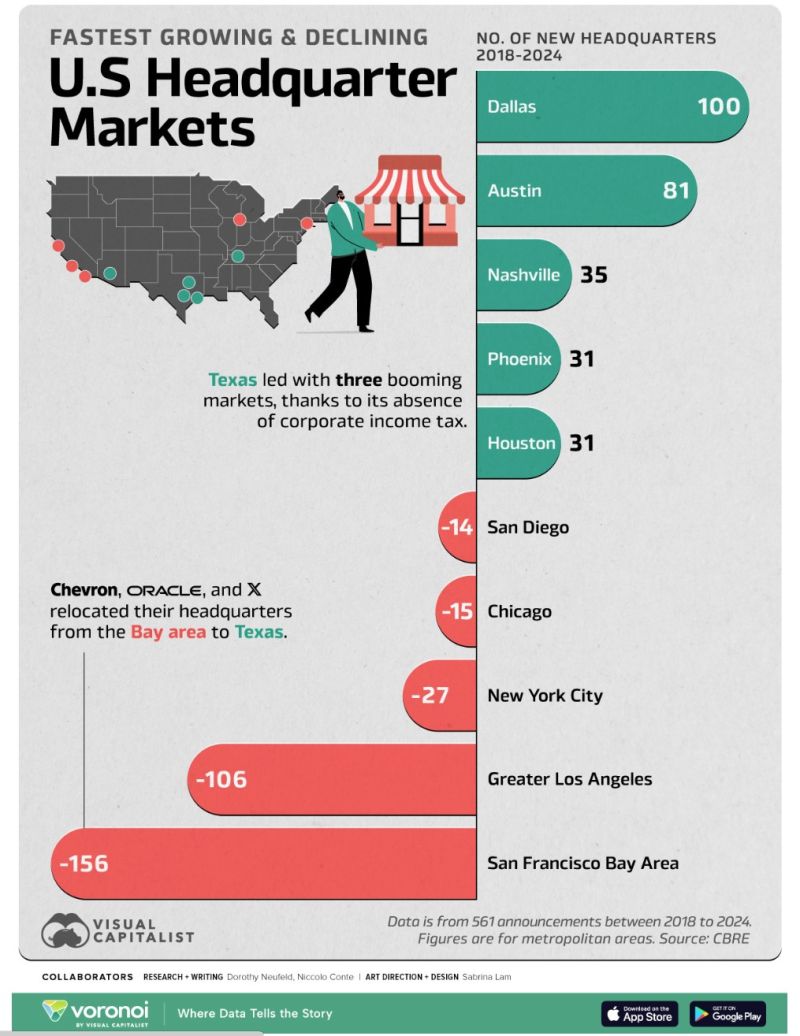

As the country’s best state for doing business, Texas is home to three of the top five markets nationally.

Fueling this migration are its growing talent pool, the absence of corporate and personal income tax, and its lack of red tape. The state is notable in its diverse business landscape attracting Chevron, Charles Schwab, and SpaceX to relocate headquarters since 2018.

Additionally, companies are expanding their presence in the state. Goldman Sachs, for instance, plans to grow its headcount in Dallas to 5,000—up from 970 in 2016.

By contrast, California is experiencing a corporate exodus.

With homes at least 50% more expensive than in Texas, along with the fifth-highest tax burden in the country, the state has lost at least 275 headquarters since 2018.

The San Francisco Bay Area stands as the hardest hit market, in a market facing one of the highest office vacancy rates in the nation.

Source: Visual Capitalist, Voronoi