24 May 2024

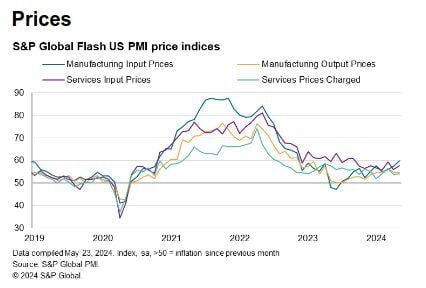

And not because they show that the US economy remians resilient. The biggest concern was the prices print as it shows that more cost increases are coming for companies and consumers alike:

- Input prices continued to rise sharply in May, the rate of inflation accelerating to register the second-largest monthly increase seen over the past eight months.

- Manufacturers reported an especially steep increase, suffering the largest cost rise for one-and-a-half years amid reports of higher supplier prices for a wide variety of inputs, including metals, chemicals, plastics, and timber-

based products, as well as higher energy and labor costs.

- Service sector costs also rose at an increased rate, reflecting higher staffing costs in particular.

- Companies again sought to pass higher costs onto customers in the form of higher selling prices, the rate of increase of which accelerated slightly compared to April.

One good news though: although still elevated by pre-pandemic standards, the rate of inflation across both goods and services remained below the average recorded over the past year.

Source: S&P Global, Markets & Mayhem