14 Jun 2024

In the era of hybrid work, with employees splitting their time between two days in the office and three days working remotely, employers have ramped up using productivity monitoring software. However, employees have outsmarted some of these surveillance programs with gadgets like mouse movers, otherwise known as 'mouse jigglers.'

The popularity of mouse jigglers has exploded on TikTok in the last several years. Firms have been cracking down on these devices following a surge in fake work activity, which has weighed on productivity.

Wells Fargo, in a new disclosure with the Financial Industry Regulatory Authority, first reported by Bloomberg, had terminated over a dozen employees in its wealth- and investment-management unit for their use of mouse jigglers.

They were "discharged after review of allegations involving simulation of keyboard activity creating the impression of active work," according to the disclosures.

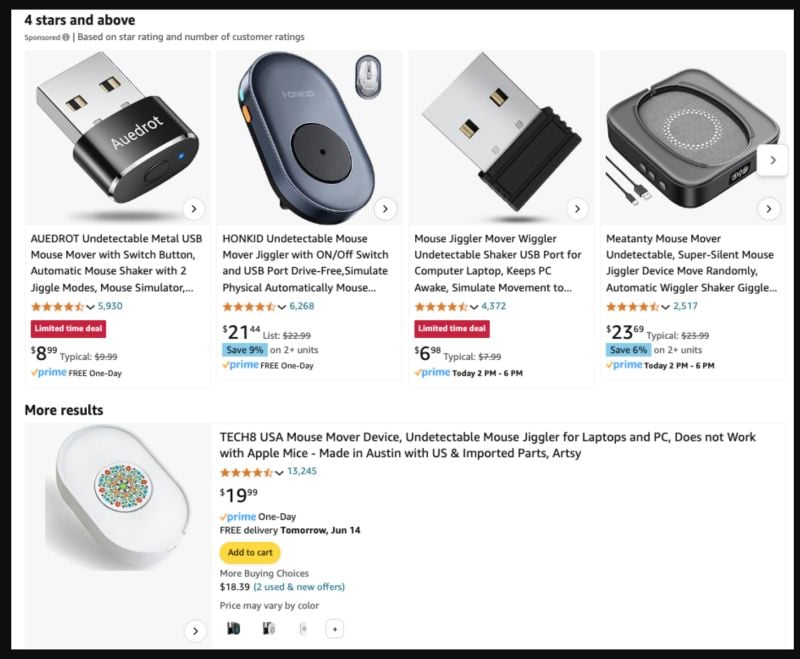

On Amazon, some of the top-ranking mouse jigglers sold have thousands of reviews and range in price between $6 and $25.

Google Trends shows a massive search spike for these devices in 2022.

The bank's Finra disclosure does not indicate whether the employees were fired for faking work at home or in the office. It's unclear how the employees were caught, and if the bank opted to use other forms of surveillance to catch the employees faking work.

Major banks, including JPMorgan Chase and Goldman Sachs, were among the most aggressive institutions in ordering workers back to the office after the government enforced lockdowns.

The jiggler is just proof of the unintended consequences of remote working. Instead of employers micromanaging their workforce with mass surveillance, perhaps implementing baseline objectives for them...

Source: www.zerohedge.com