22 Apr 2025

58 firms have 300 or more CFA Charterholders. They are domiciled in 11 countries (alphabetical order): Australia, Canada, China, France, Germany, Japan, Netherlands, Spain, Switzerland, UK, USA. These 58 firms still employ a combined quarter of all CFA Charterholders.

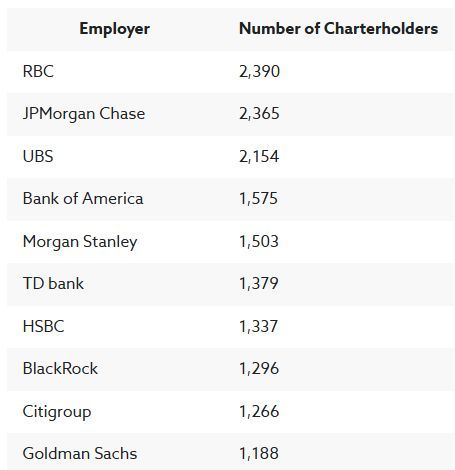

RBC moved from third place to first place, trading places with UBS which last year had been boosted into the top spot as a result of the CS merger.

JPMorgan remains #2, Bank of America #4 and Morgan Stanley #5.

Goldman Sachs displaced Ernst & Young in the top 10. TD vaulted over HSBC to take the sixth spot while Blackrock snatched eighth place from Citi.

A fun fact: over 1 in 10 of these 58 firms are led by CFA Charterholders.

A total of 14,807 candidates passed the Level III exam during the February and August 2024 exam windows. Over the last 12 months the number of CFA Charterholders for the first time climbed over 200,000. Relatedly, the total number employed at these top firms rose by 5% (from 41,805 to 44,158).

Source: Rob Langrick, CFA, CIPM