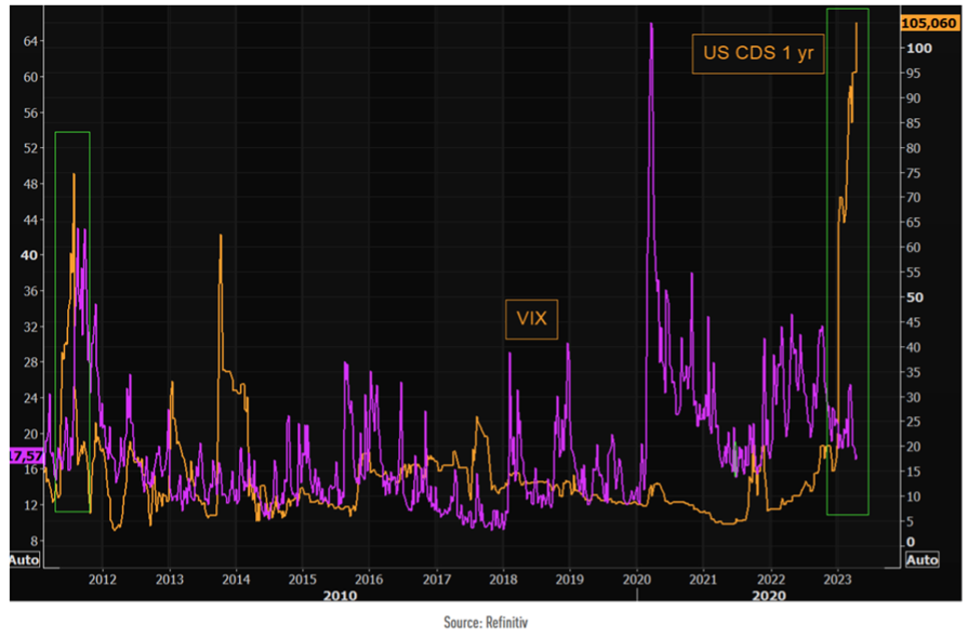

Chart #1 —

The dichotomy between the VIX index and one-year CDS on US debt

The major U.S. stock market indices posted mixed performances over the past week. While the S&P 500 and Nasdaq closed slightly lower on the week, the VIX index of implied volatility for the S&P 500 reached its lowest level since the end of 2021. A low VIX level is a signal of investor complacency.

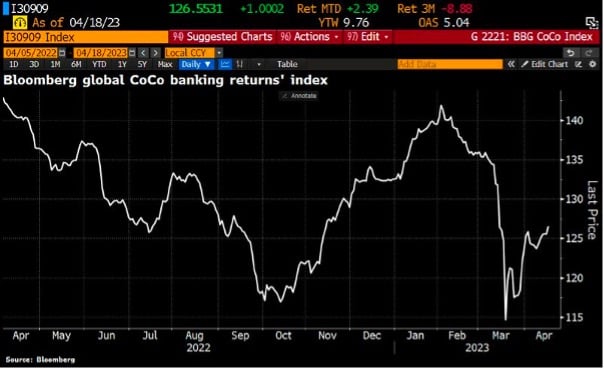

However, some market indicators seem much less serene. This is the case of the one-year Credit Default Swap (CDS) on US debt (in yellow below), a derivative product whose price reflects the premium required to insure against the possible default of a debt (that of the US in this case).

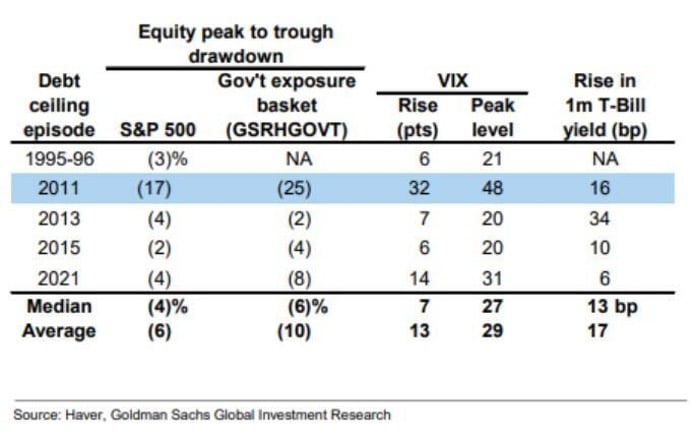

The possibility of a "technical default" by the US on its debt has been raised in the markets. Indeed, the US debt ceiling (which is set by law) is expected to be reached at some point in the coming months. While a new bill must be passed by both the House of Representatives (controlled by Republicans) and the Senate (controlled by Democrats) to raise the debt ceiling, there is currently no agreement between the two chambers. Without new legislation, the U.S. risks defaulting on some of its debt later this summer, if not sooner. The debate over the debt ceiling and concerns about it will likely intensify as the deadline approaches. By then, and perhaps beyond, concerns about a U.S. technical default could continue to grow.

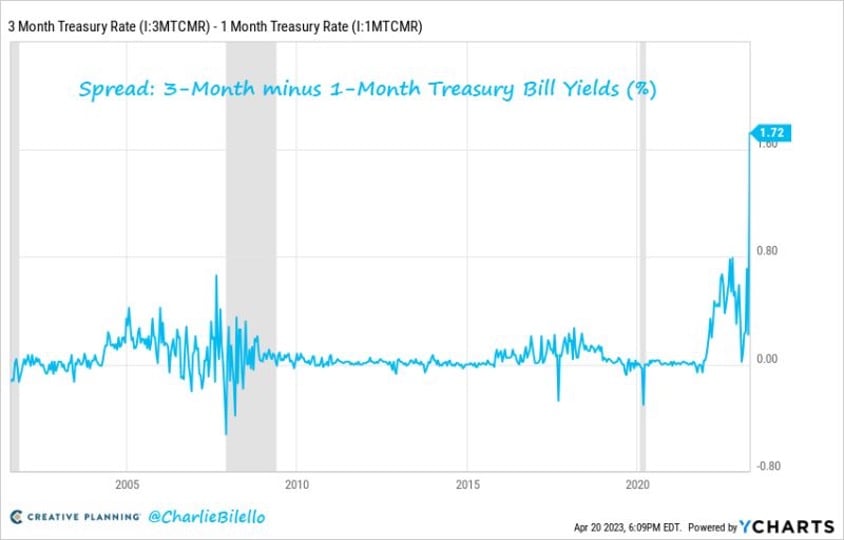

As in previous occurrences (particularly summer 2011), this event will likely bring volatility to financial markets, with downward pressure on U.S. Treasury securities maturing over the summer, whose repayment could be delayed until the debt limit is finally raised. At this stage, US CDS and the Treasury curve (see chart #2) are the assets that partially incorporate this risk. Conversely, equity markets seem to be little affected, despite the negative impact of this type of event in the past (see chart #3).

Source: TME, Refinitiv

.png)