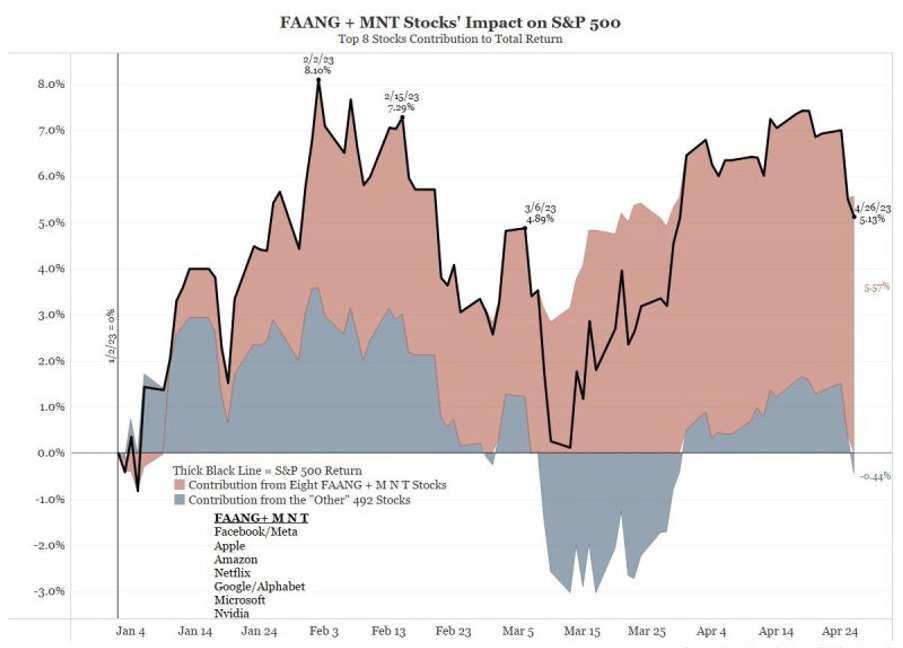

Chart #1 —

An overall positive month of April for US equities

Equity markets performed slightly better last week, as the focus shifted to corporate earnings. Indeed, 35% of the companies in the S&P 500 Index, or 44% of its market capitalization, were due to report earnings during the week.

Meta and Microsoft jumped, while other GAFAs had mixed performances.

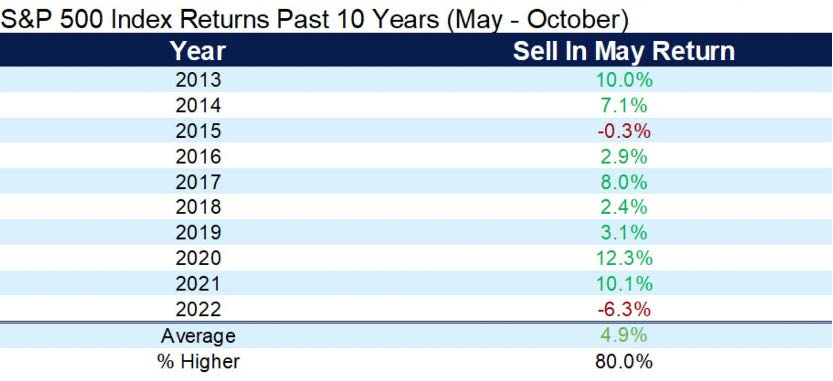

For the month, the Nasdaq closed at the same level as at the beginning of the period, while the Dow Jones recorded a +2.2% increase. Small caps, represented by the Russell 2000 Index, underperformed (-1.9%).

The S&P 500 Index gained 1.2% over the month. From a technical standpoint, it is now moving above the 200-, 100-,

50- and 20-day moving averages. However, the S&P 500 is still not out of the consolidation tunnel it has been in since

the end of last year.

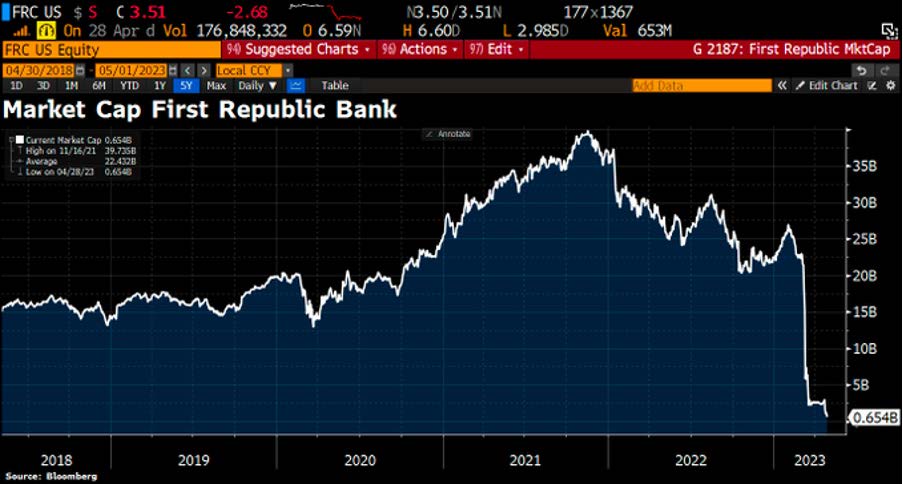

Despite the banking crisis, US debt CDS at an all-time high and an ongoing rate hike cycle in the US, the major equity

indices do not seem to want to weaken. How can this be explained? Goldman Sachs has suggested 5 possible

explanations:

1. Economic growth is normalizing, with the rate of growth now close to that of the last decade.

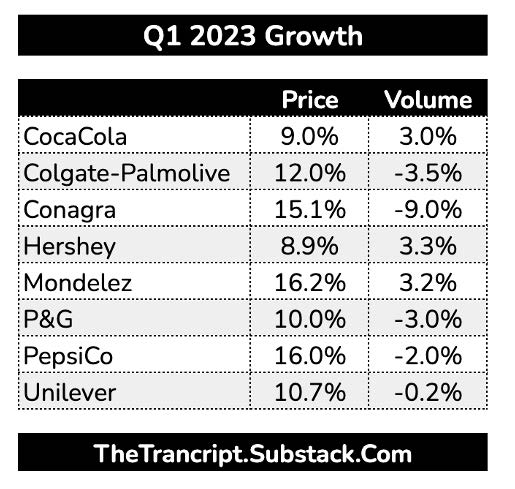

2. Inflation continues to decelerate. Core PCE for March fell from +0.35% in February to +0.28% in March

(sequential).

3. The supply chain appears to be unclogging

4. Volatility is easing. The VIX index fell back below 16 on Friday for the first time since 2021.

5. Earnings are better than expected. In addition to the relative strong results of the tech mega-caps, banks, aircraft manufacturers, industrial companies (in general), airlines (for the most part) and even toy manufacturers have posted better-than-expected or even excellent results.

Source: www.zerohedge.com, Bloomberg

Source: www.zerohedge.com, Bloomberg

.png)

Source: Bloomberg

Source: Bloomberg

Source: Ignacio Ramirez Moreno

Source: Ignacio Ramirez Moreno