While history often points to October as a volatile month for equities, we saw the opposite this year. After a correction in September, developed equity markets recorded strong gains in October. Please find below the 10 stories to remember from an eventful month.

STORY #1

Best month for the S&P 500 since November 2020

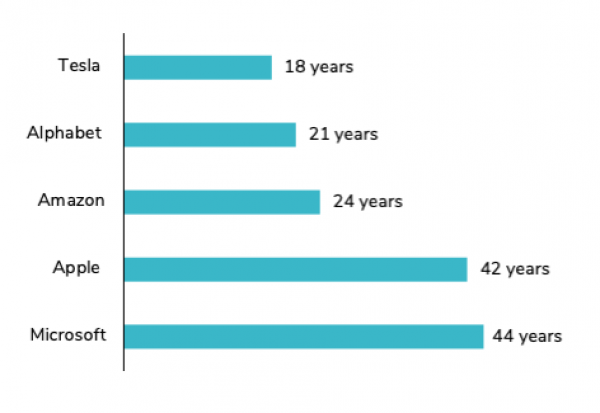

In October, the S&P 500 (+6%) climbed the stagflation / China / rate hike / profit margin wall of worries and hit a new all-time high on the last trading of the month, topping 4,600 for the first time ever. It is the 59th time this year that the S&P 500 closed at an all-time high. We need 19 more to break the record set in 1995 (77). October’s performance is the best month since November 2020.

S&P MONTHLY CHANGE %

Source: Bloomberg

STORY #2

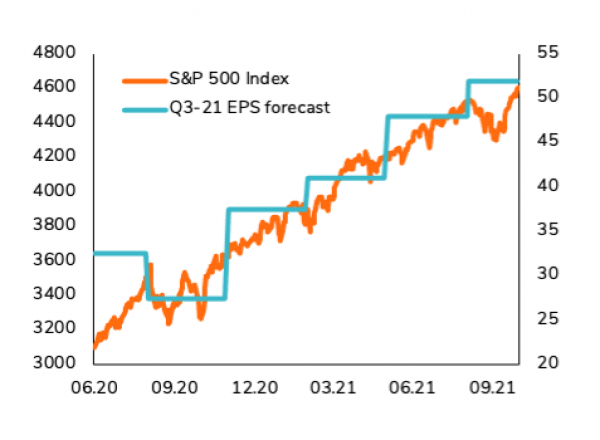

Trillion-dollar babies

The big gets bigger. This trend was quite visible in October. Tesla gained over $300 billion in market cap in the last two weeks of the month. This increase alone is bigger than the market cap of 90% of S&P500 companies - and propelled the Electric automaker to a market cap of over $1.1 trillion surpassing Facebook, (which became Meta at the end of the month). Meanwhile, Microsoft briefly surpassed Apple as the world’s most valuable company as the software company posted outstanding quarterly numbers while Apple disappointed the Street.

TIME TO REACH $1 TRILLION MARKET CAP (IN YEARS)

Source: Twitter

STORY #3

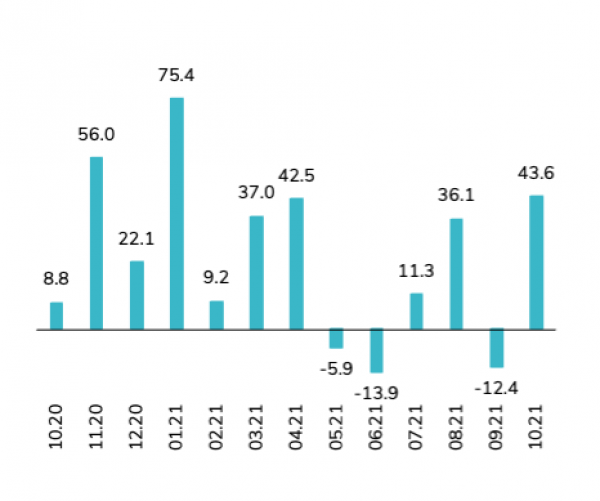

Solid company earnings

Despite some high-profile companies, including Amazon, Apple and Starbucks, missing earnings forecasts – largely driven by supply chain bottlenecks and labor shortages – third quarter earnings have overall been beating expectations. With more than half of the S&P 500 companies having reported so far, third quarter earnings growth is up a robust 36% year-on-year, well ahead of the expectation for 28% growth predicted at the end of September. This upward revision in earnings has broadly supported the positive market tone.

Source: Edward Jones, Factset

STORY #4

Reopening 2.0 – COVID-19 trends improving globally

After battling the delta variant for much of the past few months, the US and many global economies finally seem to be at an inflection point, with better COVID-19 trends overall – at least for now. In addition, vaccination rates have improved. From an economic perspective, this drop in cases has led to better consumption patterns in the U.S. and in Europe, with measures like retail sales exceeding expectations. This “Re-opening 2.0” leads to an improved demand profile broadly although supply has struggled to keep pace in some areas. While this trend has perhaps moved at a less robust pace compared with the first re-opening earlier this year, it played a role in dragging risk assets higher during the month.

STORY #5

Some light at the tunnel for US Spending Bill

Despite the spotlight on earnings and reopening, investors also appeared to react to political and economic factors. The White House made progress on the USD 1.75 trillion spending bill. President Biden’s new social spending framework includes spending on areas like universal pre-K, childcare support and an extension of the child tax credit, as well as over $500 billion on climate initiatives. While not all factions of the Democratic party endorse the proposal, policy makers are looking to get the bill passed in the weeks ahead, along with a vote on the $1.2 trillion infrastructure package in the House. Notably, the proposal does not include raising corporate or personal tax rates directly, but instead focuses on a 15% minimum tax on corporations, a 1% tax on stock repurchases, and higher taxes for those earning more than $10 million in revenue. Markets are likely viewing this shift in tax plans as a positive. If a corporate tax hike from 21% to about 25%-28% were to be implemented, this could reduce next year’s earnings growth, although it is not likely to eliminate it all together.

STORY #6

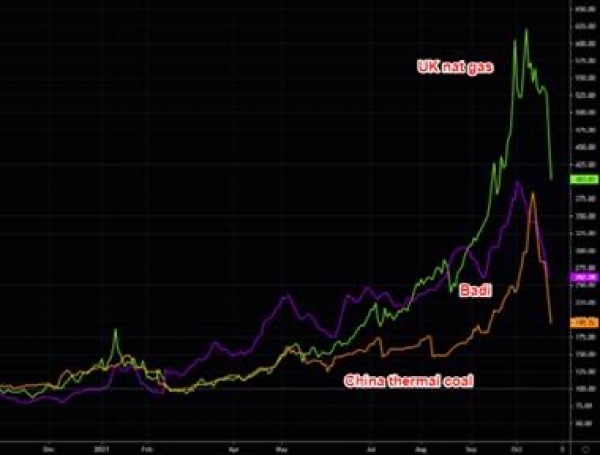

The Energy crisis

The news flow was not all rosy in October. A global energy crunch caused by weather and a resurgence in demand took place in October, stirring alarm ahead of the winter, when more energy is needed to light and heat homes. Governments around the world are trying to limit the impact on consumers, but acknowledge they may not be able to prevent bills spiking. In China, rolling blackouts for residents are taking place, while in India power stations are scrambling for coal. In Europe, natural gas jumped by 130% since early September. Investors however, seemingly anticipate that the Energy shortage and supply bottlenecks will soon peak. This is indeed the trend observed towards the end of the month as shown on the chart below. UK Nat Gas price is swiftly declining. Baltic Exchange Dry Index (BADI) is falling sharply (down 28% from its peak earlier this month). Having soared to record highs just weeks ago, Chinese coal futures extended their declines at the end of the month, down more than 50% in a little over a week as Beijing unleashed its latest verbal crackdown as saying prices have further to fall, an attempt to ease the energy crunch.

UK NATURAL GAS, BALTIC DRY INDEX AND CHINA THERMAL COAL PRICES

Source: Bloomberg

STORY #7

Market are re-pricing odds of Fed rate hikes in 2022 as the yield curve is flattening (even reverting) in the long-end

The market continues to brace for tightening, bringing ever closer the date of the first rate hike. Indeed, the market is now pricing in odds of a June rate hike as high as 87% - or around 22 bps. Meanwhile, the long end of the curve is flattening as hawkish signals from some foreign governments and central banks helped drive long-term yields lower and contributed to flattening moves along the yield curve by pulling short-term rates higher. At the end of the month, the 5s30s curve briefly reached its flattest level since March 2020 while the 20s30s Treasury even inverted.

US 30 VS. 5-YEAR YIELD SPREAD

Source: Bloomberg

STORY #8

EU growth and inflation data surprised on the upside

Preliminary estimate numbers indicate that the eurozone economy grew 2.2% sequentially in the third quarter—an uptick from the 2.1% expansion recorded in the second quarter and above the 2.0% consensus estimate reported by FactSet. Among the major economies in the euro area, France and Italy posted stronger-than-expected growth in GDP. The initial estimate from Eurostat pegged the headline inflation rate in the eurozone at 4.1% in October—the highest level in 13 years and above market expectations. Higher energy costs were a prominent factor. Core inflation, which excludes volatile energy and food prices, ticked up to 2.1% from 1.9%. Despite record inflation data, the ECB maintained its existing policies and indicated that it would continue buying assets under the auspices of its Pandemic Emergency Purchase Programme (PEPP) at the somewhat moderated rate announced in September. Despite this dovish stance from ECB president Lagarde, markets are repricing odds of European rate hikes next year.

STORY #9

The Evergrande crisis

China’s property sector, which accounts for about one-third of China’s overall economy, has stirred investor anxiety in October following defaults, credit rating downgrades and, most recently, a proposed tax plan as authorities seek to reduce leverage among leading developers. Evergrande, which is shouldering more than USD 300 billion in liabilities, grabbed international investors attention as the largest Chinese property developer is on the brink of default. The People’s Bank of China (PBOC) was able to calm investors’ nerves by injecting cash into the banking system. Nevertheless, Chinese stocks underperformed global stocks for a ninth month in October, the longest stretch since HSCEI data going back to 1993.

STORY #10

A stellar month for cryptos

Bitcoin rose roughly 15% over the month and hit a new all-time-high of $67,016 on Oct. 20. The largest cryptocurrency by market cap benefited from more evidence of broader adoption as well as the launch of the first US (futures-based) Bitcoin ETF. Ether, the world’s second-largest cryptocurrency by market capitalization, reached a new all-time price high of around $4,400 on the last opening day of the month, topping the previous record high of $4,379 in May. Ether gained 48% in October, the second best month of the year after January’s 75% gain. Ether’s new price high coincided with improving blockchain data. Some options traders are betting U.S. regulators will soon approve an ether futures-based exchange-traded fund (ETF) and so are buying cheap out-of-the-money calls in anticipation of a price rally.

ETHEREUM 1-MONTH CHANGE %

Source: Bloomberg

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Major U.S. stock indexes finished the week lower as concerns regarding the disruptive potential of AI weighed on stocks across a broad range of industries. The Nasdaq Composite fared worst, shedding 2.10%, while the S&P500 Index and Dow Jones Industrial Average fell 1.39% and 1.23%, respectively. The Russell 1000 Value Index outperformed its growth counterpart for the 7thconsecutive week, extending its YTD lead to over 1,100 basis points. On the macro side, hiring in the U.S. was stronger than expected in January as U.S. employers added 130,000 jobs during the month, the highest monthly gain in over a year. The unemployment rate also declined to 4.3% from 4.4% in December.

.png)