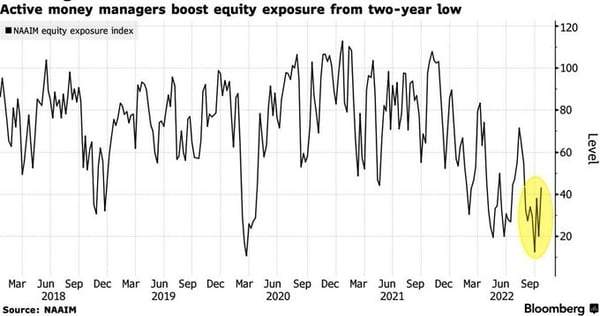

US equities rose strongly last week on the back of political changes in the UK, reassuring earnings reports and indications that the Fed may be moderating the pace of its interest rate hikes. The S&P 500 recorded its best weekly gain in nearly four months, (+4.7%), while the Dow Jones had its third consecutive week of gains. As the chart below shows, active fund managers seem to be slightly increasing their allocations to equity markets, anticipating a seasonal rally.

Investors are gradually returning to the equity markets

Portfolio managers increased their equity allocations after their aggregate exposure hit a two-year low

A record week for UK Gilts

UK sovereign bonds have been at the centre of market turmoil since the beginning of the month. They have just had their best week ever. The main triggers were a new finance minister on Monday and the resignation of Prime Minister Elizabeth Truss on Thursday.

It is still unclear what the new fiscal programme will be, but the markets have welcomed both changes in the UK executive. With Boris Johnson out of the race since Sunday night, Rishi Sunak (former chancellor) will probably be the new PM,

Record low yields on 30-year UK bonds and 10-year inflation-linked bonds

A rush on S&P 500 call options

In recent months, many investors have positioned their portfolios (too?) defensively or even net short. As a result, any rise in the market forces many investment funds to buy equities in order to hedge. To do so, they rush to buy call bonds whose price (measured by implied volatility) has rarely been very high compared to put bonds. As the chart below shows, the "skew" (i.e. the difference between the premium of out-of-the-money puts and out-of-the-money calls that are separated by the same distance from the price of the underlying) is close to record levels.

The difference between the implied volatility of call options and put options (on the S&P 500) is very large, resulting in a record skew

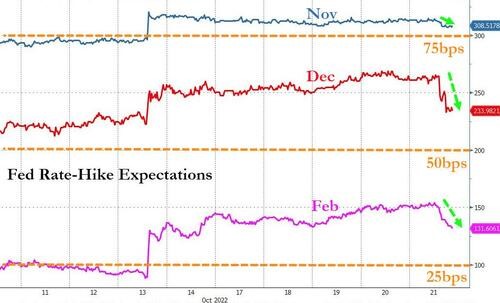

Slight downward revision to expected Fed rate hikes

Several Fed members suggested on Friday that there could be a lull in the rate hike next year. This would not be a "pivot" (i.e. a change in the Fed's monetary policy direction) but rather a pause in the monetary tightening movement.

The market has slightly adjusted downwards the level of the Fed's terminal rate, i.e. the rate at which monetary tightening is expected to peak. A 75 basis point hike at the November meeting remains a near certainty for the market. However, the probability of a 75 basis point hike at the December meeting has fallen from 70% to 30%. Similarly, the probability of a 50 basis point increase in February 2023 has dropped from 50% to 30%.

Market expectations for future Fed rate hikes

Japan intervenes in the foreign exchange market

In recent months, causal links have been established between several asset classes: the fall in the yen has led to forced sales of US Treasury bonds (by Japanese entities in urgent need of dollars). The rise in US bond yields, in turn, weighed on the valuation of risky assets - including equities.

On Thursday, a dollar could buy you JPY 153, a new low that most certainly prompted the Bank of Japan to intervene in the foreign exchange market. This intervention did not go unnoticed as the yen gained no less than 6 figures on the day.

The yen's rise had a positive impact on US bonds (lower yields) and contributed to the rise in US stocks

Yen against dollar over the last week

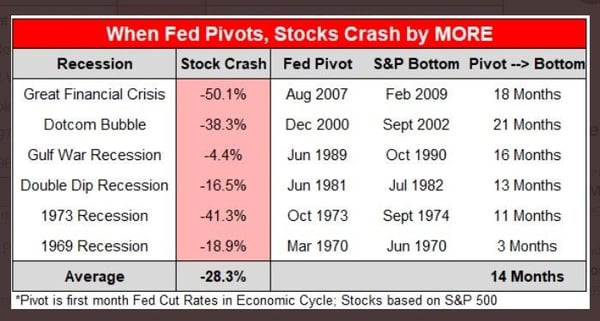

A Fed "pivot" does not guarantee a market rally

While a Fed pivot is considered by many investors to be a necessary and sufficient condition for an equity rally, this has not always been the case in recent history.

The table below shows that, on the contrary, the Fed's emergency course changes have often led to a further decline.

Indeed, pivots have most often taken place during periods of financial market dislocation, marked by forced liquidations and panic selling. On average, there was a 14-month gap between the Fed's pivot and the market lows.

Buying stocks in anticipation of a pivot is therefore risky - even if the pivot actually occurs.

Historically, a Fed pivot has triggered an accelerated decline in equity markets

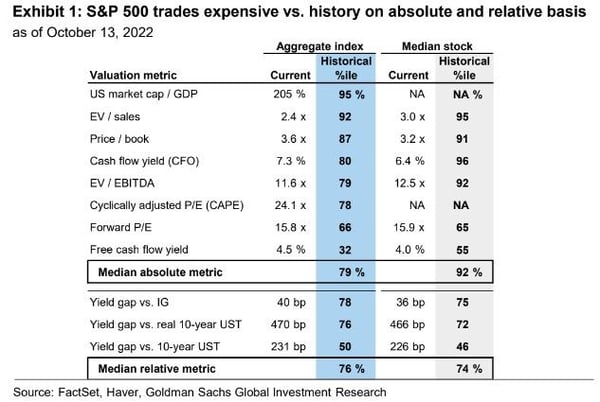

US stocks are not that cheap

The S&P 500 index cannot be considered undervalued, despite the sharp decline from the November 2021 highs. Indeed, the S&P 500 is paying more than 15 times expected earnings for 2023. As a reminder, the same multiple was less than 10 in the 1970s, the last decade with a very high inflation rate.

On an absolute & relative basis, US stocks look expensive

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Interest expenses soar in the US while ECB and SNB cut rates. Each week, the Syz investment team takes you through the last seven days in seven charts.

Bitcoin rings the bell at $100,000 and continues to deliver massive ETF inflows, while global debt hits a new high. Each week, the Syz investment team takes you through the last seven days in seven charts.

France grapples with a massive debt yield ahead of next year’s budget, while the S&P 500 surges by $10 trillion this year. Each week, the Syz investment team takes you through the last seven days in seven charts.

.png)