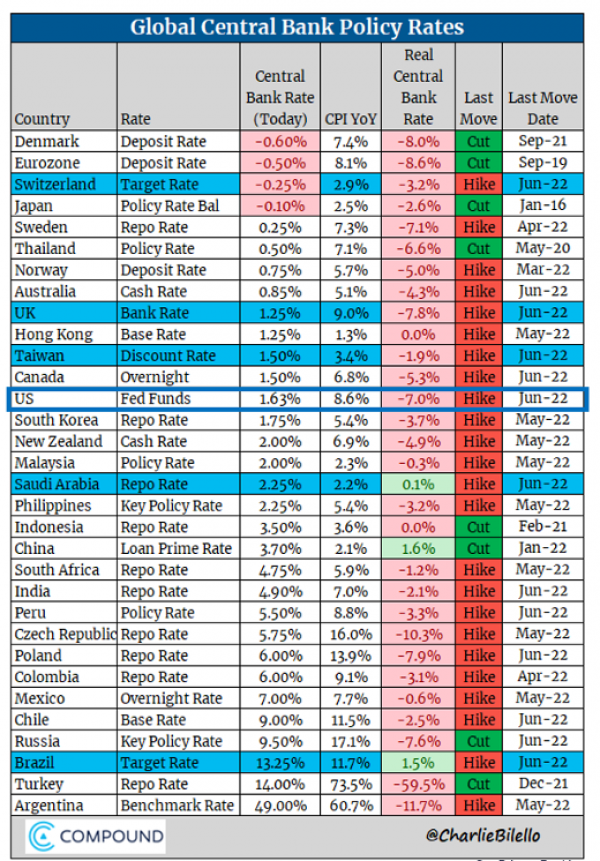

As expected, the U.S. Federal Reserve raised policy rates by 75 basis points, which is its most aggressive move since 1994. But the Fed was not the only central bank to take center stage last week. Of course, monetary authorities in countries whose currencies are pegged to the dollar raised their rates in the process (e.g. Saudi Arabia). But the most unexpected move came from the Swiss National Bank, which raised rates by 50 basis points, its first rate hike since 2007. The Bank of England also made an upward adjustment of 25 basis points. At the same time, the European Central Bank held an unscheduled meeting and indicated that it would take action to stem the widening of yield spreads between member states' sovereign bonds. Elsewhere in the world, Brazil raised its policy rate by 50 basis points and Taiwan by 12.5 basis points. The only central bank to remain inactive was the Bank of Japan, which, despite inflationary pressures, decided to maintain its negative rate policy and the use of yield curve controls to suppress any rise in long-term yields. As the chart below shows, the rate hike is global, but there are still large disparities in real rates.

.png)