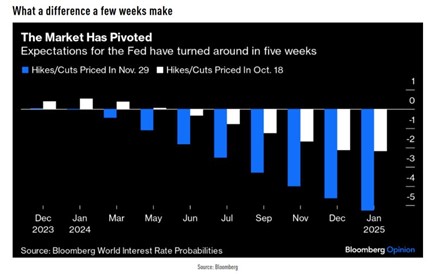

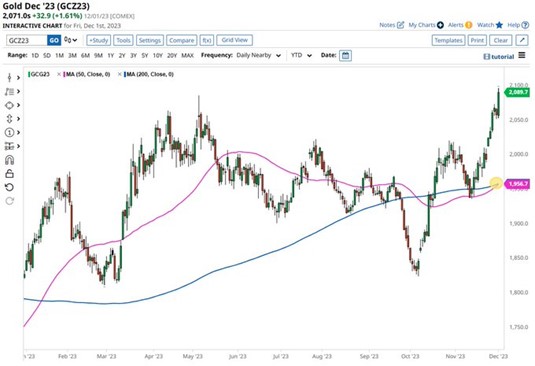

Chart #1 —

The “everything bull market”

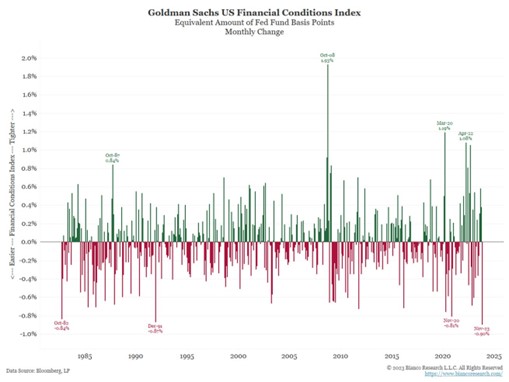

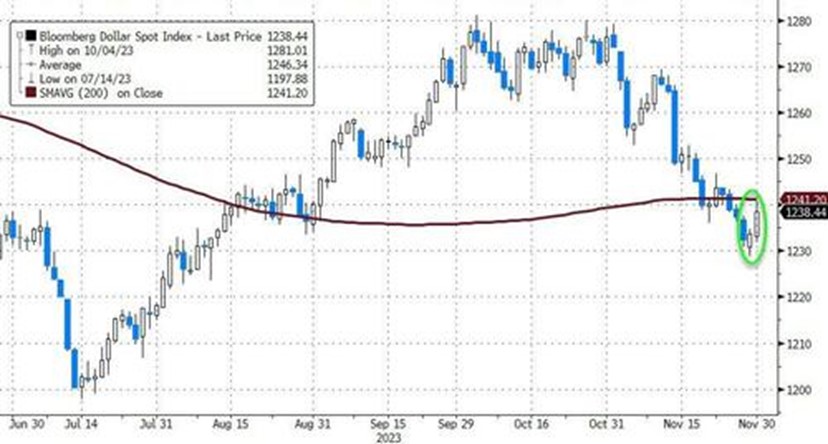

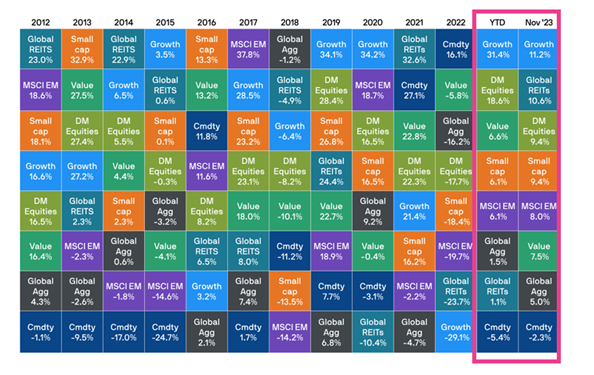

Markets closed November in a positive mood thanks to tentative signs of economic moderation in the US and falling inflation across developed markets. Data releases broadly supported the view that central banks have reached the peak of their tightening cycles, aiding both equities and fixed income.

Global bond and stock markets added over $11 trillion in capitalization in November. That is the second biggest monthly gain in history (November 2020 added $12.5 trillion).

US Growth stocks (+11.2%) outperformed US small caps (+9.4%) and US value (+7.5%) while developed equity markets (+9.4%) outperformed emerging markets equities (+8.0%). In emerging markets, MSCI China’s 2% gain in November supported the MSCI Emerging Markets Index, which grew 8% over the month and is now up 6% year-to-date.

The MSCI Europe ex-UK Index gained 7% over the month, with the financial sector in particular benefitting from stronger interest margins and profits.

Japan continued to be the year’s top performer, up 5% in November and 29% year-to-date.

From a US sector perspective, The energy sector was the only one to end the month in the red while Technology and Real Estate were the big winners.

Source: JPMorgan

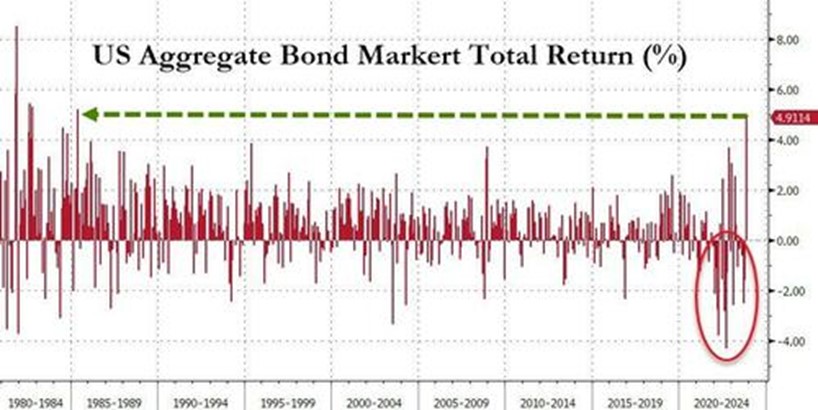

The Global Bonds Aggregate index was up 5% over the month. Commodity prices (-2.3% in November) contracted from their October peaks. Despite the ongoing conflict in the Middle East, the price of a barrel of Brent crude oil fell to $80, in part thanks to an increase in US supply and OPEC+ members’ failure to adhere to production quotas.

With the exception of commodities, all main asset classes are back in positive territory on a year-to-date basis.

.png)