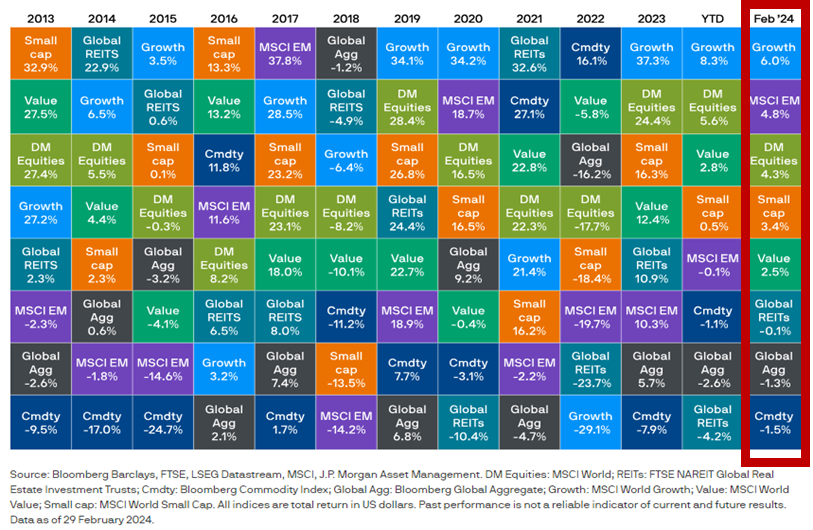

Chart #1 —

Stock markets reported a fairly positive month, supported by strong economic data and relatively high earnings.

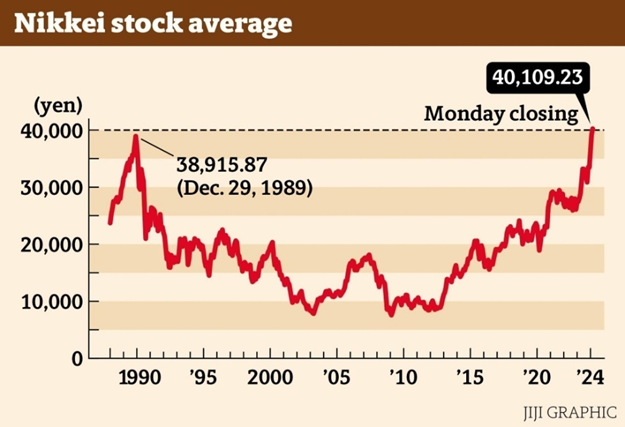

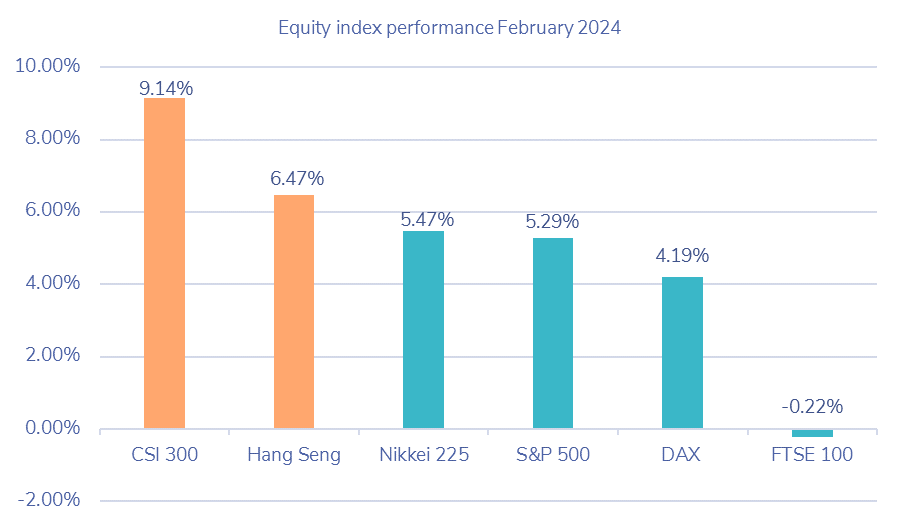

February witnessed a fairly good performance in equity markets. Stocks demonstrated resilience, buoyed by strong economic indicators and robust earnings reports. Five of the Magnificent seven stocks reported their earnings for the previous quarter. These companies largely met or exceeded expectations. Over 90% of S&P 500 companies reported earnings, and nearly three-quarters of them exceeded analysts' forecasts. This bolstered the S&P 500, which surged 5.3% for the month. The index has gained 25% since October 27, representing $8 Trillion in market capitalization and has rallied 130% since the March 2020 low. Japan's Nikkei 225 Index soared to a historic high, contrasting with lagging UK stocks. Emerging markets, particularly China, rebounded driving a 4.8% increase, while European markets struggled to keep pace. The MSCI Europe ex-UK index gained 2.8% in February, compared with 4.3% for the MSCI World index of developed markets. Growth stocks outperformed value, reflecting ongoing market trends.

Source: JP Morgan

.png)

Source

Source