Chart #1 —

Could good macro news become bad news for markets?

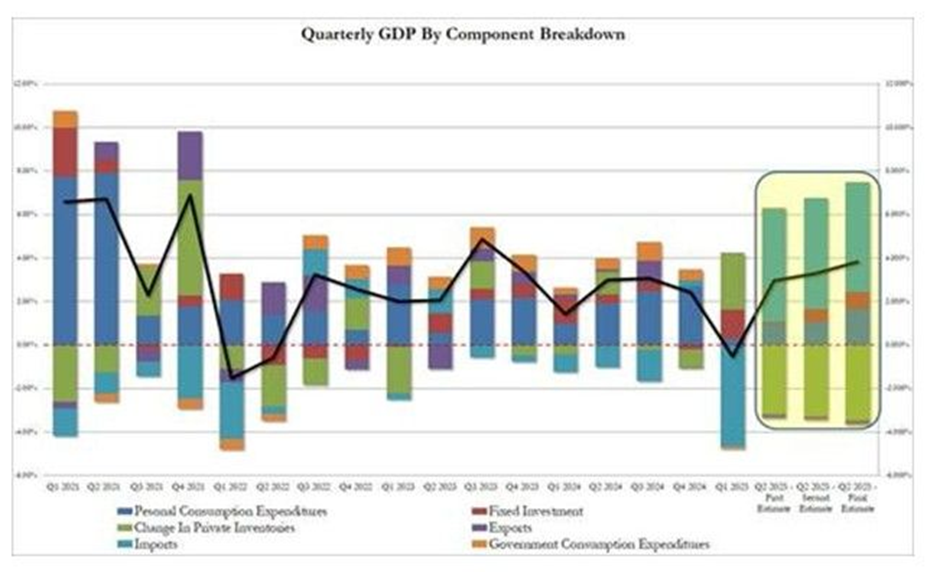

Thursday’s modest pullback on Wall Street wasn’t driven by weak US macro data, quite the opposite. Economic releases surprised to the upside across the board. Initial jobless claims dropped to new YTD lows, confirming that the Texas-related spike two weeks ago was a one-off event. Core durable goods orders rose for the fifth consecutive month. Q2 GDP was revised sharply higher to 3.8%, the strongest reading in two years, fueled by an unusual surge in consumption. US home sales also came in well above expectations.

So much for stagflation worries…

However, strong data turned into bad news for markets as traders scaled back expectations for two rate cuts by December, now pricing in just 1.56 cuts versus 1.7 earlier in the day. This shift pushed both the 10-year Treasury yield and the US dollar higher. With equity valuations already stretched, rising bond yields could easily trigger some profit-taking in US stocks.

Source: Zerohedge

.png)

Source: StockMarket.news, JPAM

Source: StockMarket.news, JPAM Source: Chartr

Source: Chartr Source: StockMarket.news

Source: StockMarket.news Source: Michel A.Arouet, Forbes

Source: Michel A.Arouet, Forbes