Chart #1 —

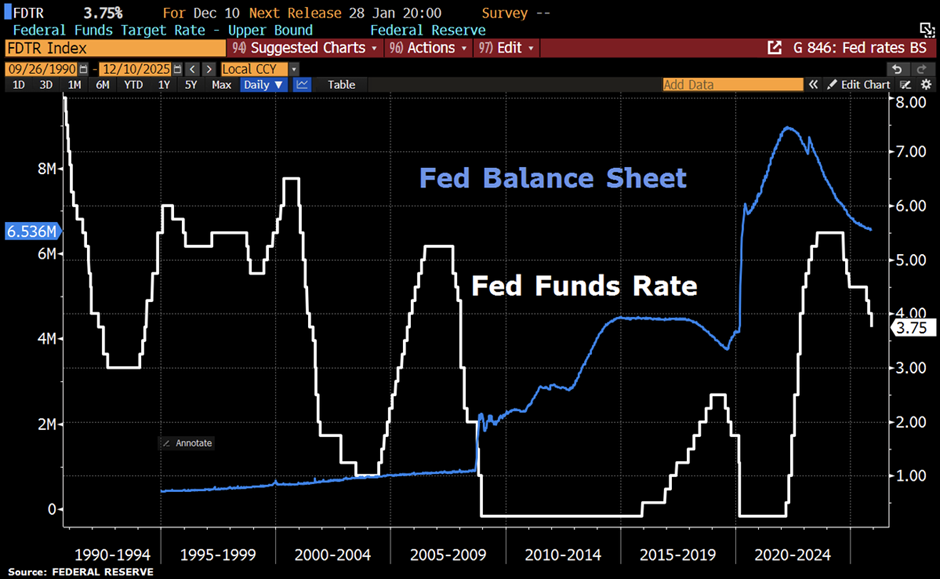

The Fed cut rates as expected and initiate purchases of short-term US Treasuries

In its December meeting, the US central bank (Federal Reserve) decided to cut its key rate by 0.25 percentage points to the range of 3.50% to 3.75%. In addition, it stopped its quantitative tightening programme (i.e., the reduction of its balance sheet) on 1 December and decided to initiate purchases of shorter-term Treasury securities as “needed to maintain an ample supply of reserves on an ongoing basis”.

By cutting its key rate a third time in a row and announcing to assign purchases of shorter-term Treasury securities, the Fed finally met all market expectations. The Christmas present was given in form of Powell's “dovish touch” at the press conference, arguing to aim for a strong economy, although he also indicated that the key rate got now close to a “plausible estimate of a neutral rate”, bringing the Fed into a situation where it can afford to “wait and see”.

Source: HolgerZ, Bloomberg

.png)