“History is full of surprises, and so is the future.”

- George W. Bush

Before diving into the 10 surprises for 2026, let’s take a look back at the surprises that shaped 2025.

Trump 2.1

Trump did impose sweeping tariffs, especially on China, but rising living-cost concerns forced a rethink. By mid-2025 he reopened negotiations and rolled back some tariffs. Chinese equities briefly regained interest from US investors.

Germany pushes for fiscal stimulus

A CDU-led coalition relaxed the debt brake and launched a $500 billion fiscal package, but Germany still avoided issuing Eurobonds. Public debt rose from 62.2% of GDP in 2024 to a projected 63.5% in 2025, while nominal GDP managed only 0.2% growth according to the European Commission.

Near-zero inflation in Europe—negative rates return in Switzerland

Eurozone inflation sits at 2.2%, and the ECB’s key rate is 2%. In Switzerland, inflation did fall to 0% in November, but the SNB has not returned to negative rates.

Trump & Musk go from BFF to foes

We predicted a public split between Trump and Musk, which came true. Their relationship became strained in mid-2025 after a series of policy disagreements. Musk distanced himself from DOGE and focused on Tesla, SpaceX, and xAI. However, there is no evidence that the US government reduced support or contracts for Tesla or SpaceX. Tesla shares are up 14% year-to-date.

And then there were the REAL surprises, the ones nobody expected:

- Gold is the standout asset of 2025, reaching a new all-time high of $4,355 per ounce and delivering its best yearly performance since 1979 (62.14% YTD)

- Japan fully exited yield-curve control, yet the yen continued to weaken

- France’s sovereign debt was downgraded twice in 2025, first by Fitch, then by S&P

- The US experienced the longest government shutdown in history

- Google’s Gemini overtook OpenAI’s ChatGPT in multiple benchmark rankings, reshaping expectations in the AI leadership race

What surprises could be in store for 2026?

SURPRISE #1

MOST US TARIFFS GET ELIMINATED

[PROBABILITY: MEDIUM]

Trump’s 2024 election win and the Democrats’ recent special-election victories are both tied to voter frustration over the rising cost of living, which has become the dominant political concern.

Private companies, meanwhile, have adopted a “wait-and-see” approach. They are putting major US investments on hold until after the 2026 midterms because they do not want to commit billions only to see trade rules rewritten a few months later. This pause weighs on the US economy and raises the odds of a Republican defeat. Trump understands the stake. If Republicans lose the midterms, a Democratic Congress will almost certainly move to repeal his tariff strategy.

Republicans recognise the financial pressure households are under and understand that tariffs feed directly into higher prices, making them eager to avoid any appearance of economic softening heading into the midterms. These concerns could push the administration to move quickly on trade negotiations, an urgency heightened by the political fear that a GOP loss in 2026 could leave a Democratic-controlled House poised to launch a potentially endless series of impeachment efforts.

In this environment, “acceptable” trade agreements become plausible with Canada, Mexico, Brazil and India, even if they "lack substance", like those previously reached with the UK, the EU and Japan.

The overall direction would be a reduction in tariffs, a move widely seen as supportive for growth. Markets would welcome the change and extend the equity rally.

SURPRISE #2

KEVIN WARSH IS THE NEW FED CHAIR AND MARKETS LOVE HIM

[PROBABILITY: HIGH]

Here is a double surprise. First, Kevin Warsh is named the new Fed chair, instead of the current favourite, Kevin Hassett.

The second surprise is that his appointment is taken very positively by the market. Rather than focusing on the risk of a loss of independence at the Federal Reserve, vis à vis the White House, investors welcome the prospect of a new, pro-growth monetary policy era.

Indeed, the current Fed is criticised for having been "too slow" to cut, just as they were criticised for keeping rates "too low" after the pandemic, which fuelled inflation.

Markets also progressively conclude that despite the presidential appointment, the fears of Trump completely controlling the Fed are unwarranted. While Trump will have nominated four of the seven Board of Governors, the rate-setting FOMC has five additional voting members, none of whom have been nominated by Trump. This means the institution remains independent, unlike central banks in China or Japan.

Warsh’s arrival, and his expected focus on growth, brings three shifts that markets quickly welcome. First, the new leadership will likely agree with the assessment that short-term rates need to be cut faster and deeper to stimulate the economy. Second, the "new" Fed is expected to tolerate a slightly higher level of inflation, potentially moving the upper range of the target from 2.0% to 2.5%. It is important to note that Warsh is regarded as an experienced figure with a strong grasp of financial markets, a sharp contrast with Powell’s perceived unpopularity and “arrogance” among investors.

To the surprise of many, the market greets the change very positively. US assets surge and capital inflows into the country hit record levels.

SURPRISE #3

THE GREENBACK'S REVIVAL

[PROBABILITY: MEDIUM]

Against widespread bearish forecasts, the US dollar could stage a strong and unexpected rise in 2026, supported by three underappreciated factors:

- Superior growth and investment: markets realise that the US economy continued to expand faster than the Eurozone, Japan and the UK. This growth is fuelled by massive, future-focused investments (e.g., $350bn in AI infrastructure in 2025). This keeps the United States the unparalleled magnet for global capital.

- Positive real yields: the dollar remains one of the few major currencies offering investors a real return—return adjusted for inflation—unlike the negative real returns of the euro, yen and Swiss franc.

- Undervaluation and stability: IMF purchasing-power estimates suggest the dollar is around 10% undervalued (e.g., USDCHF target of 0.95). It progressively becomes consensus that “de-dollarisation” talks lack credibility given the absence of any stable alternative to the USD’s political and legal stability.

Politics also help. A stronger dollar reduces living-cost pressures ahead of the 2026 midterms, and reduced political risk (e.g., end of tariffs, new Fed Chairman) support the USD's strength.

A rising dollar triggers a surge in European exporters, and a weaker Swiss franc helps Swiss equities deliver one of the strongest market performances globally in local-currency terms.

SURPRISE #4

THE COMEBACK OF THE REAL ECONOMY

[PROBABILITY: HIGH]

A significant rotation takes place within global equity markets, supported by the comeback of the real economy. Indeed, the economic acceleration in 2026 surprises even the most bullish forecasts, built upon a rare alignment of three major policy levers:

- After years of fighting inflation, major central banks are shifting to a more accommodative stance, with more rate cuts taking place throughout 2026. Lower borrowing costs are unlocking investment and directly stimulating activity in capital-intensive, cyclical sectors.

- Fiscal policy remains highly supportive as governments inject money into infrastructure, manufacturing, R&D, defence, and green technologies, lifting global demand.

- Targeted regulatory easing is creating a more market-friendly environment, particularly within the financial and energy sectors, unlocking capital and encouraging risk-taking in credit-dependent segments.

This confluence of stimulus drives a shift in investment preferences, leading to the outperformance of value and cyclical segments over the previously dominant large-cap growth stocks until summer 2026.

Sectors like Industrials, Financials, Materials, and Energy benefit disproportionately from economic growth, low interest rates, and deregulation. Their often-lower valuations make them particularly attractive as the cycle matures and broadens. A similar outcome takes place in the small & mid-caps space.

Non-US developed markets like Europe and Japan as well as Emerging Markets deliver strong performance as well, helped by their lower tech concentration and heavier exposure to cyclical and value sectors.

A strengthening global economy, especially in manufacturing and infrastructure, increases demand for physical inputs. This robust demand, coupled with potential supply constraints, creates a powerful tailwind for commodities like crude oil, industrial metals (copper, aluminium), and potentially precious metals (gold).

The “real economy” boom is expected runs through the first half of 2026. However, the same forces driving growth eventually creates a systemic risk in financial markets: higher inflation expectations and rising bond yields.

As the global economy heats up, and demand outpaces supply, persistent inflationary pressures force central banks to hawkishly pivot once again. Bond yields rebound sharply from their mid-cycle lows. Higher yields make bonds more attractive relative to equities and increase discount rates, pressuring stock valuations.

This final surge in bond yields around mid-2026 trigger a widespread market correction, marking the end of the cyclical outperformance of the real economy and ushering in a new, more volatile, and perhaps structurally different market regime.

SURPRISE #5

PRODUCTIVITY BOOM ARRIVES FASTER THAN EXPECTED

[PROBABILITY: MEDIUM]

By 2026, the long-promised productivity boom finally shows up in the data, driven by a new model of work between people, “agents” and “robots”—machines that can automate nonphysical and physical work, respectively.

Companies begin reporting 20-40% labour-productivity gains as large-scale AI agents automate entire workflows, from customer service to accounting to logistics. What wasn’t anticipated is how quickly robots join the wave. Cheap, flexible industrial robots and autonomous systems flood warehouses, factories, and fulfilment centres, compressing operating costs and accelerating output.

AI handles the cognitive workflows; robots handle the physical ones. Together, they create a step-function improvement in efficiency. Corporations enjoy a period of margin expansion before wage renegotiations catch up, and management teams start guiding earnings sharply higher.

Markets react accordingly. Tech multiples expand as investors price in a multi-year boost to profitability, and bond yields fall on expectations that rapid productivity gains will keep inflation structurally subdued. In other words, the economy enters a rare phase of “deflationary boom”, where strong output meets disinflation.

SURPRISE #6

US & EUROPEAN COMPANIES MASSIVELY ADOPT CHINA'S AI "OPEN-SOURCE" MODEL

[PROBABILITY: MEDIUM]

In 2026, the world realises that the US has made a strategic mistake by concentrating on massive, proprietary “closed-weights” models like ChatGPT and Gemini. These systems demand enormous computing resources and are expensive to operate, limiting their practicality outside the largest corporations.

China follows a completely different playbook. It develops smaller, cheaper models such as DeepSeek and Alibaba’s Qwen that deliver far more usable compute in real-world settings. Their lower parameter count and simpler architectures make them dramatically more economical to run, especially given China’s lower energy costs.

On top of that, China releases its models as “open-weights,” meaning the parameters are freely accessible. This lets developers run the models locally, fine-tune them for specific use cases, and integrate them rapidly—a flexibility that US “closed-weights” models simply don’t offer.

This strategy is proving successful, as a recent study found that Chinese open models have now overtaken comparable US models in terms of global adoption.

Consequently, the world discovers that US and European companies also prefer using Chinese AI models. As it is already the case for Airbnb, they become "fans" of the Chinese model Qwen because it satisfies their need for speed and affordability.

The growing adoption and success of Chinese models are challenging the previous assumption that "bigger is always better”. The market is starting to realise that AI models such as OpenAI, Anthropic, and Gemini are losing their competitive advantage. Investors start to exit from stocks belonging to the OpenAI complex (Nvidia, Oracle, etc.), leading to a massive correction of the Nasdaq.

SURPRISE #7

THE FAILURE OF THE EUROPEAN INFRASTRUCTURE FUND

[PROBABILITY: LOW]

Germany has rolled out significant fiscal expansion plans this year, primarily centred on defence modernisation and infrastructure investment, aiming to stimulate economic growth after a period of stagnation. These plans include legislative changes to circumvent the constitutional "debt brake" for these key areas. This has reignited some confidence among businesses and investors in European growth.

Unfortunately, markets gradually realise that the German special EUR 500bn fund is not used for genuinely new and productive investments—"additionality". Instead, a significant portion of the money is used to offset existing spending from the core budget, which simply avoids budget cuts elsewhere. In addition, the funds are used to finance questionable measures that are more akin to public consumption, like certain social outlays, rather than high-productivity capital investments.

Germany still faces too many headwinds: regulations (labour laws, environmental protection, etc.), high energy costs, and a private sector that remains stagnant. Meanwhile, US tariffs start to bite.

This pushes the German economy into another recession as the unemployment rate surges. The Merz government’s fragile coalition collapses, leading to another snap election. The right-wing party AfD secures more than 35% of the vote and takes power after attempts to form a Grand Coalition among the remaining parties’ collapse.

European sovereign debt and equity markets sell off, credit spreads widen, and the euro depreciates significantly—falling to 0.85 against the Swiss franc—ultimately tipping the global economy into recession.

SURPRISE #8

THE US LAUNCHES A MILITARY INTERVENTION IN VENEZUELA

[PROBABILITY: LOW]

Crude oil prices experience a temporary surge as American strikes hit key facilities. Following the installation of a pro-US government, Venezuela—which sits on the world’s largest oil reserves—cranks production higher, pushing prices back down. The whole thing plays straight into Trump’s agenda: contain inflation and remove Maduro.

SURPRISE #9

FUSION TECH CHANGES THE GEOPOLITICAL LANDSCAPE

[PROBABILITY: MEDIUM]

A breakthrough in fusion technology in 2026—specifically achieving engineering break-even, where a reactor produces more energy than the entire plant consumes, in a scalable, compact design—would dramatically accelerate the arrival of an unlimited, safe, and carbon-free energy source.

The anticipated timeline shift stems from the success of private companies, like Commonwealth Fusion Systems (CFS) and Helion, which are pursuing diverse, accelerated technological approaches. A major breakthrough in 2026 would validate their designs and shift the focus from decades of pure research to rapid industrial scaling and commercialisation.

Consequences would be numerous.

First, it would redefine global power dynamics, as the influence of traditional petrostates erodes. The wealth and geopolitical clout of countries dependent on oil and gas exports would decline sharply. Second, this breakthrough would enable near-total energy independence, as nations could rely on widely available fuels such as deuterium and lithium. Geopolitical attention would shift from controlling fossil fuels to leading in fusion technology, intensifying competition among the US, EU, and China. Let’s not forget the high productivity gains through decarbonisation and cost reduction. Providing cheap, 24/7, carbon-free energy would eliminate the power cost constraint for heavy industries like steel and cement, and large-scale processes like desalination and carbon capture.

Finally, it would meet the exponential, high-intensity power demands of advanced AI, supercomputing, and data centres without environmental compromise, driving sustained growth in the digital economy.

Source: TAE Technologies

Source: TAE Technologies

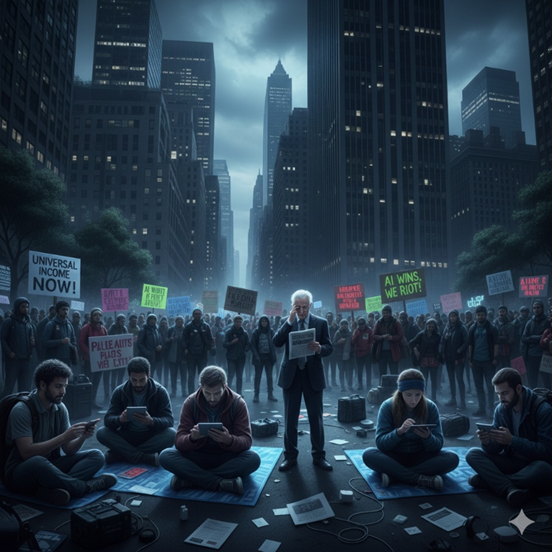

SURPRISE #10

OCCUPY WALL STREET 2.0 LEAD TO THE LAUNCH OF A UNIVERSAL MINIMUM INCOME

[PROBABILITY: LOW]

Occupy Wall Street (OWS) was a left-wing populist movement protesting economic inequality, corporate power, and the influence of money in politics. It began in Zuccotti Park in New York City’s Financial District and lasted fifty-nine days, from 17 September to 15 November 2011. Its emergence reflected deep public distrust in the private sector during the aftermath of the Great Recession.

15 years later, frustration over a K-shaped economy—AI and high income doing well, low to mid income and all other industries struggling—fuels a new wave of social unrest across major global capitals. To contain the rising anger, the US and other G7 countries introduce a universal minimum income.

The policy announcement temporarily calms the streets, but financial markets immediately price in the long-term consequences: higher inflation expectations, widening deficits, and accelerating public debt. Equity and bond markets crash globally just months before the US midterm elections.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)