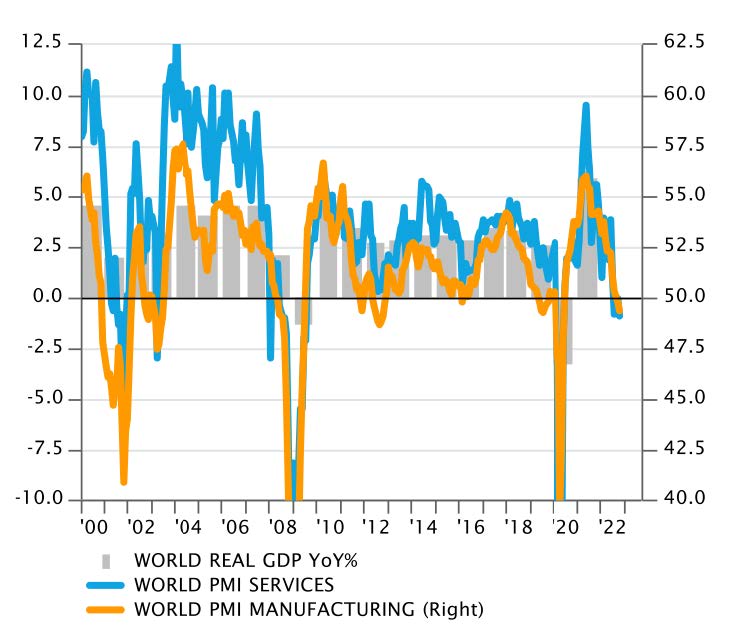

In 2023, global economic growth should continue to decelerate, with all large economies having to deal with negative factors. In Europe, surging energy prices and uncertainties around the consequences of the war in Ukraine have already created a shock of confidence and dragged the Eurozone and the UK on the brink of a recession. Slowing global growth also directly affects export-driven economies such as Germany or Italy, and will impact the Swiss economy despite resilient domestic demand. In the US, tighter financing conditions already undermine interest rate sensitive sectors such as real estate. Higher interest rates will weigh on US economic growth in 2023 even if the employment market remains a strong support to domestic consumption and service sector activity. China is still struggling with the pandemic, and strict anti-Covid policies could remain a headwind for growth in 2023, in a context where tighter regulations and the correction in the real estate sector are already dampening domestic demand. Japan fares no better, faced with slowing demand for its exports and softer domestic consumption due to rising inflation. Emerging Markets' fortunes differ greatly depending on the geography and structure of the economies. Eastern Europe bears the heaviest cost of the war in Ukraine, sanctions on Russia and energy supply disruption. In Asia and Latin America, economies heavily geared toward global manufacturing demand suffer from the weaker growth environment, while commodity exporters benefit from rising prices. All in all, global growth then appears likely to get weaker again and the macroeconomic environment should remain challenging in 2023.

Global activity in the service & manufacturing sectors and real GDP growth

Source: Banque Syz, FactSet

While economic growth in the US and Europe has slowed more than expected, it remains positive and in line with

the long-term potential of these economies. As long as unemployment rates remain low and fuelling wage increases, the negative impact of inflation on consumption may be contained.

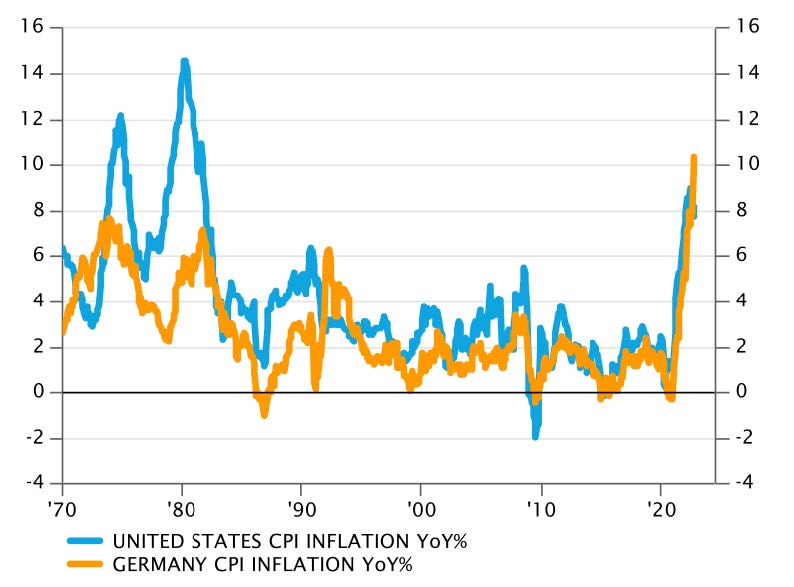

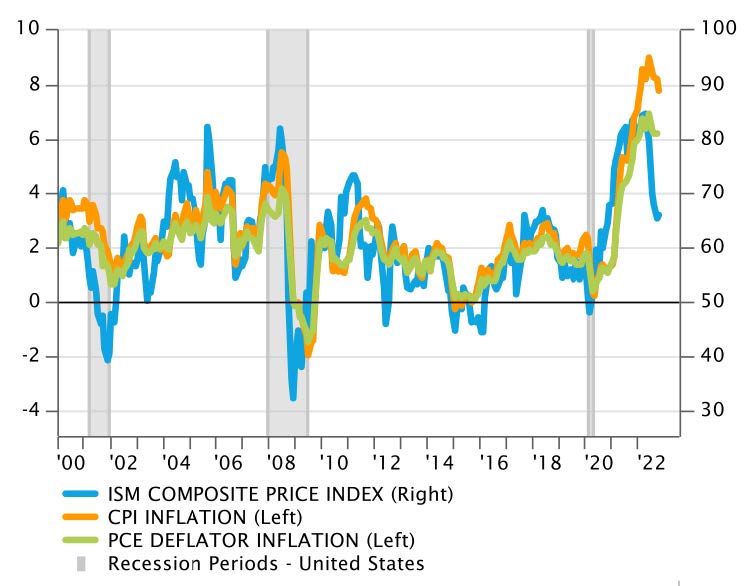

Emerging economies are impacted in different ways by this environment. After strict lockdowns, the Chinese economy will rebound in the second half of the year, helped by targeted monetary and fiscal support. But growth is unlikely to accelerate much above the government’s ‘around Central to economic developments in 2022, inflation will remain a key driver in 2023, for its impact on household consumption and business margins as well as for its consequences on monetary policy across large, developed economies. Inflation surged to unexpected levels in 2022 due to supply disruptions leading energy and commodity prices to rise. It also surged due to tentative signs of a wage/price upward spiral appearing in developed economies, in a context of record low unemployment. Those two powerful inflation drivers should lose steam in 2023, thanks to slower global growth and higher interest rates. At this stage, the question is no longer whether inflation will slow down from 2022 levels, but rather how fast this slowdown will take effect. Several indicators indeed point to an easing in price dynamics under the combined effect of softer final demand and supply chain normalization. However, after the inflation shock experienced this year, some factors may prove to be persistent and will likely prevent inflation rates to drop rapidly. Upward pressures on wages will remain for as long as unemployment levels remain low and give workers bargaining power in negotiations with employers. In any case, inflation is expected to remain a key driver of the macroeconomic environment in 2023. A slowdown is highly likely from 2022 levels, but the absolute level of inflation should remain higher than what has been experienced in the past decade.

Inflation rate in the United States and in Germany since 1970

Source: Banque Syz, Factset

United States – Prices paid by manufacturing & service sectors and inflation rate YoY % (CPI & PCE indices)

Source: Banque Syz, Factset

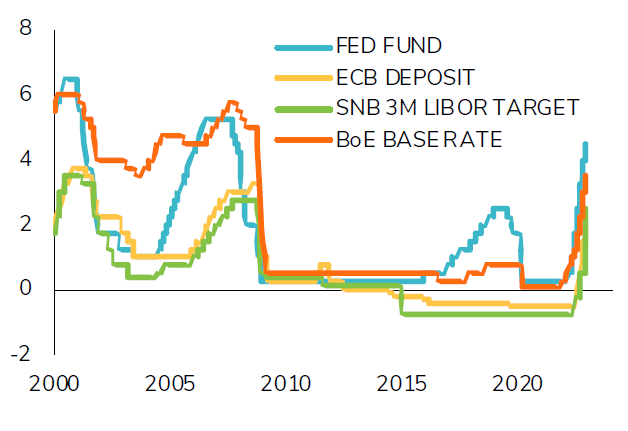

In developed economies, the persistence of upward price pressures will keep the focus of central banks on making their monetary policy more restrictive, by rising interest rates and withdrawing some of the liquidities injected during the pandemic. For two decades, the low-inflation environment had allowed central banks to be very responsive, by swiftly easing financial conditions whenever downside risks to economic growth appeared. This no longer holds when inflation rates are so far off target and when expectations and underlying wage dynamics are drifting higher. In such a context, central banks have to focus on their primary mandate of “price stability”. They need to tighten their policy almost regardless of any economic growth slowdown, until they can be confident that high inflation doesn’t become a persistent feature.

Central banks’ key rates

Source: Banque Syz, Factset

Source: Banque Syz, Factset

This trend has already started in 2022 and some central banks are already well advanced in this process (the

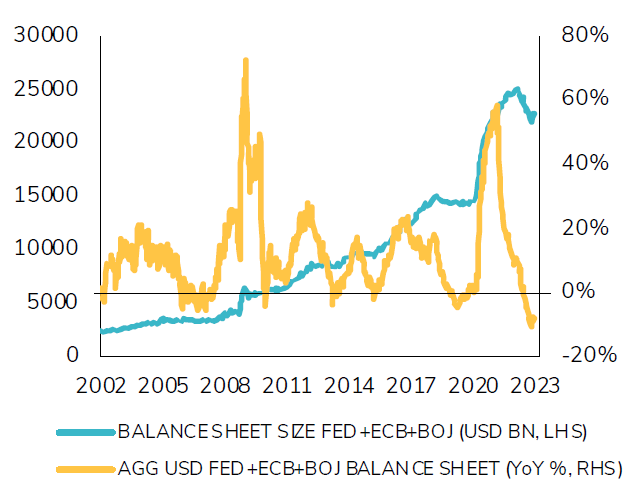

Fed and most Anglo-Saxon peers). The European Central Bank (ECB) is lagging behind and is still in the midst of the adjustment process along with the Swiss National Bank. The Bank of Japan stands out as the only large central bank to maintain its ultra-accommodative stance, with no intention at this stage for joining the global rate hike chorus. Except for Japan, developed central banks are expected to continue to raise short term rates and remove liquidity from the economy in 2023, while most Emerging Market central banks are close to having completed their rate hike cycle. The magnitude of future rate hikes is highly uncertain at this stage and will be dependent of developments on the inflation front. However, unless inflation were to slow down significantly in 2023, short term rates are likely to be raised toward levels that are neutral for economic activity: close to 5% in the United States, close to 3% in the Eurozone. In parallel, liquidity will be reduced as central banks work on shrinking the size of their inflated balance sheet, adding to the ongoing tightening of global financing conditions.

A potential “pivot”, namely a reversal in course with rate cuts during the second half of the year, could only be contemplated if inflation were to dramatically fall and reach central banks’ targets, a scenario unlikely at this stage. In 2023, monetary policy will remain a headwind for economic activity, with a continuation of rate hikes for most developed central banks.

Central banks’ liquidity (USD and YoY%) measured by aggregated balance sheet size (Fed, ECB & BoJ)

Source: Banque Syz, Factset

The macro-economic environment is therefore expected to remain challenging in 2023, with a global economic growth slowdown, lingering inflationary pressures, and tighter financing conditions. However, before getting overly depressed, one has to bear in mind that those developments are already largely priced in by financial markets. Lower global growth, including a “winter recession” in Europe and a US economy running out of steam, appear to be the consensual view for the coming year. Indeed, economic data surprises have been positive in all main regions since the end of the summer. Even if weaker in general, those data have proved to be “less weak” than economists’ forecasts, a sign that the ongoing deterioration in growth is, so far, already widely accounted for. A significant decline in inflation rates is also already discounted for 2023, as reflected by the low level of survey and market-based inflation expectations. And a continuation of rate hikes from major central banks is also clearly priced in when looking at forward market interest rates.

Around this scenario, we identify two types of risks that could lead to an unexpected additional deterioration of the macroeconomic backdrop next year. Firstly, “conventional downside risks” at this stage of the cycle cannot be neglected, even if this economic cycle is born out of a very atypical shock and policy response. The ongoing energy crisis in Europe, so far mitigated by mild temperatures throughout the autumn, remains a strong headwind that has already severely hit business and households’ sentiment. Europe is at the mercy of cold temperatures and potential renewed upward pressures on energy prices that may impact economic activity more heavily and trigger a deeper and/or longer recession than currently expected. In the US, the strong tightening in financing conditions, already heavily impacting rate-sensitive sectors such as real estate, will be fully felt by the rest of the economy only in the course of next year and might trigger a proper recession. The brutal rise in interest rates also raises the risk of financial instability and of a “systemic event” derailing the expected global growth trajectory. In a nutshell, the risk of a weaker-than-expected growth environment is significant in this context of higher rates, strong US dollar and declining liquidities. And energy prices remain a sword of Damocles hanging over the outlook, especially for Europe.

“Unconventional downside risks”, resulting from the very peculiar nature of this economic cycle, also threaten the 2023 outlook. Inflation could potentially remain at an elevated level instead of gradually slowing down, either for endogenous reasons (resilient final demand) or from exogenous factors (additional increase in energy and commodity prices, geopolitical and trade tensions…). In both cases, persisting inflationary pressures would likely weigh on consumption and economic activity. They would also force central banks to raise their key rates to actual restrictive levels, beyond the peak currently expected for 2023. Such forced monetary policy tightening in the midst of an ongoing economic slowdown would likely further heighten the risks of a “growth accident” or of a systemic event, leading the macro-economic environment to become even more challenging next year. Lastly, the recent rise of Covid cases in China shows that the world is not completely out of the pandemic yet, and a new outbreak could strike yet another blow to an already weakening global growth rate.

We believe that there is a path between the risk of a sharp growth slowdown and the risk of inflation remaining too high. Central bankers will have to find the right balance and tighten monetary policy sufficiently to dampen inflationary pressures, without triggering an abrupt growth slowdown or systemic financial instability by overtightening. Similarly, governments will have to find the right balance with some fiscal support to mitigate the impact of rising prices on households’ purchasing power, without unduly fueling inflationary pressures or worsening further public finances already stretched by the massive response to the Covid pandemic. The macroeconomic trajectory for 2023 is at stake and much depends on the ability of policy makers to be reactive to the evolution of economic conditions. With their credibility and reelection prospects also at stake, the incentive is strong for them to find the right balance, unlike the “whatever it takes” kind of responses that had become the norm.

We also do not want to rule out potential positive surprises that could help to improve the environment next year, even if they are more likely to come from outside the strictly economic sphere: an easing in geopolitical and trade tensions (Europe/Russia, US/China in particular) could help dampen global inflationary pressures and bring some relief to central banks, and potentially stimulate global trade and economic growth. A mild winter in Europe could help to soften the impact of high energy prices and potential restrictions on economic activity. A reopening of the Chinese economy, with receding Covid-related restrictions and a less interventionist government, would also have a significant impact on global economic growth, even if it is possibly at the cost of higher energy and commodity prices.

To sum up, the economic environment will likely remain challenging in 2023 as economic growth slows down while inflation remains elevated and central banks continue to raise rates. However, we do not expect that the macro-economic situation will deteriorate much more than what is already expected, leaning towards a scenario of an economic “soft landing” after the turbulences of the past three years. Decision makers may be able to adjust monetary and fiscal policies and manage the highly unusual combination of downside risks to growth and upside risks on inflation. Still, risks around this central scenario are mostly tilted to the downside for a global economy already weakened by the developments of this year.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)