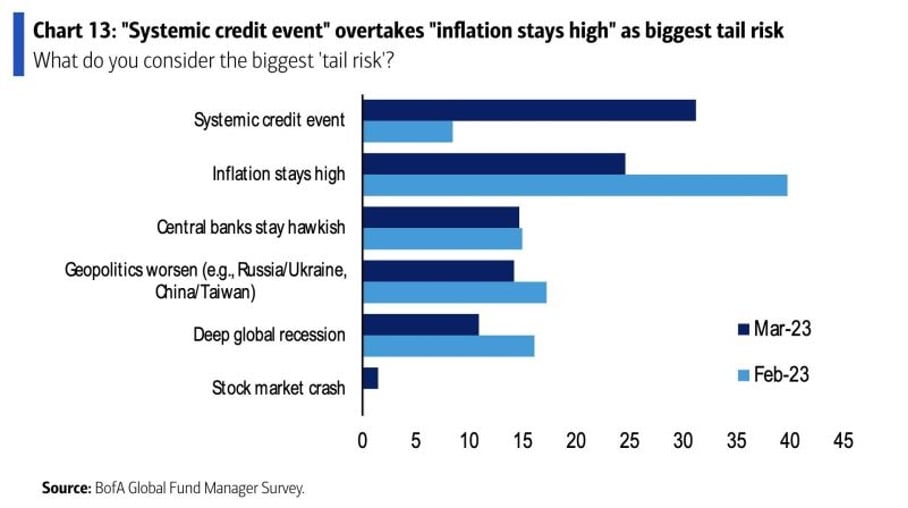

The first quarter of 2023 ended on a relatively positive note for risky assets, with the S&P 500 index up around 7%. However, after the setbacks of several US banks and Credit Suisse, the fear of another "black swan" is dominating investor sentiment. Indeed, the latest Bank of America survey of fund managers shows that a systemic credit event is now considered by investors as the most important tail risk, replacing de facto the risk of inflation remaining high over time.

Systemic credit event overtakes inflation stays high as biggest tail risk

Source: BofA Global Fund Manager Survey

How can investors protect their portfolios against this type of event (called "tail risk")?

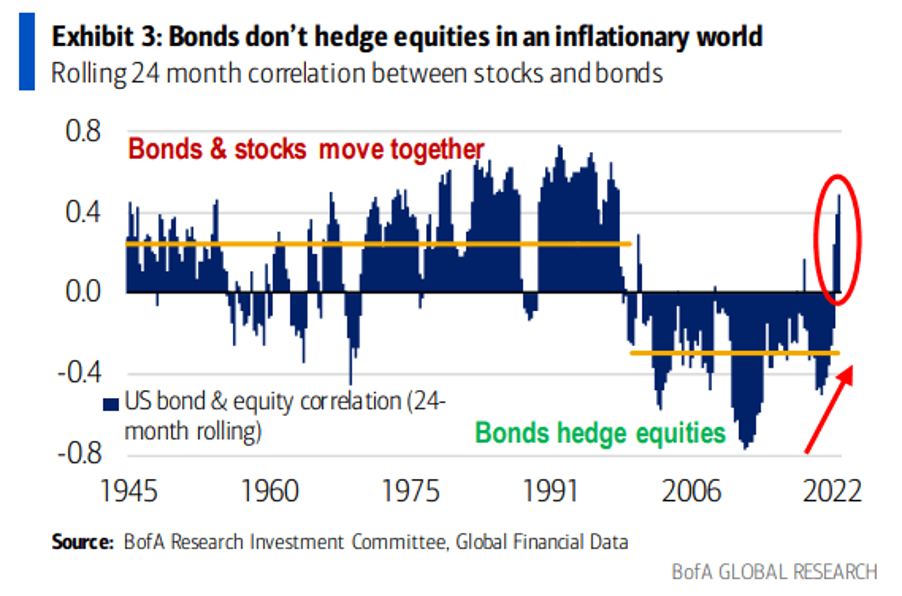

In a world of low inflation or even deflation, the combination of equity and bond pockets in a portfolio was a winning formula. Indeed, the correlation between stocks and bonds proved to be negative most of the time. When stocks performed poorly, bonds performed well and vice versa. Their offsetting performance allowed investors to build less volatile portfolios, better manage market declines and improve risk-adjusted returns.

But with the return of inflation, we are now in a new paradigm. Equity and bond markets tend to move in the same direction (see chart below showing the correlation between the two asset classes over 24 months). In this context, government bonds are no longer fulfilling their role of portfolio protection. Should investors consider other asset classes to diversify portfolios?

Bonds don't hedge equities in an inflationary world

Rolling 24 month correlation between stocks and bonds

Source: BofA research Investment Committee, Global Financial Data

.png)