Introduction

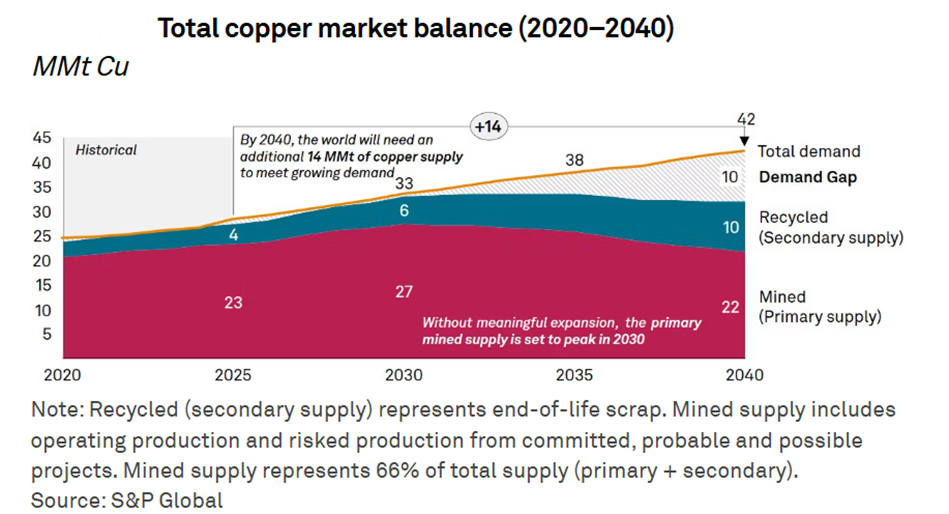

When Thomas Edison electrified cities in the late 19th century, he relied on copper to transmit electricity from power stations to homes, factories, and streets. Since then, copper has become a foundational material of modern economies, embedded in energy systems, industry, transport, and communications. Today, its importance has intensified. Copper sits at the core of electrification, AI infrastructure, electric vehicles, and defence technologies. However, the scale and speed of this transformation are testing the physical limits of copper production. S&P Global estimates that without major investment, the market could face a copper shortfall of around 10 million metric tons by 2040.

Copper’s record prices signal structural change in demand

At the beginning of the year, copper prices printed fresh all-time highs on the London Metal Exchange (LME), hitting $13,407 a metric ton. Year-to-date, copper is already up around 3%, following a gain of roughly 40% in 2025.

Historically, copper has been a cyclical commodity, closely tied to the global growth cycle, particularly construction and manufacturing activity. In previous upcycles, price strength tended to fade once growth slowed or inventories rebuilt. This time, however, demand drivers appear broader and more durable. An increasing share of copper consumption is now linked to long-term electrification trends that are less sensitive to short-term economic fluctuations.

From a demand perspective, copper is a critical material for conducting electricity. It enables efficient power transmission, resists corrosion, has natural antimicrobial characteristics and retains its properties through repeated recycling. Substitution options are limited. Aluminium is often cited as an alternative, but it has only about 60% of copper’s conductivity, meaning cables must be thicker to carry the same electric current and often require additional insulation due to poorer heat dissipation.

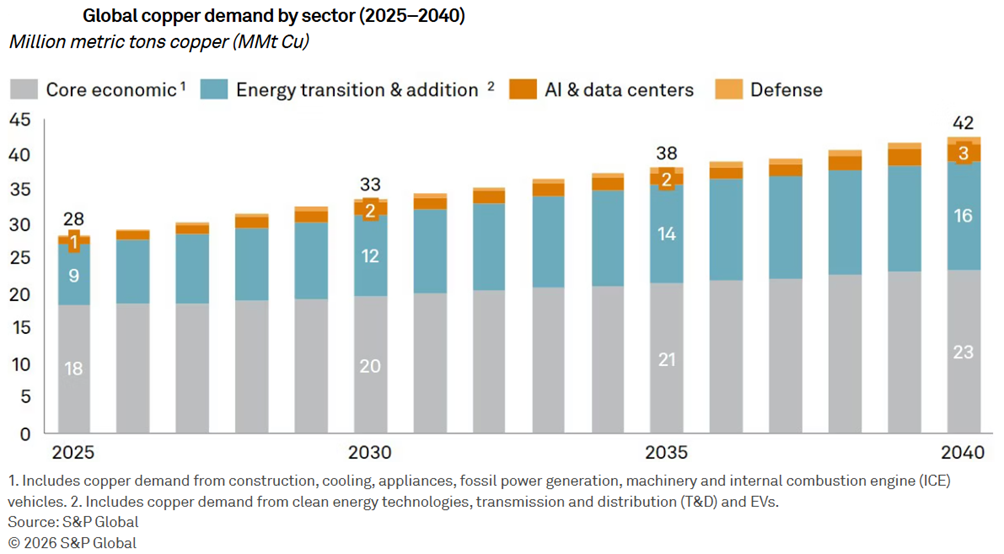

According to S&P Global, global copper demand is expected to increase by around 50% by 2040, rising from roughly 28 million metric tons today to about 42 million. This growth is driven by four main vectors: core economic demand, the energy transition and capacity additions, AI and data centres, and defence modernisation. Core economic demand and energy transition–related uses are expected to remain the largest contributors, and Asia is likely to account for 60% of the incremental demand.

Three quarters of global copper consumption is tied to electrical applications. This includes power generation, transmission and distribution, electronics, and electrical equipment. Construction continues to be the largest single end-market. Copper is widely used in building wiring, plumbing, heating and cooling systems, and renovation activity, providing a stable base of demand even during periods of slower growth.

The energy transition is an additional source of demand. Electrification of transport and power systems is increasing copper use across the economy. Electric vehicles are one of the main contributors to this change. An electric vehicle uses 2.9 times more copper than combustion engine vehicles. This is mainly due to the additional wiring, batteries, power electronics, and electric motors required.

More recently, AI and data centres have emerged as a fast-growing source of demand. S&P Global estimates that copper demand from data centres could rise from around 1.1 million metric tons in 2025 to roughly 2.5 million metric tons by 2040. Much of this demand comes from internal power distribution, cooling systems, and the grid connections required to supply these facilities. AI training data centres alone are expected to account for more than half of total data-centre-related copper demand by the end of the decade.

Beyond these established drivers, emerging technologies could add further upside. Humanoid robotics is still at an early stage, but its copper intensity is meaningful. A single humanoid robot typically contains 4 to 8 kilograms of copper, used in motors, actuators, wiring, sensors, batteries, and semiconductors. Even conservative adoption scenarios imply a material impact.

Defence is another area where copper demand is expected to increase. Geopolitical tensions and the modernisation of military systems are driving higher defence spending and faster adoption of new technologies. Copper is widely used across military equipment and infrastructure because of its conductivity characteristics and reliability in electrical systems, communications, and propulsion. Given its strategic importance, this investment is largely inelastic. At the 2025 NATO summit in The Hague, member states committed to raise defence spending to 5% of GDP. Annual copper demand from defence applications is projected to approach 1 million metric tons by 2040, roughly three times current levels.

A tight and inflexible supply side

Global demand is increasing, but supply is projected to remain constrained due to the ageing of current mining assets. In the absence of significant capacity growth, this could lead to a deficit of around 10 million metric tons by 2040.

Closing this gap is a massive challenge for the coming decades. The supply response is complex and structurally constrained. Substitutes are not a viable solution, due to copper’s exceptional conductivity, durability, and recyclability.

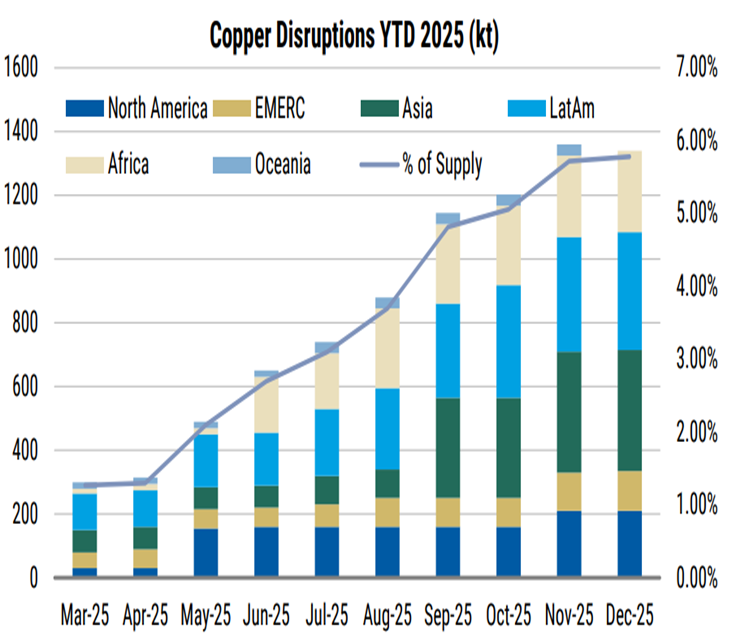

Over time, the depletion of copper mines has made extraction increasingly complex and costly, while mining companies face growing regulatory pressures and environmental opposition from local communities. These fragilities have translated into repeated disruptions in recent years. Freeport-McMoRan declared force majeure at its Grasberg Mine, the world’s second-largest copper mine which represents around 4% of global output, with a full recovery not expected until 2027. Supply disruptions are set to persist this month following strikes at Capstone Copper’s Mantoverde Mine in Chile.

Source: Morgan Stanley

Developing new copper assets takes nearly two decades, approximately 17 years, from discovery to first production- due to regulatory, environmental, political, and cost-related challenges. Current prices, however, provide insufficient incentive to bring major new deposits into production by 2040. Most of the easily accessible copper deposits have already been mined or are currently being mined. This emphasises the need to maximise production from existing assets, improve operational efficiency, and streamline permitting and incentive frameworks for new projects. Future supply will depend on deeper exploration and will be more costly and technically complex.

Several deposits have been discovered that could, in theory, help meet future demand. However, many of these proposed projects may never exist, as they are not feasible at current prices or with current technologies.

Secondary supply relies on recycling, which provides an additional source of production but cannot fully close the gap. Unlike other metals, copper retains its essential properties when recycled, making it virtually identical to newly mined material. As copper use expands across industries, more waste will become available for recovery as assets reach the end of their useful life. Total end-of-life copper waste is expected to grow by about 4% per year, reaching over 15 million metric tons by 2040. According to S&P Global, if recycling rates rise from 50% in 2025 to 66% in 2040, recycled copper from end-of-life materials could contribute roughly 6 million metric tons to the total supply.

The development of copper recycling depends on the establishment of more efficient collection and processing infrastructure. Compared to mined copper, scrap supply is relatively flexible, but policies will play a crucial role in expanding recycling worldwide. Several regions, including the United States, the European Union, and China, have already introduced policies setting recycling targets or supporting infrastructure development. These measures aim to increase the supply of secondary copper while reducing environmental impacts. Even with significant improvements in processing methods, recycling could contribute at least one-third of total copper supply by 2040.

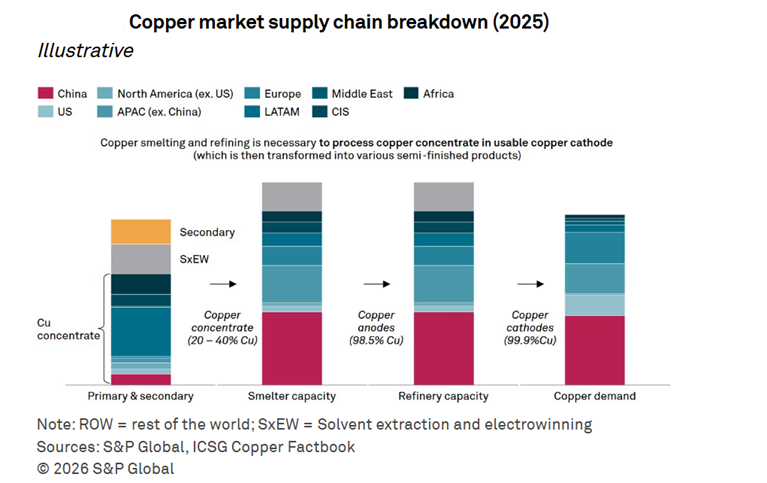

The conversion of raw materials through smelting and refining is concentrated primarily in China, making it a strategic point in the global supply chain. China controls a substantial share of global smelting capacity roughly 12 of the 29 million metric tons worldwide and continues to expand its footprint, further increasing industry concentration. Processing margins are becoming increasingly fragile due to declining treatment and refining fees, as well as regionally varying costs and regulations. At the same time, the high concentration of capacity, estimated at 40 to 50% of the global total, heightens systemic vulnerability and the risk of geopolitical disruptions.

For all these reasons, governments recognise the strategic importance of mineral supply chains. New forms of international cooperation and the growing involvement of sovereign wealth funds are creating alternative strategies for strengthening and diversifying access to critical mineral resources and supply chains away from China.

Conclusion: a global race for critical metals

The world is entering an era of unprecedented growth in renewable power, electric vehicles, artificial intelligence, data centres, and defence, driving a steep rise in global copper demand—the key metal for electrification. Emerging technologies, from battlefield electrification to advanced robotics are set to further accelerate this demand. This rapid electrification is outpacing the growth of copper supply.

This competition is not only about geological scarcity, but also about the intermediate stages that determine the purity and value of these minerals. China's dominance in copper refining and magnet production poses a significant risk to global supply chain, while advanced economies such as the EU are launching initiatives to secure alternative supply channels and accelerate local capabilities.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)