Albert Edwards, the well-known strategist from Société Générale, built his reputation in part on the "Ice Age" theory. In 1996, he made the assumption that the major economies (United States, Europe) would follow in Japan's footsteps, i.e. face a long period of deflation and stagnation of their GDP growth. From his point of view, this macroeconomic context was likely to lead to a decorrelation between bonds and equities and an outperformance of long-duration bonds compared to global equity markets. In his craziest dreams, Albert Edwards even assumed that the US 10-year could yield -1% and that the 30-year yield would also end in negative territory. As for the equity markets, the strategist expected growth to outperform value...

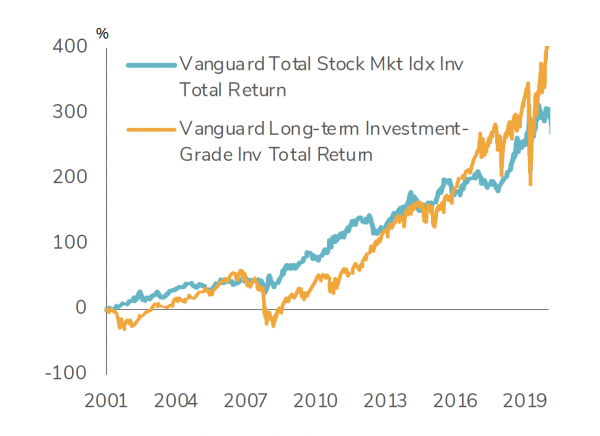

Twenty-five years after his first publication on the topic, it seems that the extreme scenario imagined by Albert Edwards is unlikely to come true - at least not at this stage. On the other hand, the vast majority of his predictions proved to be accurate: the G7 countries have indeed had to face several prolonged episodes of deflation and sluggish growth. And while most market participants have been talking about an unprecedented bubble in the equity markets, the best cumulative performance over the last 20 years has been produced by long-duration sovereign bonds - and with lower volatility (see chart below). During this period, the growth style (especially technology stocks) has outperformed the value style (banks, basic resources, energy, etc.) to an unprecedented degree.

Vanguard Long-Term Investment Grade Total Return ETF (yellow line) & ETF Vanguard Total Stocks Market Total Return ETF (blue line)

Source: Charlie Bilello

The melt-up

Albert Edwards has often been asked about the conditions necessary for the ice age to come to an end. This topic was also heavily debated when Covid-19 became a pandemic, forcing governments and central banks to resort to massive stimulus packages. At the end of 2020, Albert Edwards spoke for the first time of an imminent "melt-up". The trigger? The so-called "helicopter money" that most developed countries have been pouring into their economies since 2020 to prevent a severe global recession. For the strategist, the trillions of dollars injected through quantitative easing (QE) and fiscal stimulus packages (e.g. Biden's famous “anti-recession checks”) are generating money supply growth far in excess of economic growth, leading to strong inflationary pressures. In this new paradigm, budget deficits are likely to remain very high, as governments have no way to restrict fiscal support. This scenario forces policymakers to use the weapon of financial repression, i.e. negative real interest rates over time. The corollary for the financial markets is a rise in bond yields and the end of the period of underperformance of the value style.

Looking at how financial markets have recently been performing, it seems that the melt-up scenario could eventually become reality. Perhaps the most emblematic chart of the regime change we are witnessing is that of the nominal amount of negative yield bonds (see chart below). Since the end of November, its decline (-70%) is even more dramatic than that of crypto-currencies.

Barclays Global Aggregate Negative Return Bond Index

Source: Bloomberg

The come-back of sovereign bonds into positive yield territory reflects market expectations of a rise in short-term rates and thus the end of the NIRP (Negative Interest Rates Policy) and ZIRP (Zero Interest Rates Policy) era. For investors, the switch to a world where the risk-free rate once again pays savers has both financial and psychological consequences.

As far as the financial implications are concerned, it should be remembered that some sectors benefit directly from a rise in interest rates. This is the case, for example, of banking stocks, which have been penalized for more than a decade by overly accommodating monetary policies. Their profit margins are positively correlated with interest rates. The insurance sector should also benefit.

Conversely, a rise in the risk-free rate has mechanical repercussions on the discount rate of future cash flows when it comes to assessing the value of a listed stock. The stocks most affected by a rise in the discount rate are those belonging to the so-called long duration sectors. Growth stocks, such as technology stocks (including the famous FAAMNGs) or biotech, are among them. It is therefore not surprising to see them underperforming in this sector rotation phase.

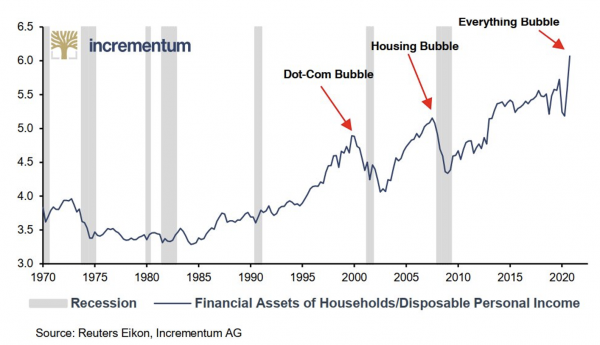

But as mentioned above, a return to positive territory for the risk-free rate also has psychological implications. Over the past two decades, zero or negative interest rate policies have somehow forced investors to leave their comfort zone and move up the risk ladder. Gradually, they have allocated their assets to the riskiest segments of the market: investment grade bonds, junk bonds, leveraged loans, technology stocks from non-profit companies, private debt, venture capital, commercial real estate, etc. To the point of creating what many observers have dubbed "the everything bubble" (see chart below). All this at the expense of cash.

Financial Asset s of Households / Disposable Personal Income

Source: Incrementum

For many market observers, the end of the Ice Age could prompt investors to leave the riskiest segments of the market and return in part to risk-free assets, to the point of bursting bubbles one by one.

Could the Ice Age ever come back to life?

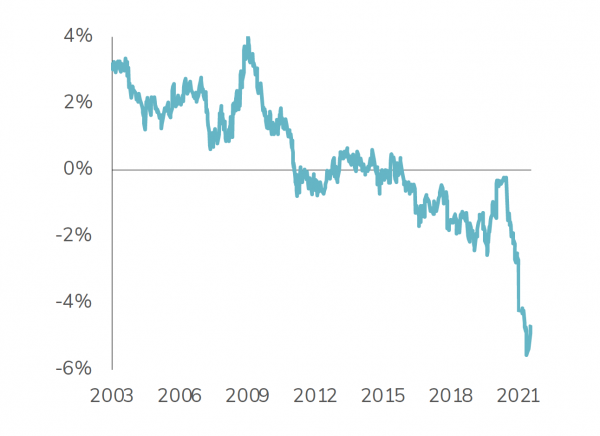

In the scenario described above, we have reasoned in terms of nominal interest rates and bond yields. Investors' risk appetite must also be considered in a real rate context. From this point of view, financial repression seems to remain the order of the day. Indeed, the sharp rise in bond yields has been accompanied by an equally dramatic rise in inflation. As the chart below shows, real 10-year yields in Germany have been in negative territory for 69 consecutive months. In view of this, can savers move away from risky assets and into money market investments? This seems difficult to envisage - all the more so as the government and monetary authorities intend to maintain financial repression, an essential tool in a context of high budget deficits.

German 10 year real bond yields

Source: Bloomberg

Finally, let's not forget that even if the market anticipates a rise in short-term rates, it could prove to be relatively short-lived. In the long term, global growth and inflation will continue to face the secular forces that led to the Ice Age - the so-called 3 Ds: demographics (chronically low and de facto impacting growth), debt (which literally exploded during the pandemic and acts as a drag on growth when rates rise) and digital disruption (still accelerating and with proven deflationary impacts). In the medium term, the end of bottlenecks and a rebalancing of supply and demand in the energy market should allow inflation to gradually return to central bank targets. And why not below? Just one figure to keep in mind: if energy commodity prices (oil, natural gas) were to return to their pre-pandemic levels, the inflation rate in Europe would move into negative territory. A scenario that would take us back to the Ice Age, with the (likely) consequence of a return to negative bond yields and an outperformance of growth stocks.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Is it the “trade of the century”? MicroStrategy’s stock price soared 600% in the past 12 months, thanks to the audacious Bitcoin strategy of its visionary founder, Michael Saylor.

Treasury scenarios for 2025: fiscal policy, inflation, and yield projection

A month to shape the future of the global economy

.png)