A bad start for debt

Emerging market (EM) sovereign and corporate bonds (hard currency) are off to the worst start in their history, with a performance of close to -4%. This added pressure to the already poor performance of 2021: since January 1, 2021, emerging market sovereign bonds have lost about 7%.

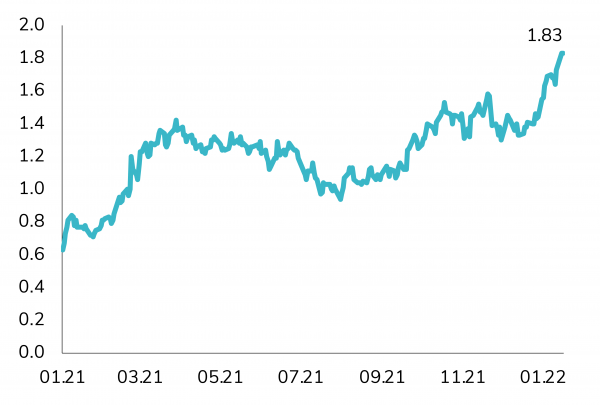

First two weeks of performance each year

Source: Bloomberg

This performance is in part due to rising US interest rates. In fact, the US intermediate yield curve (7-10 years) has lost more than 3% since the beginning of the year.

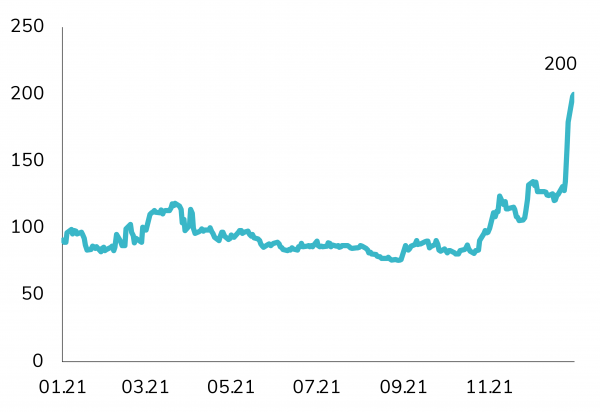

Since the beginning of 2021, the US Treasury 7-year rose more than by 120 bps

Source: Bloomberg

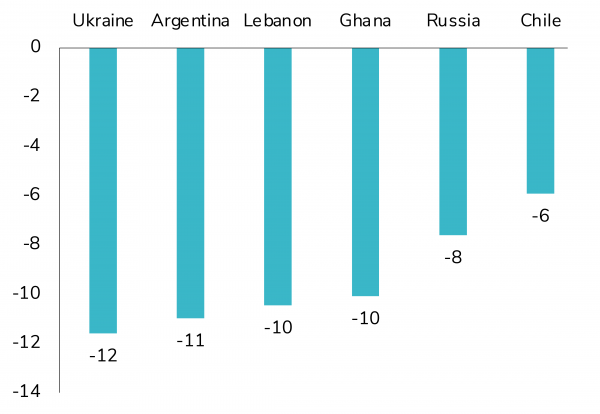

Furthermore, some idiosyncratic risks are also weighing on performance. Tensions between Russia and Ukraine have hit their bonds, with an average performance of -7.5% since the beginning of the year.

Russia CDS 5-Year (in BPS)

Source: Bloomberg

In Argentina, bonds, which are among the worst performers since the beginning of the year, lost nearly 10% due to difficulties in reaching an agreement with the IMF on debt restructuring. In Mexico, bonds were hit by a loss of more than 3% from a new supply (an amount of $6 billion) that gave an attractive premium.

Largest underperformers of 2022 so far - Total Return (%)

Source: Bloomberg

The house’s take on things

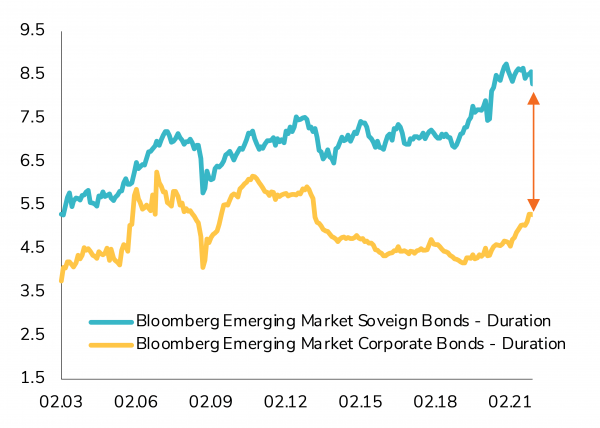

In general, we are less negative on EM debt, which is justified by rising commodity prices, more attractive valuations and the fact that the monetary policy tightening cycle is already well underway in Emerging Markets. We also prefer corporate bonds to sovereign bonds, as the latter are more sensitive to rising US interest rates (and a stronger US dollar).

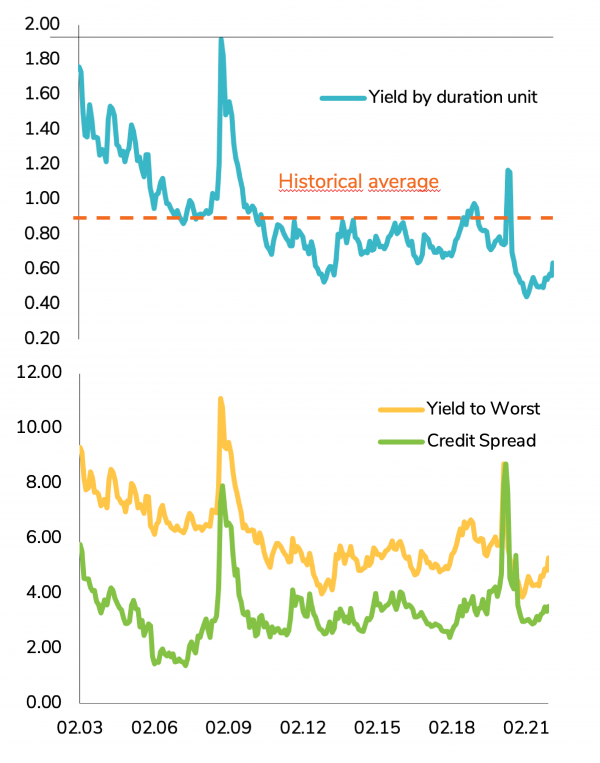

The sensitivity (duration) to a rise in U.S. interest rates is almost at its widest between the emerging market sovereign and corporate bond indices.

Source: Bloomberg

On a negative note, geopolitical tensions are rising (e.g. Russia/Ukraine), which will continue to affect the performance of emerging market sovereign bonds. The Brazilian elections will also continue to put pressure on Brazilian bonds until the end of the year.

In addition, the average yield to maturity of the USD emerging market sovereign bond index is still below its historical average (5.2% vs. 6%). See the following graphs:

Yield by duration unit

Source: Bloomberg

Conclusion

Overall, the entry point is much better than a year ago, but emerging market sovereign bonds could suffer again in the short term. We therefore recommend waiting for more stability before investing in cash bonds. We would also favor to invest now only via option strategies.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Below are the top 10 events and surprises that could impact financial markets and the global economy in the New Year. These are not forecasts, but potential macroeconomic, geopolitical, or market events that are not anticipated by financial markets. We also try to assess the probability of occurrence (high, medium, low) of each of them.

Gemini 3 has just been ranked as the best performing AI model, a reversal that few saw coming. A year ago, OpenAI models were leading the charts.

The 2025 season is coming to an end. This year has been anything but quiet: Trump's historic return to the presidency, the April "Liberation Day" tariff shock, major AI breakthroughs, bitcoin's volatile journey, and a stunning market rebound. Here are ten stories to remember.

.png)