The depreciation of the euro against the Swiss franc accelerated over the summer, with the EUR/CHF falling from 1.037 in mid-June to 0.96 in mid-August, a depreciation of almost 7% in two months.

EUR/CHF 2017 - 2022

Source: Bloomberg

Can the franc continue to appreciate against the single currency?

Below, we mention the various factors that weigh in favor of a continuation of the upward movement of the Swiss franc but also the elements that could, on the contrary, allow the euro to stabilize.

A major shift by the SNB

As we wrote in a previous FOCUS note (“The reverse currency war”), we may have entered a new era where countries seek to strengthen their currencies rather than weaken them.

Between 2008 and 2021, our national bank had to make huge efforts to prevent the Swiss franc from becoming too strong. The SNB implemented a negative interest rate policy but also multiplied the size of its balance by four in order to make massive purchases of dollars and euros. The strength of the franc threatened the competitiveness of our companies’ exports and also risked reinforcing deflation in Switzerland.

But since last year, we are witnessing a paradigm shift. Several countries seem to have entered an era of competitive appreciation. The world has emerged from deflation and is now facing record inflation rates. A strong currency is one weapon among others to fight inflationary pressures. In Switzerland, the SNB surprised the markets in June by raising rates earlier than expected and by announcing that its balance sheet could now be used to buy Swiss francs. The stated goal was to contain inflation by lowering the cost of imported goods and services through the appreciation of the franc.

According to Goldman Sachs, the SNB probably did not intervene this summer to curb the recent appreciation of the franc. And it could continue to raise rates by at least the same amount as the European central bank.

This 180-degree turn has contributed to the rise of the Swiss franc in recent weeks. However, it would appear that the market is still underestimating the SNB's determination to fight inflation, probably because many investors still have in mind the drastic measures put in place over a decade to fight the appreciation of the franc.

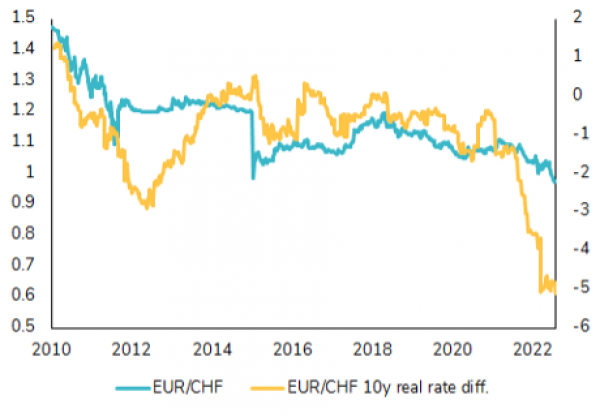

A real rate differential in favor of the Swiss franc

Regarding the evolution of the Swiss franc against the euro, the real interest rate differential is clearly in favor of the Swiss franc; while nominal interest rates are almost identical between Switzerland and the euro zone (-0.25% and 0% respectively), inflation has increased much faster in the euro zone than in the Swiss Confederation (8.9% year-on-year against 3.4% in July). Consequently, the real interest rate differential is clearly in favor of the Swiss franc.

EUR/CHF and real 10-year interest rate differential between the euro zone and Switzerland

Source: Banque Syz, FactSet

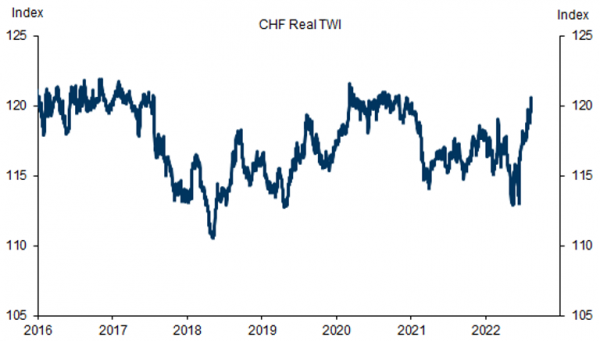

The evolution of the (trade-weighted) real exchange rate of the Swiss franc against a basket of currencies provides an interesting perspective. The SNB's decision on June 16 to raise its key rate by 50 basis points and to change its currency intervention policy has brought the real effective exchange rate (REER) back to the level that prevailed during most of the negative rate period.

Trade Weighted Real exchange rate of the Swiss franc

Source: Goldman Sachs

Assuming that the SNB aims to maintain the real effective exchange rate at this level, a further substantial appreciation of the Swiss franc against the euro and the dollar is necessary. Indeed, there is a gap of about 5 percent between inflation in Switzerland and that of the Eurozone or the US. The nominal exchange rate will have to continue to appreciate (albeit at a slower pace) for the real exchange rate to remain stable.

The SNB is increasingly referring to the inflation differential between Switzerland and its trading partners, which seems to indicate that the real exchange rate is an important input for the monetary policy outlook in Switzerland.

It is also worth remembering that the SNB seems to have a stricter inflation target than its international counterparts. The SNB does not have a 2% inflation target and instead aims for an even lower level of inflation. During the years of low inflation following the crisis of 2008/2009, the SNB had repeatedly stated that it had reached its target, even though inflation in Switzerland had averaged only slightly above 0%. This is one of the reasons for the Swiss franc's reputation as a safe haven currency (see below), and it is probably why the Swiss franc tends to appreciate in times of high global inflation.

It is therefore important not to underestimate the determination of the SNB to fight inflation and therefore to favor a strong franc policy until inflation returns to very low levels.

The Eurozone facing significant recession and political risks

Inflation has not been the sole driver of the euro’s weakening against the Swiss franc.

Indeed, the macroeconomic dynamics have also contributed to the weakening of the euro. The likelihood of the Eurozone falling into recession in the coming months is relatively high. The continent is currently facing a serious energy crisis due to the constraints of gas supply from Russia. If there is a gas shortage this winter, rationing is likely, which will have an impact on both business activity and the inflation rate.

The impact of rising inflation, the energy crisis and deteriorating sentiment has been much more pronounced in the Eurozone than in Switzerland, and EU economic data has not only slowed significantly, but was also clearly below expectations. This has not really been the case in Switzerland, where economic activity remains healthy according to the latest economic data.

Beyond the impact of the energy crisis on the macroeconomic fundamentals of the Eurozone, it is likely to reinforce the current flows towards the Swiss currency, as capital seeks the stability of the franc when Europe is in trouble. Geopolitical uncertainties, with the upcoming elections in Italy, the war in Ukraine and Sino-American tensions may also support the attractiveness of the CHF in the coming weeks.

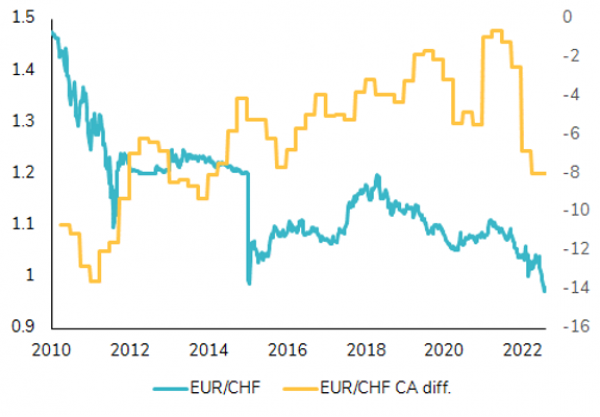

Other macroeconomic fundamentals continue to argue for a strong CHF (or even stronger) against the EUR. While both Switzerland and the Eurozone have trade surpluses, Switzerland's current account surplus is sustantially larger (9.7% of GDP vs. 1.7% for the Eurozone in Q1 22). The Eurozone surplus is shrinking with the energy crisis, and the Switzerland / Eurozone differential is therefore moving in the direction of a weakening euro against the Swiss franc.

Some factors could limit the weakening of the euro

As mentioned above, the macroeconomic momentum is currently more favorable for Switzerland than for the Eurozone. But as is often the case in the markets, the second derivative is more important than the absolute level. Thus, we can see that the differential between economic surprises in Switzerland and in the Eurozone is fading.

The bad news from the Eurozone is already well anticipated by the market. As growth expectations have been revised downwards significantly, the potential for negative surprises has diminished. In contrast, Switzerland is showing the first signs of a downturn. The combination of a strong franc and slower growth in Europe could have a negative impact on economic activity in Switzerland, a scenario that does not seem to be fully integrated by the market.

The next few months could therefore be characterized by European macroeconomic figures that are decidedly weak but in line with expectations, while Swiss figures could disappoint market expectations. This dynamic - if it materializes - would favor a stabilization of the EUR/CHF.

EUR/CHF and trade balance differential between the Eurozone and Switzerland

Source: Banque Syz, FactSet

Another factor that could limit the appreciation of the Swiss franc is valuation.

The SNB may consider that "the Swiss franc is no longer very expensive", but from a valuation perspective, the CHF is certainly not cheap... According to the Economist's Big Mac Index, the Swiss franc remains 40% overvalued against the euro.

While valuations (especially in the foreign exchange market) are certainly not enough to form an opinion on a currency, they do matter when they reach extreme levels. This factor is likely to limit the extent of the move if the downward trend in the EUR/CHF continues in the coming months.

Conclusion

The SNB is determined to fight inflation by letting the Swiss franc appreciate. Moreover, macroeconomic fundamentals continue to argue for a strong (or even stronger) Swiss franc against the EUR. The CHF is a safe haven in difficult times, especially when the problems are in neighboring Europe.

However, the macroeconomic dynamics that have weighed on the EUR/CHF recently may become less negative for the euro in the coming months. Valuations are limiting the potential for further EUR/CHF downside.

Based on these elements, a significant rebound of the euro in the short to medium term does not seem likely. The franc could even continue to strengthen against the single currency, but at a slower pace than observed this summer.

A significant drop of the euro below 0.90 could be envisaged in a scenario where the energy crisis would plunge the euro zone into a pronounced recession while keeping inflation high. In this scenario, the European Central Bank (ECB) could be forced to stand still despite an inflation rate well above the ECB target. The real interest rate differential would then continue to weigh on the EUR/CHF and the franc would also benefit from its safe haven status. Switzerland would be affected by a recession in neighboring Europe, but probably less than the eurozone, paving the way for a further appreciation of the franc. The probability of such a scenario remains high.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

Below are the top 10 events and surprises that could impact financial markets and the global economy in the New Year. These are not forecasts, but potential macroeconomic, geopolitical, or market events that are not anticipated by financial markets. We also try to assess the probability of occurrence (high, medium, low) of each of them.

Gemini 3 has just been ranked as the best performing AI model, a reversal that few saw coming. A year ago, OpenAI models were leading the charts.

The 2025 season is coming to an end. This year has been anything but quiet: Trump's historic return to the presidency, the April "Liberation Day" tariff shock, major AI breakthroughs, bitcoin's volatile journey, and a stunning market rebound. Here are ten stories to remember.

.png)