Known for its decentralised nature and blockchain technol-ogy, bitcoin has become a cornerstone in the world of digital currencies. In addition to BTC's spectacular rise this year, a new phenomenon known as "Bitcoin Ordinals" has recently attracted attention, marking a notable evolution in the Bitcoin ecosystem.

The concept of Bitcoin Ordinals introduces a unique way of leveraging the Bitcoin blockchain away from the traditional financial transaction role it has played since its emergence in 2009. This innovation, which was launched on the main Bitcoin network in January 2023, has not only attracted the interest of enthusiasts and investors, but has also opened new avenues for the creation and ownership of digital assets on the Bitcoin network. The Bitcoin Ordinals boom is linked to the growing interest in digital collectibles and their integration into established blockchain systems.

What are Bitcoin ordinals?

Bitcoin Ordinals was created by Casey Rodarmor, also known for proposing "Runes", a new fungible token protocol based on Bitcoin.

Bitcoin Ordinals introduce a distinct form of digital asset to the Bitcoin blockchain, akin to non-fungible tokens (NFTs). Unlike traditional Bitcoin transactions, which focus on the transfer of currency, ordinals embed unique data on individual satoshis, the smallest unit of bitcoin (1 bitcoin = 100,000,000 satoshis). This process transforms each satoshi into a distinct, identifiable object, capable of carrying digital content such as images, text or code.

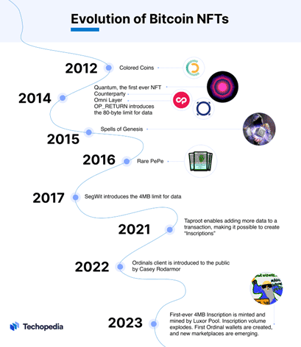

The concept of embedding data in Bitcoin transactions is not entirely new. Over the years, various methods have been employed to write small amounts of data into the Bitcoin blockchain, for purposes ranging from timestamps to personal messages.

While Ethereum's blockchain is renowned for its native support of non-fungible tokens (NFT), Bitcoin has not traditionally been a platform for these types of assets. Ordinals, however, have brought a similar concept to the Bitcoin network. Unlike Ethereum's NFTs, which are usually part of separate token standards such as ERC-721 or ERC-1155, Bitcoin's ordinals are not separate tokens, but rather an integral part of bitcoin itself. This distinction is crucial, as it means that the security, immutability and decentralised nature of the Bitcoin blockchain apply directly to each satoshi embedding data. Furthermore, unlike NFTs on Ethereum, which require smart contracts, Bitcoin ordinals are simpler in their creation and transfer, relying solely on the basic transaction capabilities of the Bitcoin network.

How important are Bitcoin ordinals?

The advent of Bitcoin Ordinals is more than a technological breakthrough in the field of digital assets; it has economically reinvigorated the Bitcoin ecosystem. As mentioned above, they introduce a new dimension of utility to the Bitcoin network by enabling the creation and ownership of unique digital assets directly on the Bitcoin blockchain, demonstrating the versatility of this technology. This diversification of use cases could attract a wider audience to the Bitcoin platform, including artists, collectors and enthusiasts interested in digital art and collectibles. The importance of Bitcoin ordinals also lies in their impact on the perception of Bitcoin.

By adding a layer of creative and expressive utility, ordinals help to extend Bitcoin's utility beyond that of a purely transactional one. This change could have a considerable impact on Bitcoin's adoption and public image, presenting it as a more versatile and dynamic platform. Finally, the introduction of ordinals could have an impact on the value of Bitcoin (BTC). As unique digital assets on the blockchain gain in popularity, they could lead to an increase in demand for Bitcoins, given that each ordinal is linked to a specific satoshi. This potential increase in demand could influence the dynamics of the bitcoin market and increase its valuation.

The ordinals boom

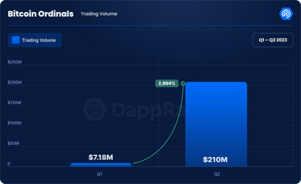

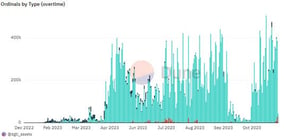

Bitcoin ordinals really took off in 2023. According to DappRadar, the volume of ordinals on the Bitcoin blockchain rose from $7.2 million in the first quarter to $211 million in the second quarter, an increase of 8,834%. This exponential growth underlines the growing interest of users and investors in ordinals.

Several factors have contributed to this boom. The launch of a new token standard by ordinal launch company Luminex was a major event. This standard significantly reduced the cost of ordinal registrations by over 90%, making ordinals more accessible and attractive to a wider audience.

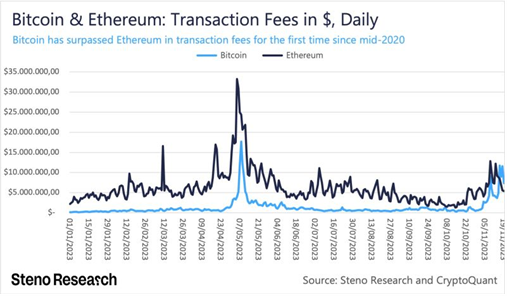

Another notable development: for the 1st time since mid-2020, transaction fees linked to the Bitcoin blockchain have surpassed those linked to the Ethereum blockchain. It would appear that ordinals played a definite role in this.

Technical constraints and limitations

Despite this boom, ordinals are still the subject of debate within the Bitcoin community. By writing data directly onto individual satoshis, ordinals dramatically increase the amount of data stored on the Bitcoin blockchain. This increase can lead to the so-called "bloat" of the blockchain, which can have an impact on the efficiency and scalability of the network. The problem is that, as more and larger entries are added, the size of the blockchain could grow exponentially, making it more difficult to store and validate, especially for individual users operating full nodes. This could potentially slow down transaction processing times and increase costs, impacting one of Bitcoin's key strengths - its efficiency.

Some members of the Bitcoin community claim that the blockchain was never designed to store non-financial data, such as images or text associated with ordinals. They argue that this misuse could divert bitcoin from its primary objective, namely the creation of a decentralised digital currency.

In addition, some fear that increasing the size of the blockchain could lead to centralisation, as fewer people and organisations would have the capacity to maintain complete nodes, a scenario that runs counter to the ethos of Bitcoin's decentralised nature. Another point of contention is the potential impact on transaction fees. If demand for block space increases due to ordinals, it's possible that transaction fees could rise, which could make the Bitcoin blockchain less attractive for small transactions. This could lead to a situation where the Bitcoin blockchain becomes reserved for the wealthiest users at the expense of other users, contradicting Bitcoin's goal of financial inclusivity.

In response to these challenges, the Bitcoin community is constantly working on solutions to mitigate the impact of ordinals on the blockchain. This includes exploring the possibility of compressing data more efficiently and optimising the way data is stored and accessed on the blockchain. The development of secondary layers and "sidechains" is also being considered as a potential way of easing the pressure on Bitcoin's main blockchain.

Perspectives

The future of ordinals is a topic of great interest and speculation in the world of digital assets. One of the most interesting prospects is the potential for innovation and development in the field of ordinals. As this technology evolves, we could see the creation of more advanced and diverse forms of digital assets. Ordinals could evolve beyond art and collectibles, into areas such as digital identity and decentralised content management. This could reinforce bitcoin's role not only as a currency, but also as a multi-faceted blockchain platform.

Another area of potential growth is the intersection of ordinals with other emerging technologies. Integrating ordinals with smart contract functionality, either directly on the Bitcoin blockchain or via other compatible solutions, could open up new use cases, in the same way that NFTs have been used in decentralised finance (DeFi) and gaming on other platforms.

However, the future of ordinals will also depend on how effectively the Bitcoin community addresses current technical challenges and limitations. The development of solutions to minimise blockchain congestion and keep transaction fees low will be crucial in determining the extent to which ordinals are adopted and integrated into the wider Bitcoin ecosystem.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

President Donald Trump signed an executive order relating to cryptocurrencies. The US is now one step closer to the creation of a strategic bitcoin reserve. Overview below.

"There are decades where nothing happens; and there are weeks where decades happen." - Vladimir Ilyich Lenin

Solana and Ethereum are two dominant blockchains in the crypto sector, each boasting robust DeFi ecosystems and a plethora of diverse applications. The two blockchains are often seen as competitors. How do they compare?

.png)