History

The Thanksgiving to Santa Claus Stock Rally, often referred to as the "Santa Claus Rally," is a phenomenon in the stock market where there is a tendency for stock prices to rise in the last five weeks of the year, starting from Thanksgiving Day in November and running through the end of December.

The term was introduced by Yale Hirsch in his 1972 publication of “The Stock Trader’s Almanac.”

Hirsch, examining the stock market performance from 1952 through 1971, noted that the period from November to January is typically the most favorable three-month span for holding stocks. It is quite unusual to witness such a consistent uptick in the market, especially considering the efficient market hypothesis, which suggests that stock prices reflect all available information.

This seasonal trend begins with Thanksgiving, setting the stage for the Santa Claus Rally and the subsequent January Effect. Starting in mid-December, the January Effect is characterized by small-cap stocks outperforming large-caps in January, amplifying the positive momentum initiated by the Santa Claus Rally.

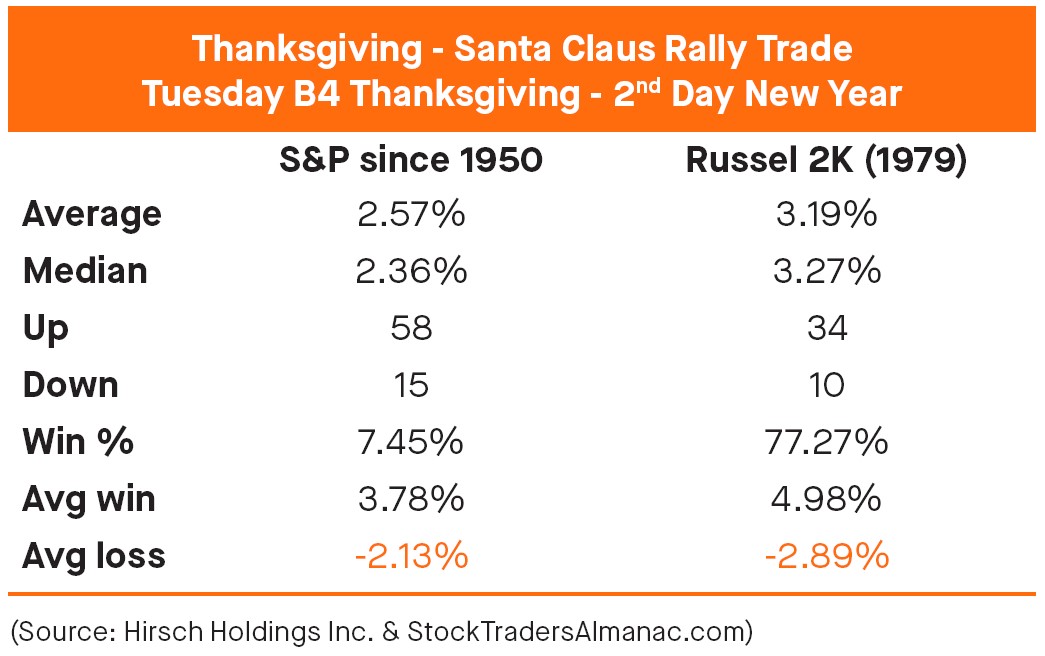

Building on this insight, Hirsch and Larry McMillan of the Options Strategist developed an investment strategy aligned with these seasonal trends. Their approach involved buying stocks the Tuesday before Thanksgiving and holding them until the second trading day of the New Year, leveraging the historically observed market behavior.

Is Santa Even Real?

The significance of the Santa Claus Rally is highlighted by its historical performance. Statistically, the strategy has shown considerable success. According to The Stock Trader's Almanac, the S&P 500 has been up 79.45% of the time since 1950, during these rally periods, with an average gain of 2.57%. The Russell 2000 index also shows positive results, being up 77.27% of the time since 1979 with an average gain of 3.19%. LPL Financial's Chief Market Strategist Ryan Detrick has also observed that a positive Santa Claus Rally often leads to robust returns in January, highlighting its connection with the January Effect.

But what if things don't go according to plan? Yale Hirsh cap-tures it simply, “If Santa should fail to call, bears may come to Broad and Wall”, alluding to the location of the New York Stock Exchange at the intersection of Broad and Wall Streets.

When the rally fails to materialize in December, January tends to see lower returns. In the instances since the mid-1990s where the Santa Claus Rally did not occur, January experienced a decline in five out of six cases, and the full year only saw a significant gain once, in 2016, despite an early mini-bear market. This relationship positions the Santa Claus Rally as a precursor to the January Effect, often setting the tone for market behavior in the early part of the year.

What Causes the Rally?

The Santa Claus Rally is influenced by a confluence of factors. Foremost among these, and the hardest to measure and verify, is the wave of optimism ushered in by the holiday season. This period, filled with festivities and a general sense of happiness, significantly influences investor behavior. The prevailing cheerful mood and optimism often lead to increased buying activity in anticipation of the new year.

Following this, tax considerations play a pivotal role. As the year draws to a close, investors engage in year-end tax plan-ning, often selling losing stocks to claim capital losses. This sell-off is usually followed by a reinvestment phase, where the money is put back into the market, leading to a surge in stock purchases and an upswing in prices. The rebalancing of portfolios is a key driver of the rally.

The holiday season also coincides with reduced trading volumes, primarily due to many institutional investors taking vacations. With fewer trades happening, the market expe-riences lower levels of activity.

In this environment, even small increases in buying can have a disproportionately large impact on stock prices. With institutional players less active, retail traders, who are generally more bullish, gain a stronger foothold in the market, further influencing its direction.

Another contributing factor is the influx of year-end bonuses. This is a time when many individuals receive extra income, some of which is often invested in the stock market. The additional capital flowing into stocks helps drive up demand and, consequently, prices.Meanwhile, the historical trends of the Santa Claus Rally itself play a role. Investors aware of this past pattern may buy stocks during this period in anticipation of a rally, thereby con-tributing to its occurrence. This expectation of a rally can turn into a self-fulfilling prophecy as more investors participate, driven by the belief in the historical trend.

Will there be a rally this year?

The prospect of a Santa Claus rally in 2023 is threatened by various economic challenges. Rising US Treasury yields, now near 5%, increase debt financing costs and may shift investor interest from volatile equities to government bonds. China's slowing economy, indicated by the Hang Seng index's 19% drop and the yuan's decline, impacts global markets and may worsen inflation. China, being a major consumer goods buyer, influences global markets extensively. Additionally, rising oil prices, with WTI and Brent crude reaching around $95 per barrel, add to the economic strain. Historically, high oil prices have led to increased inflation and higher costs for companies, impacting overall economic performance. Geopolitical risks, particularly the ongoing war in Ukraine, also play a role. The conflict strains the budgets of Western countries supporting Ukraine, potentially impacting their domestic economic policies and contributing to uncertainties in the financial markets.

However, these challenges are set against a backdrop of a cautiously optimistic Federal Reserve policy. As of November 2023, the Fed maintains the interest rate at 5.4%, indicating a shift from a hawkish to a more balanced approach. This could be a mitigating factor, as it shows a commitment to monitoring inflation and economic conditions without further aggressive rate hikes. Additionally, earnings season is approaching, and corporate earnings, especially in the booming technology sector driven by advancements in artificial intelligence, could provide the anticipated boost to bullish investors.

Conclusion

While technical analysis and fundamental data are crucial in investment decisions, understanding cyclical trends like the Santa Claus Rally can add another dimension to a trader's strategy. Statistically significant for over 70 years, this phenomenon demonstrates the potential of seasonal trends to influence market performance. However, investors should approach this with caution, acknowledging that past performance is not a definitive predictor of future outcomes. As we look ahead, the occurrence of a Santa Claus Rally in 2023 remains uncertain but there's always hope that Santa makes it down the chimney, bringing a much-needed boost to conclude a challenging year in the markets.

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)