Gold has always been regarded as a safe haven in times of economic and geopolitical turbulence. Historically, its price has been influenced by a variety of factors, including global political stability, inflation rates and currency fluctuations. However, the recent surge in gold prices, from a low of $1,630 an ounce in 2022 to a record high of $2,100 an ounce early last week, is cause for concern.

The rise in gold prices in 2023 runs counter to the conven-tional relationship between real interest rates and the price of gold. With real interest rates above 2% and a strong dollar, some models estimate that gold should be close to $700 an ounce today. This anomaly in the behaviour of gold prices highlights a significant change in market dynamics and is intriguing to investors, prompting an in-depth analysis of the underlying causes of this unexpected rise.

Source: www.longtermtrends.net

China's role in the rise of the gold prices

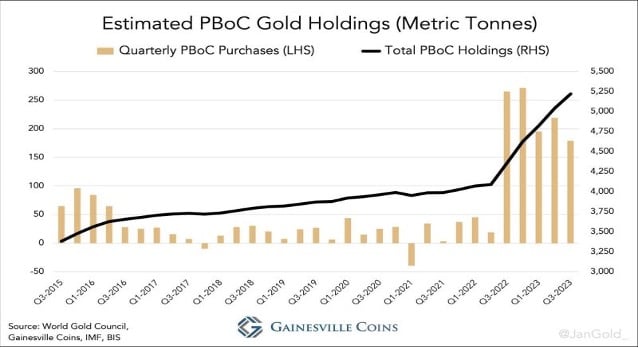

China's massive accumulation of gold could be behind the resilience of gold prices. According to unofficial estimates (Gainesville Coins), total gold purchases by China's central bank, which include both declared and undeclared purchases, far exceed what has been officially disclosed. In the third quarter alone, China reportedly purchased 179 tonnes of physical gold, and since the start of the year, the People's Bank of China (PBoC) has accumulated some 593 tonnes, an increase of 80% compared with the first three quarters of the previous year. As a result, China's estimated gold reserves stand at 5,220 tonnes, more than double the officially announced figure of 2,192 tonnes. There are many reasons for this buying spree:

1. Geopolitical tensions

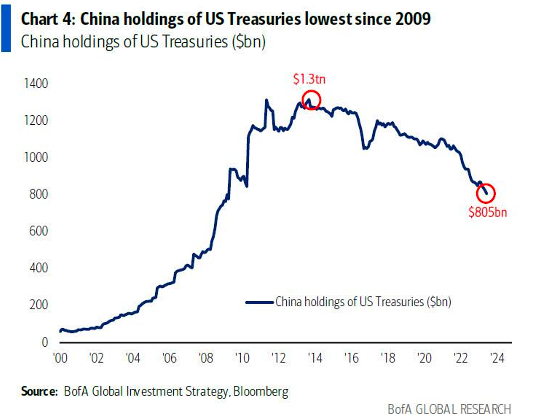

Firstly, it is a response to global economic uncertainties. The war in Ukraine and the sanctions imposed on Russia by the Western bloc have changed the situation for many emerging countries. For China, this conflict has highlighted the risks associated with heavy dependence on the US dollar and other Western fiat currencies. In response, the People's Bank of China (PBoC) stepped up its purchases of gold, viewing the precious metal as a stable and geopolitically neutral asset. This move was also seen as a response to the increasing use of the US dollar by the United States as an instrument of its foreign policy ("weaponisation of the dollar"). China is seeking to strengthen its financial security and reduce its vulnerability to international conflict and economic sanctions by using gold as a safe haven in times of geopolitical turbulence. It should be noted that the accumulation of gold by the People's Bank of China coincides with the reduction in the stock of US Treasury bonds by the Chinese authorities. As the chart below shows, the number of US bonds held by China is at its lowest level since 2009.

2. The trend towards de-dollarisation

As a corollary to the above, China is reducing its dependence on the US dollar as a reserve currency, a move seen as part of a wider strategy of de-dollarisation.

De-dollarisation refers to the gradual emancipation of the US dollar from international trade and finance, a trend that has significant implications for the role of gold in the global economy.

First of all, it is important to distinguish between the role of the dollar as a trading currency and as a reserve currency.

In the former case, the dollar is used for international trade transactions, benefiting from the stability and liquidity of the US financial markets.

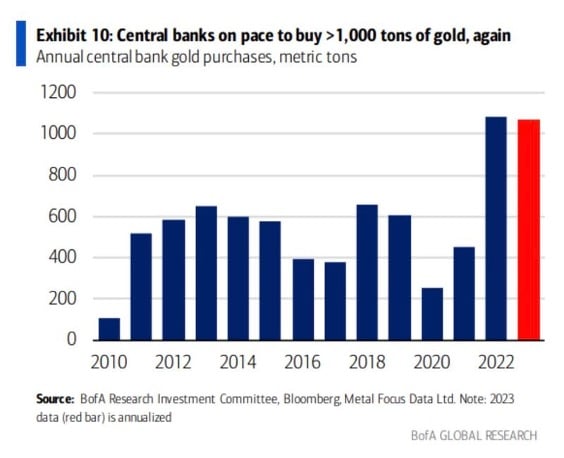

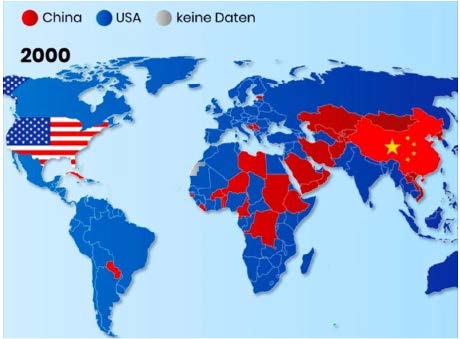

However, as a reserve currency, the dollar's dominance is more nuanced. Although there is currently no fiat currency capable of replacing the dollar in this role, the situation is changing, particularly with the rise of gold as a reserve currency. China's aggressive gold purchases can be seen as part of this strategy. This strategy is not unique to China; other countries, particularly in the South and in the European Union, are also exploring gold as an alternative to dollar-denominated assets - see chart below.

If the unofficial estimates are correct, suggesting that China's true gold reserves amount to 5,220 tonnes rather than the 2,192 tonnes officially declared, this would mean that it not only exceeds Germany's gold reserves of 3,353 tonnes, but is fast approaching the United States, which holds 8,133 tonnes. Taking into account Russia's gold reserves of 2,333 tonnes, the combined reserves of these two great nations would exceed 7,500 tonnes of gold, approaching the US total, assuming that all physical gold in the US is still stored at Fort Knox, which is questioned by many gold analysts.

While the yuan cannot be considered a serious enough candidate to replace the dollar, China's importance in world trade (see chart below) seems to militate in favour of a growing influence for the Chinese currency. In the meantime, de-dollarisation through the accumulation of large quantities of gold could be a necessary step for the Chinese authorities.

3. Domestic demand and market dynamics in China

China's strong growth in demand for gold is not solely due to international factors; it is deeply rooted in domestic dynamics. Chinese banks, such as the Bank of China and China Merchants Bank, have actively promoted investment in gold, offering products such as gold bullion and gold-backed products to retail investors. The difference in the price of gold bars sold by these banks in mainland China compared with their Hong Kong branches indicates a higher demand for gold in China. This demand is partly fuelled by the desire of Chinese savers and households to diversify their investments and protect themselves against currency risks. With the depreciation of the yuan during 2023, there has been a growing trend among Chinese savers to look for ways to transfer their savings abroad. In addition to Bitcoin, Tether and other crypto-currencies, gold has become one of the preferred ways of circumventing the very strict Chinese government controls on money transfers abroad.

Source: Statista

Other factors behind gold's rise

Although China has a strong influence on the gold market, it is essential to recognise that the surge in gold prices is not solely attributable to that country. In addition to the trend towards de-dollarisation and rising global geopolitical ten-sions, other factors have strongly influenced the trajectory of the yellow metal.

1. Economic uncertainty and concerns about inflation

Economic uncertainty and inflation concerns played a crucial role in driving investors into gold in 2023. As the world faces various economic and geopolitical challenges, gold has emerged as a viable tool for diversifying portfolio risk. Histor-ically, gold has outperformed other assets in periods of high volatility, including equities, bonds and even the US dollar. This performance is attributed to gold's perceived stability in times of economic uncertainty and its traditional role as an inflation hedge, making it an attractive asset for investors seeking to protect their wealth against inflationary pressures and economic downturns. The US election year of 2024 is also likely to create volatility in risky assets - and therefore encourage investors to seek refuge in precious metals.

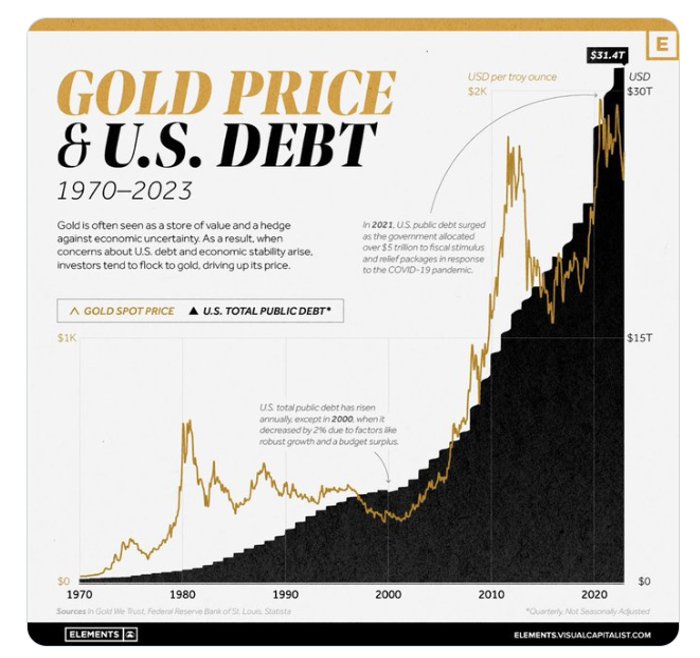

2. Gold seen as protection against fiscal excesses and government debt

2023 will be remembered as the year in which US indebtedness rose almost exponentially, resulting for the first time in an interest burden in excess of $1 trillion, i.e. more than defence spending. Investors in treasury bills are increasingly uneasy about the budgetary and the indebtedness of the United States - but also of other sovereign states (Europe, Japan, etc.). Will gold prices continue to be correlated with the rise in government debt (see attached gold curve and US debt curve)?

3. Technological and industrial demand

Finally, let's not forget that demand for gold in technological and industrial applications was a key factor in its appreciation in 2023. Gold's unique properties, such as high conductivity and corrosion resistance, make it indispensable in a variety of high-tech industries. While demand for jewellery has had its ups and downs, gold's technological applications have consistently contributed to its overall demand. Gold's importance in electronics and other industrial sectors underscores its versatility beyond its simple status as a precious metal and investment asset, making it a valuable commodity in a variety of industrial applications.

Source: Elements

Conclusion

The gold market is currently benefiting from several favourable winds. China's frenetic and significant accumulation of gold is one of them.

As we enter the New Year, a number of factors could help gold to continue its ascent.

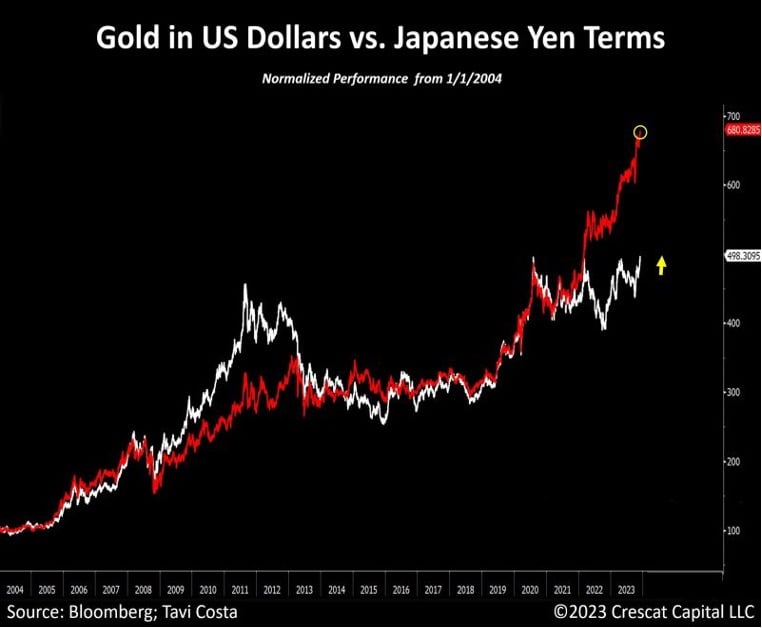

Firstly, the fall in US real interest rates and a depreciation of the dollar in 2024 could create a favourable dynamic for gold expressed in dollars. Let's not forget that gold expressed in currencies weaker than the dollar has reached even more impressive levels this year. Will gold in dollars follow the same pattern as gold in yen (see chart below)?

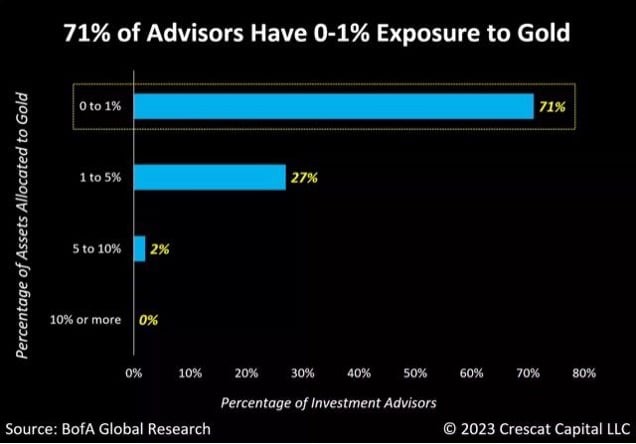

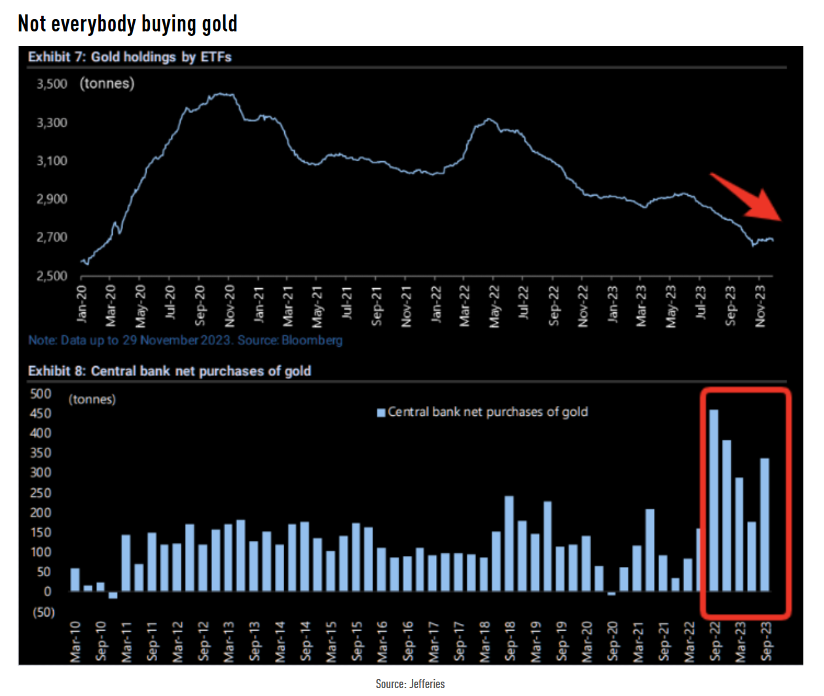

Another important factor to consider is that, while central banks have accumulated very large quantities of gold, investors have not (yet) done the same. As the chart below shows, the average gold allocation of private investors is relatively low. ETF flows show a strong dichotomy between purchases by private investors and those by central banks. Are we going to see another gold rush from private investors?

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

The iShares Expanded Tech-Software ETF (IGV), treated as the benchmark for the sector, has slid almost 30% from its September peak, a sharp reversal for what was considered one of the market’s safest growth franchises. Every technological cycle produces its moment of doubt. For software, that moment may be now.

Nuclear power is getting a second life, but not in the form most people imagine. Instead of massive concrete giants, the future may come from compact reactors built in factories and shipped like industrial equipment. As global energy demand surges and grids strain under new pressures, small modular reactors are suddenly at the centre of the conversation.

Cosmo Pharmaceuticals’ successful Phase III trials in male hair loss has drawn attention to a market long seen as cosmetic. Growing demand for effective treatments has accelerated research and encouraged the rise of biotechnology companies exploring new approaches.

.png)