Quick rundown

At a time of environmental concerns and geopolitical upheaval, the importance of economic planning and the development of new industrial strategies has never been greater. Under the Biden administration, the United States has implemented a gigantic investment programme aimed at strengthening its position as the world's leading power. On the old continent, the EU and the UK seem to be moving in the opposite direction, grappling with challenges such as de-industrialisation and energy dependency.

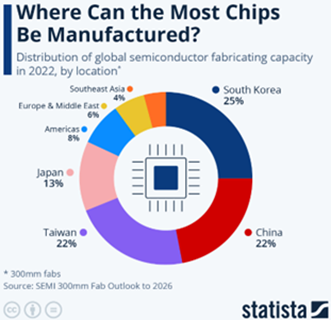

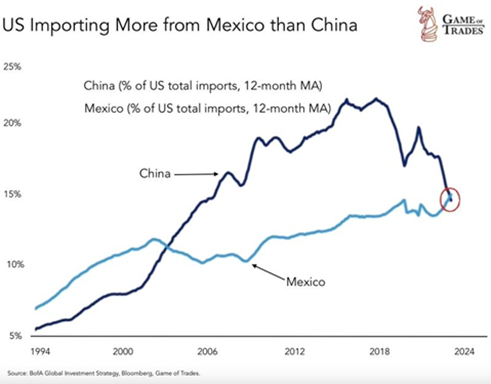

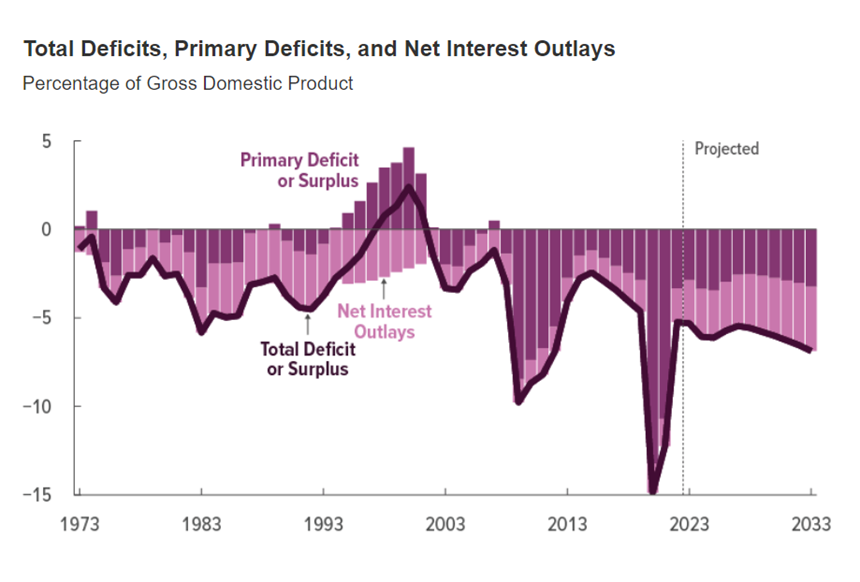

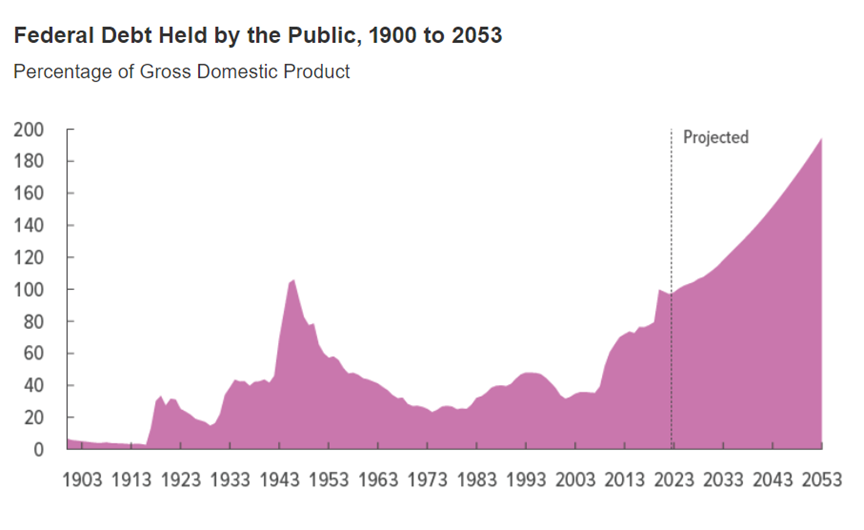

On the face of it, the strategic turn taken by the United States should give it a major competitive advantage over Europe. Their energy independence and local production of semi-conductors give them a definite advantage in a world prey to "slowbalisation" and geopolitical risks. But the price of Bidenomics is high. In particular, budget deficits will widen, and indebtedness will accelerate (see below for the CBO's projections for the coming years). Such a headlong rush will have consequences for future taxes and/or inflation ("the hidden tax"). As President Ford once said, "A government that is big enough to give you everything is a government that will also be there to take everything from you..."

Another price to pay for 'Bidenomics' is what is known as 'crowding out', an economic phenomenon characterised by a fall in investment and private consumption as a result of increased public spending. In simple terms, Uncle Sam's massive public spending is absorbing not only available capital but also labour (with effects on wages and hence inflation). The very large Treasury bond issues needed to finance Bidenomics are pushing up bond yields, with effects on the cost of capital for companies. As mentioned by Gavekal Group, Biden's interventionism should lead to a more stable US economy, but with negative effects on labour productivity growth and, by extension, on US structural growth.

For Europeans, there is an urgent need to modernise their industrial base and secure access to energy. This means putting in place a new foreign affairs policy common to the whole Union. It also means resorting to major investment plans similar to the Bidenomics. But the room for manoeuvre is limited. Firstly, because the level of debt is already very high. But also, because Germany's debt brake rules prevent the pursuit of such policies. Last week, the German Council of Wise Men came out in favour of reforming these rules. Europe urgently needs to take action.

.png)