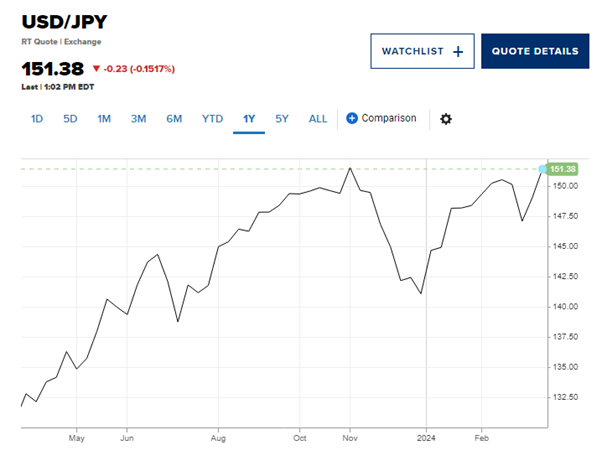

As expected, the Central Bank of Japan (BoJ) took a historic step on Tuesday March 19, 2024 by raising interest rates for the first time in seventeen years, marking a significant break with its negative interest rate policy initiated in 2016. By fixing the short-term rate in the [zero to 0.1%] range and ending the yield curve control on the 10-year Japanese government bond, the BoJ is fostering an environment conducive to economic recovery and growth.

When a central bank raises its interest rates, the intuition is to anticipate more restrictive financial conditions, lower inflation, and weaker equity market. However, when it is to exit a negative interest rate environment, it is set to be stimulative, signaling a move towards normalisation in monetary policy. Explanation below.

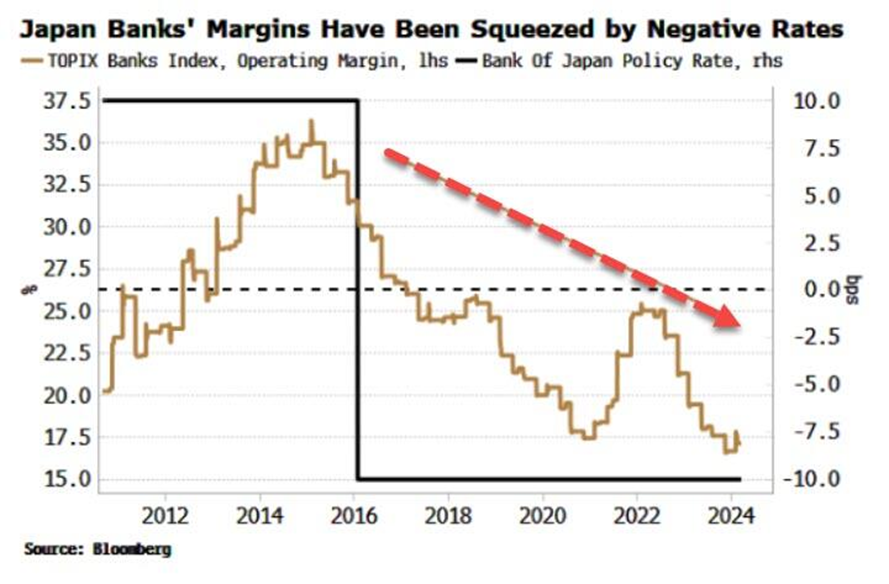

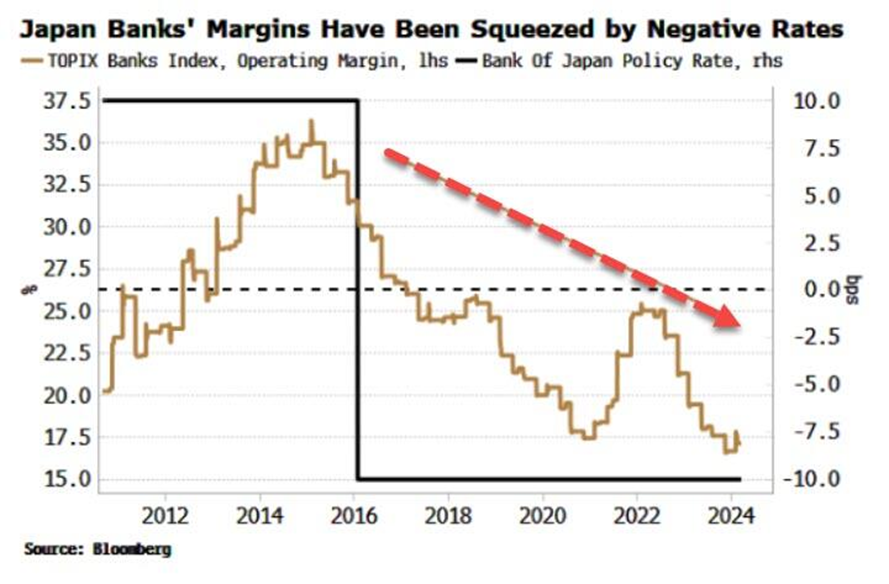

Japanese banks set to boost earnings following BoJ policy change

According to Bloomberg, Japan's major banks collectively hold 107 trillion yen ($712 billion) in reserves with the BoJ. These reserves do not generate any income. In addition, these institutions hold 79.4 trillion yen in deposits, currently yielding 0.1%.

Given the BoJ's recent policy change, which introduces an interest rate of 0.1% on balances in excess of reserve requirements, these banks should benefit from an increase in annual interest income of around 100 billion yen. This adjustment, as calculated by Bloomberg, represents a significant improvement in revenues.

Japanese banks' operating margins (brown) vs. BoJ reference interest rate (black)

Source: ZeroHedge, Bloomberg

Source: ZeroHedge, Bloomberg

In the absence of negative interest rates, banks are likely to increase lending

Despite the steepening of the yield curve over the past two years, which should have encouraged banks to lend more, they have continued to reduce their lending (as a percentage of assets). Negative interest rates appear to be the main reason.

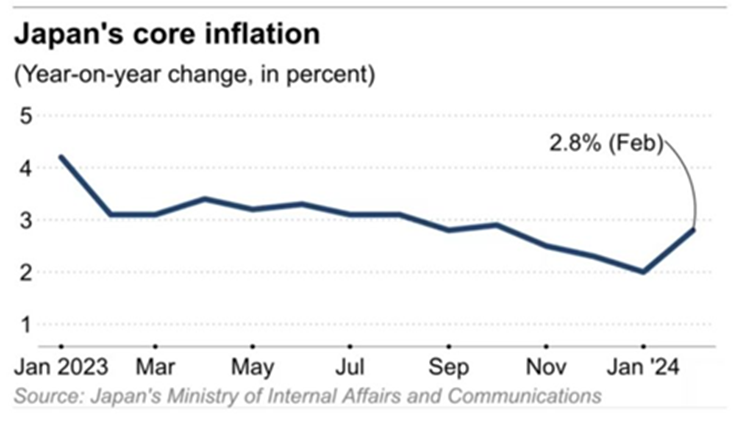

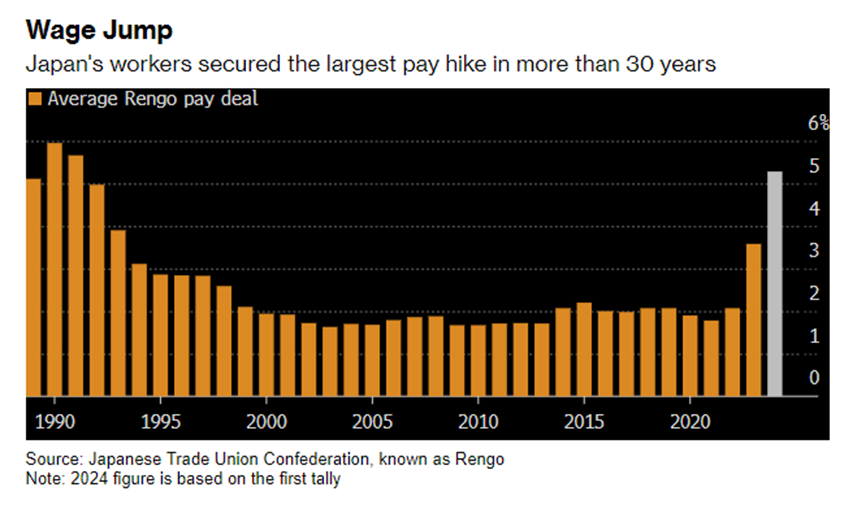

The departure from negative interest rate policies should stimulate lending, especially given the gradual and modest nature of the rate increases, as indicated by BoJ Governor Ueda's recent remarks that the 2% inflation target is still some way off.

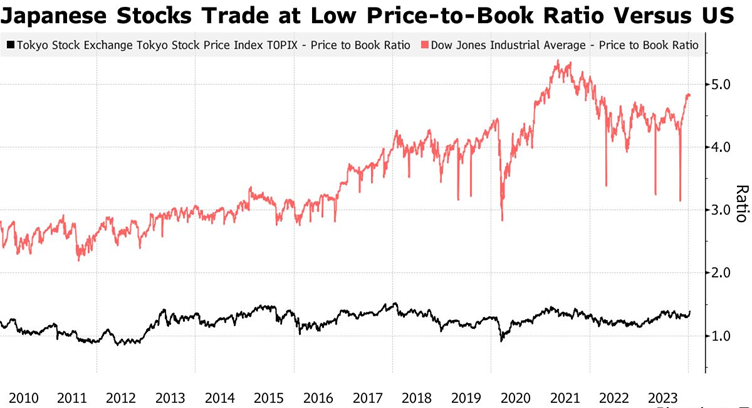

Return of inflation should drive up equity investment

Instead of the negative effect it can have in other developed markets by penalising corporate margins and raising the cost of living, it is positive in an economy like Japan's, which has suffered from deflation for so many years. In particular, Japanese companies can finally raise their prices and potentially increase their margins after many years of forced cost discipline.

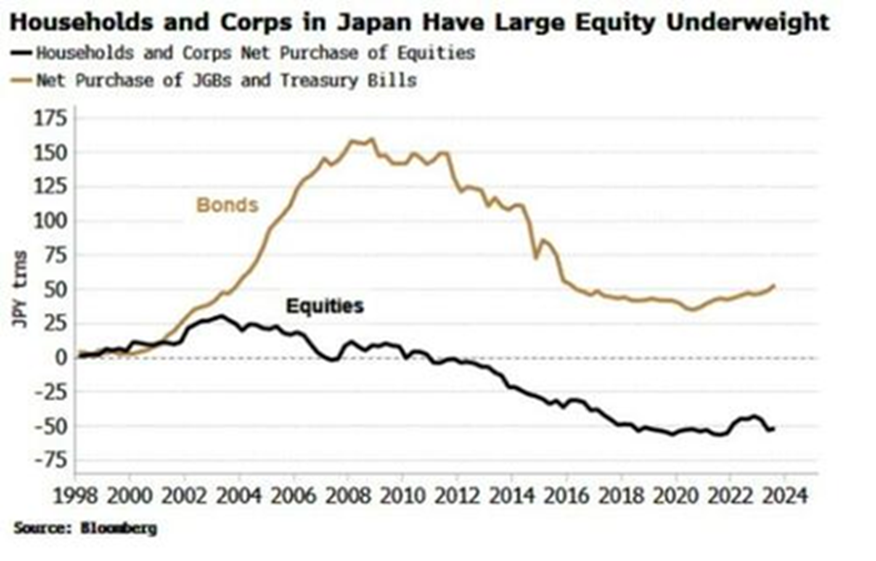

As the chart below shows, local investors have avoided equity markets for years. But with the return of inflation, investors should be more inclined to invest in risky assets. Indeed, years of deflation or low inflation have led households and companies to favour bonds over equities. However, as inflation erodes the real value of government bonds, equities offer more attractive prospects. What's more, if the yen strengthens, Japanese investors could be led to reduce their exposure to US equities in favour of domestic equities.

.png)

Source : Win Smart

Source : Win Smart

Source: ZeroHedge, Bloomberg

Source: ZeroHedge, Bloomberg