As we enter 2023 and focus on our next investment calls, we want to also reflect on our main calls in 2022. Obviously, some were very accurate, and some others are waiting to unfold.

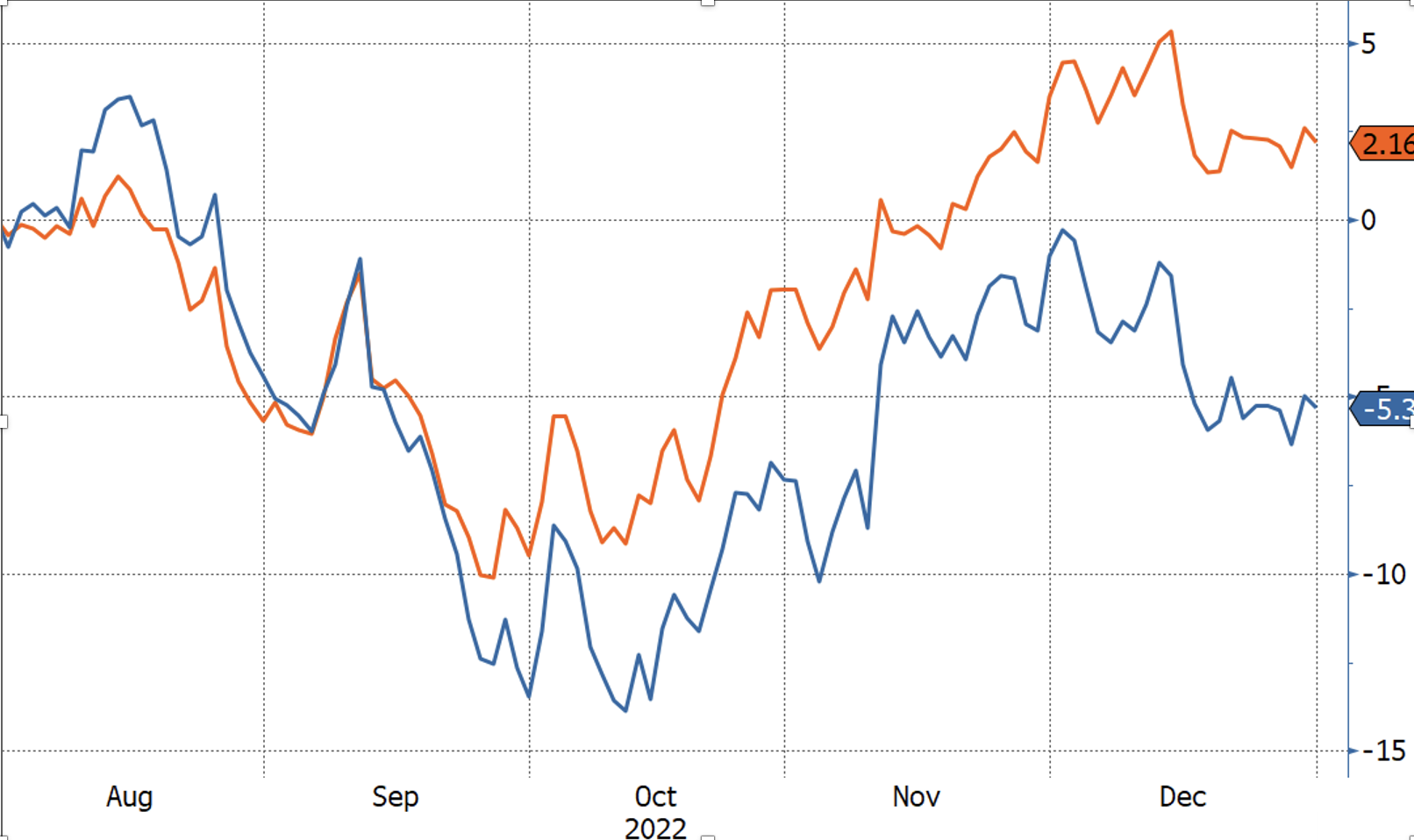

The healthcare sector was a “treat”-ment for portfolios. It has been one of our preferred sectors since August at a time when it was getting obvious that global growth was slowing down, and inflation would impact bottom line earnings. Since then, healthcare equities have been positive while the market was down 5%. Indeed, these companies and especially global and diversified ones tend to show resilience and low sensitivity to macro trends in general. Longer term, an aging global population, better access to healthcare in emerging markets, and innovation (advances in sciences and technologies) will act as tailwinds.

Healthcare equities have been outperforming global equities since last summer

Source: Bloomberg

Source: Bloomberg

Energy equities fueled portfolios in 2022. The sector has been one of our preferred sectors since February 2022 and has been performing extremely well, jumping by 24% while global equities were down 14%. The anchor tailwinds come from the structural demand-supply imbalance. The lack of investment in long term projects during the last ten years (as large companies focus on the transition to renewable energy production) coupled with the EU embargo on Russian oil as well as an aggressive output cut by OPEC+ have led to current tight supply conditions across the industry. Most global oil & gas companies have demonstrated a meaningful shift towards capital discipline. They now have lower debt levels, and record free cash flow yields. Despite the rally of the past two years, we continue to find energy equity valuations relatively subdued. Chinese easing on covid lockdowns, and the need to refill the Strategic Petroleum Reserve in the U.S. might support oil prices.

Energy stocks were a clear winner in 2022

Source: Bloomberg

Source: Bloomberg

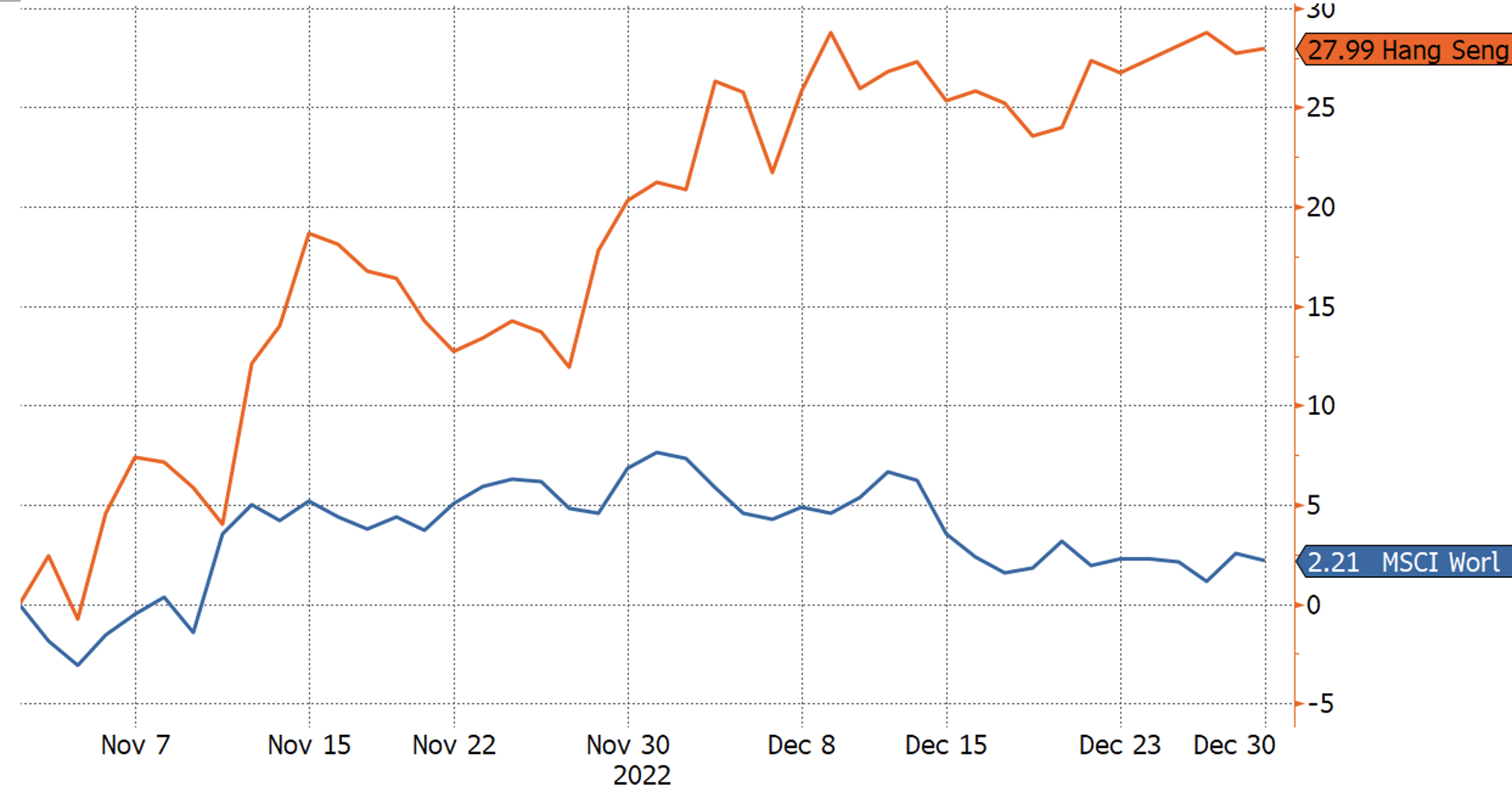

China – too big to ignore in 2023? In 2022 we remained cautious during the summer season, before upgrading our tactical view to “positive” in November. Chinese equities have been down for many reasons but there are others factors that should be reconsidered which are more positive for the markets. The reelection of President Xi Jinping, the easing of the Covid policy coupled with valuations at depressed levels could restore the China’s growth momentum. Ever since the regulatory crackdown started with the cancelation of the Ant Group IPO, Chinese ADRs have been under intense stress, losing ~80% of their value, being perceived as “un-investable” by the major U.S. financial firms. Overall, most of the decline so far is explained by geopolitical factors rather than by fundamentals, which makes our bottom-up view on some stocks rather appealing. However, pessimism towards China seems to have reached its peak even though the long-term outlook remains very attractive. China ADRs remain very cheap in comparison to their U.S. counterparts and growth/margins are still attractive even if cut in half.

Chinese equities have started to recoup some of their losses

Source: Bloomberg

Source: Bloomberg

Short duration bonds – Yield is back. We have been favoring short term bonds since June, promoting single line bond investment, and launching dedicated buy & hold portfolios, maturing no later than 2024-end, be it on European high yield to benefit from the excessive credit stress vs the U.S., or in Latin American investment grade bonds. Both are positive since launch, while the Bloomberg U.S. aggregate bond index is still in deep negative territory. The double effect of widening spreads and rising yields has considerably improved the risk reward of short to mid duration credit. The situation is similar for high yield credit, which offers attractive yields on the front end, but spreads are not at cheap levels. We have seen some retracement in spreads already but yields in USD are still attractive. We favor investment grade short term bonds, while the intermediate segment is becoming attractive due to the steepness of the credit spread curve.

.png)