Who are the BRICS?

The term BRICS refers to the coming together of five countries with vast territories: Brazil, Russia, India, China and South Africa.

The acronym first appeared in 2001 following the publication of a Goldman Sachs report written by Jim O'Neill. The involvement of an investment bank in the birth of the BRICS is not insignificant since the evidence of the tremendous growth potential of these countries has subsequently generated huge investment flows into the equity and bond markets of these countries. It should be noted that the invasion of Ukraine by Russia has led many asset managers to remove the "R" from B(R)ICS.

But let's get back to the genesis and mechanics of the BRICS. Although the term was used at the very beginning of this century, it was mainly from 2011 onwards, with the regular holding of summits and the entry of South Africa, that the BRICS became an official group.

Indeed, the BRICS group has since then taken the form of a full-fledged diplomatic conference, giving rise to an annual summit, taking place in turn in each of the five states. The purpose of these summits is to affirm the major place of these countries on the international scene, and to showcase their economic and political weight, particularly in relation to other states or groups of states such as the United States or the European Union.

The BRICS group is not a free trade bloc. However, members coordinate on trade issues and have established a supranational bank, the New Development Bank (NDB), which finances infrastructure loans. Established in 2014, the bank aims to provide alternative lending mechanisms to the IMF and World Bank structures, which members felt were too U.S.-centric. The Asian Infrastructure Investment Bank (AIIB) was created by China around the same time and for the same reasons. Both NDB and AIIB are triple A or double A rated and capitalized at US$100 billion. The shares of the NDB are held equally by each of the five members. In total, the BRICS group, as it currently exists, represents more than 40% of the world's population and nearly a quarter of global GDP.

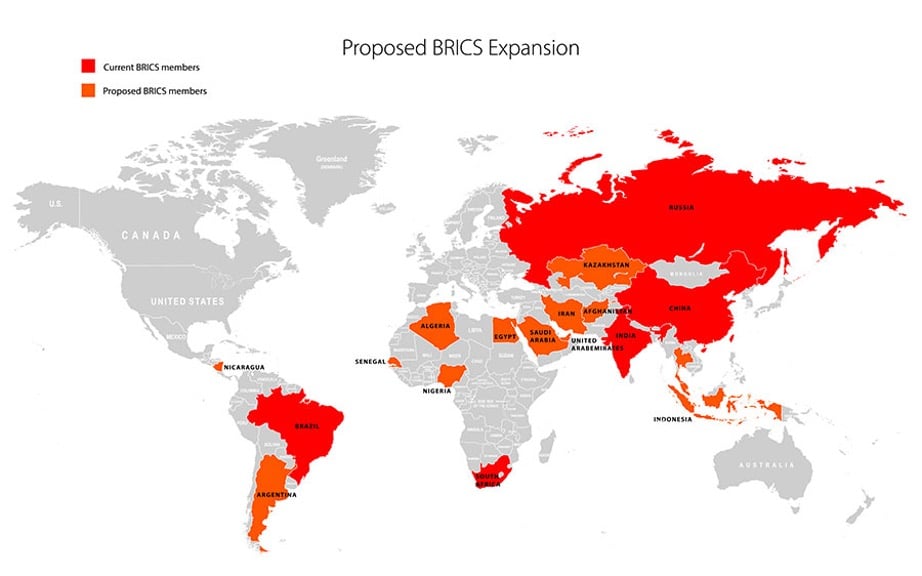

The GDP figure is expected to double to 50% of global GDP by 2030. An expansion of the BRICS could accelerate this process.

.png)