14 Mar 2024

Bitcoin faces a “sell-side liquidity crisis” by September if institutional inflows continue, an industry analyst says. In a thread on X on March 12, Ki Young Ju, founder and CEO of on-chain analytics platform CryptoQuant, predicted a BTC supply watershed “within six months.” Bitcoin as an institutional investment allocation is only just getting started, industry participants have said, as United States-based spot Bitcoin exchange-traded funds (ETFs) gain momentum. Now holding nearly $30 billion, they have become the most successful ETF launch in history.

Should the trend continue, however, a new phenomenon could arise where THERE WILL BE NOT ENOUGH BTC AVAILABLE TO MEET DEMAND.

“Bears can’t win this game until spot Bitcoin ETF inflow stops,” Ki summarized.

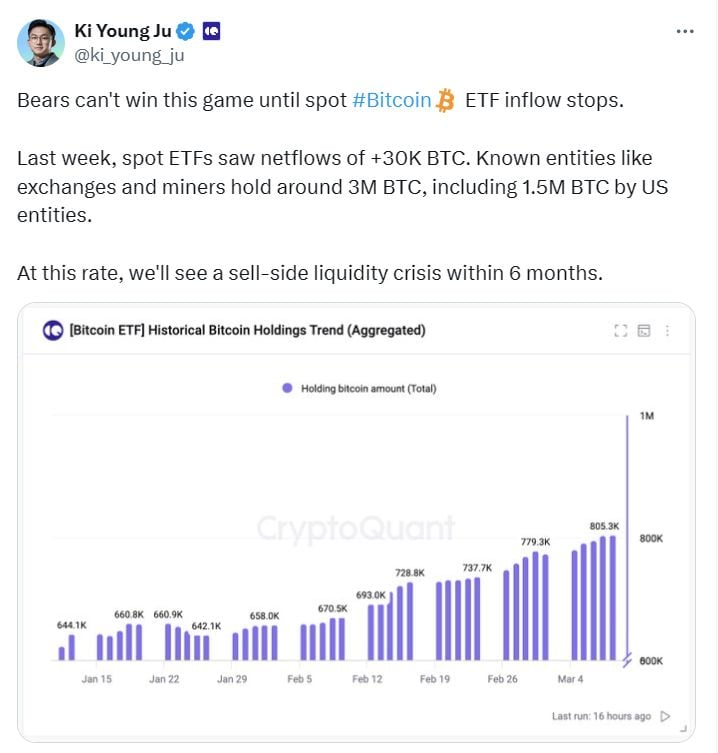

He noted that ETFs alone put away more than 30,000 BTC last week, and with 3 million BTC in exchange and miner wallets, the odds of a supply-induced price shock become clear.

“Last week, spot ETFs saw net flows of +30K BTC. Known entities like exchanges and miners hold around 3M BTC, including 1.5M BTC by US entities,” he continued.

“At this rate, we’ll see a sell-side liquidity crisis within 6 months.”

Given BTC price gains since the ETF launch in January, popular commentator WhalePanda notes, the dollar value of GBTC’s diminished BTC holdings has, in fact, barely declined. “The problem is that with the price going up and their massive outflows, their holdings in $ are still same as where we started at.”

When the tipping point from ETF demand comes, Ki forecasts the BTC price impact may be beyond market expectations. “Once a sell-side liquidity crisis happens, its next cyclical top may exceed our expectations due to limited sell-side liquidity and thin orderbook,” he concluded.

To avoid the liquidity crisis, we need to see whales starting to move their BTC to exchanges and sell them. This should happen if BTC price hit higher levels. The law of supply and demand...

Source: www.zerohedge.com