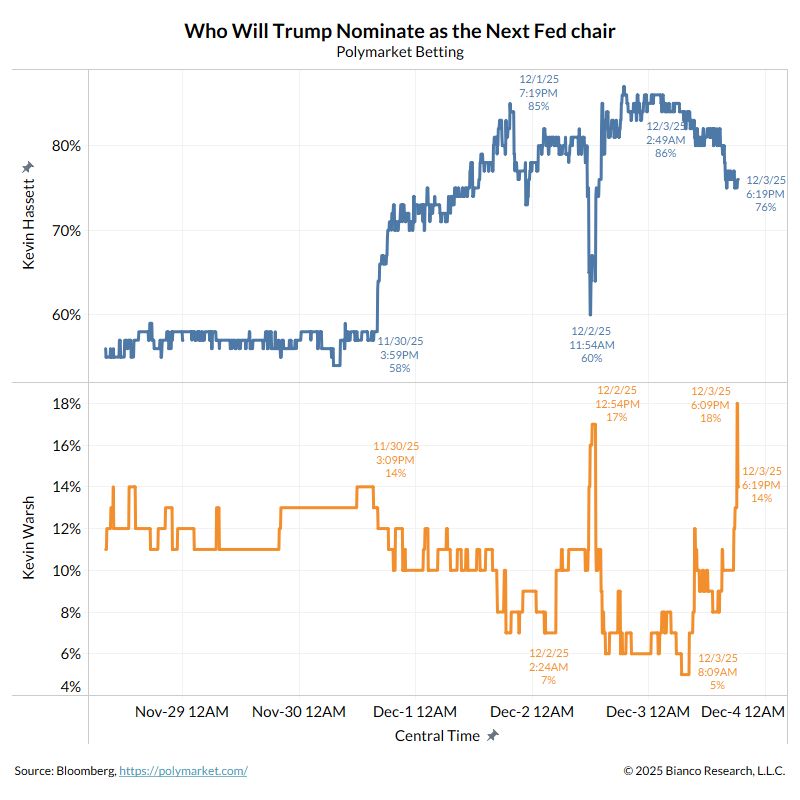

As shown by Jim Bianco on X, Hassett (blue) has been wildly gyrating the last 48 hours (85% to 60% to 86% to 76%).

Disclaimer

This marketing document has been issued by Bank Syz Ltd. It is not intended for distribution to, publication, provision or use by individuals or legal entities that are citizens of or reside in a state, country or jurisdiction in which applicable laws and regulations prohibit its distribution, publication, provision or use. It is not directed to any person or entity to whom it would be illegal to send such marketing material. This document is intended for informational purposes only and should not be construed as an offer, solicitation or recommendation for the subscription, purchase, sale or safekeeping of any security or financial instrument or for the engagement in any other transaction, as the provision of any investment advice or service, or as a contractual document. Nothing in this document constitutes an investment, legal, tax or accounting advice or a representation that any investment or strategy is suitable or appropriate for an investor's particular and individual circumstances, nor does it constitute a personalized investment advice for any investor. This document reflects the information, opinions and comments of Bank Syz Ltd. as of the date of its publication, which are subject to change without notice. The opinions and comments of the authors in this document reflect their current views and may not coincide with those of other Syz Group entities or third parties, which may have reached different conclusions. The market valuations, terms and calculations contained herein are estimates only. The information provided comes from sources deemed reliable, but Bank Syz Ltd. does not guarantee its completeness, accuracy, reliability and actuality. Past performance gives no indication of nor guarantees current or future results. Bank Syz Ltd. accepts no liability for any loss arising from the use of this document.

Related Articles

With the French presidential election approaching, Lagarde may step down early to let Macron and Merz influence her ECB successor. Key stakes: filling the power vacuum, deciding among top contenders like Hernández de Cos, Knot, Schnabel, and Nagel, and shaping the ECB’s post-crisis legacy.

Dropped off a cliff after Trump was elected. Source: FRED, Geiger Capital

Kevin Warsh, nominee for Fed Chair, has proposed a “New Fed-Treasury Accord” inspired by the 1951 agreement that granted Fed independence. The plan aims to restore Fed independence, shrink its $6.6 trillion balance sheet, and clarify roles between the Fed and Treasury. The Fed would focus on short-term rates and price stability, while the Treasury manages bond markets. Warsh also favors less forward guidance, letting the Fed react to data rather than constantly signaling. The goal is to prevent the Fed from becoming a tool for cheap government borrowing, modernize its balance sheet, and protect its ability to fight inflation.