20 Dec 2023

In a recent Bank of America survey, when asked which asset would likely excel if the Fed cuts rates in H1'24, an intriguing 26% (earning the top spot) pointed to the Long 30-Year US Treasury. This raises an important question: Is this a sound strategy given the current economic climate?

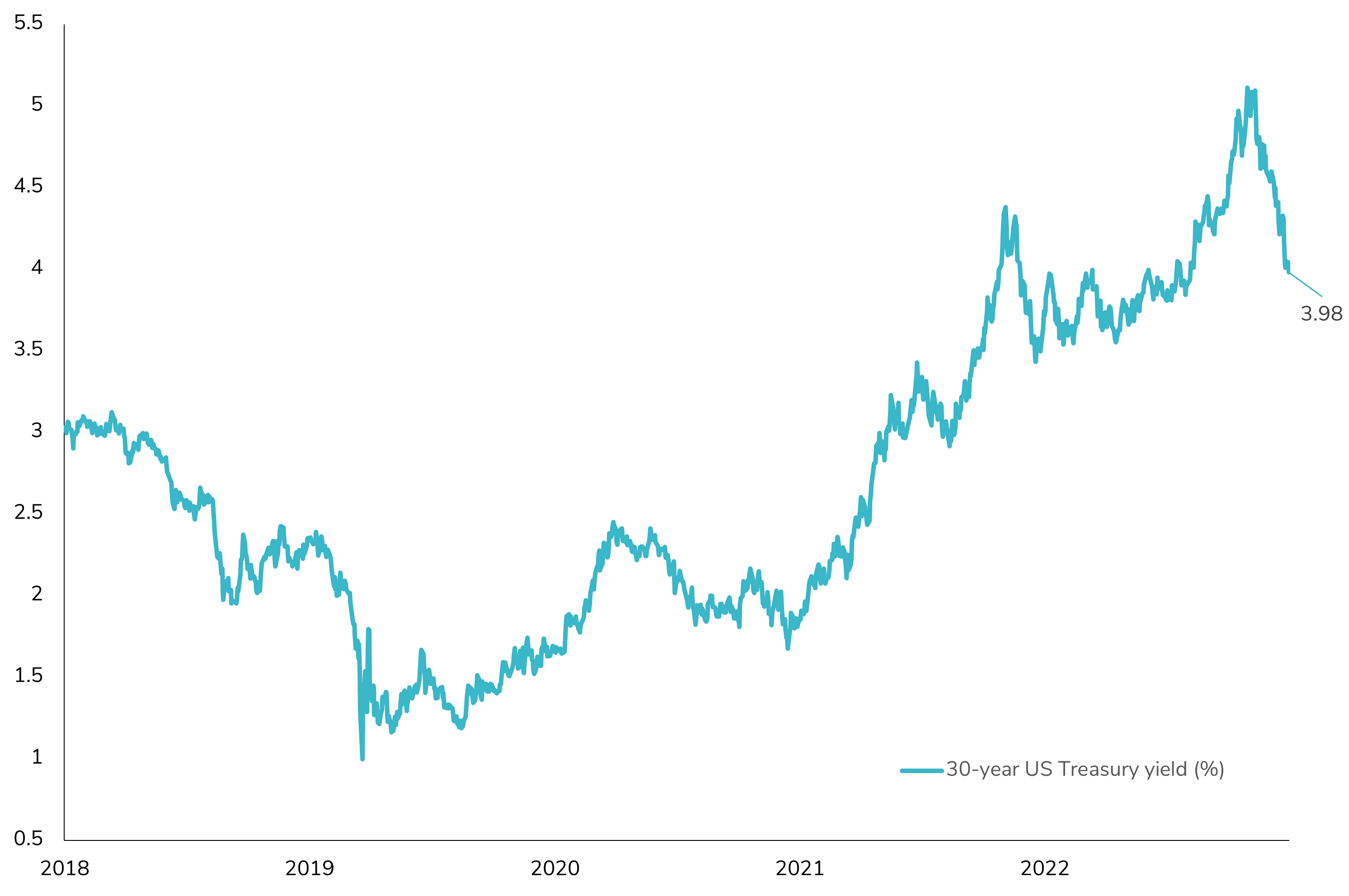

Notably, the preference for long-term bonds comes amid a significant drop in the 30-year US Treasury yield (>100 bps). However, the landscape is complicated by the anticipated heavy Treasury supply in the first quarter, alongside other factors. These include the uncertain economic repercussions of potential fiscal policies from the 2024 US election results (if Trump or another candidate favoring fiscal stimulus were to win), a negative US term premium, and an unusually persistent inverted yield curve in what appears to be a late economic cycle.

Moreover, there's a critical consideration often overlooked: in scenarios of Fed rate cuts, the front-end of the yield curve, when adjusted for duration risk, might actually offer a more favorable position.

So, is pouring resources into long-term bonds for 2024 a judicious move right now? Are long-term US bonds really the safe haven they’re perceived to be, or should we approach this strategy with a more critical lens?

🤔📊 #InvestmentStrategy #FixedIncome #FinancialMarkets"