13 Nov 2023

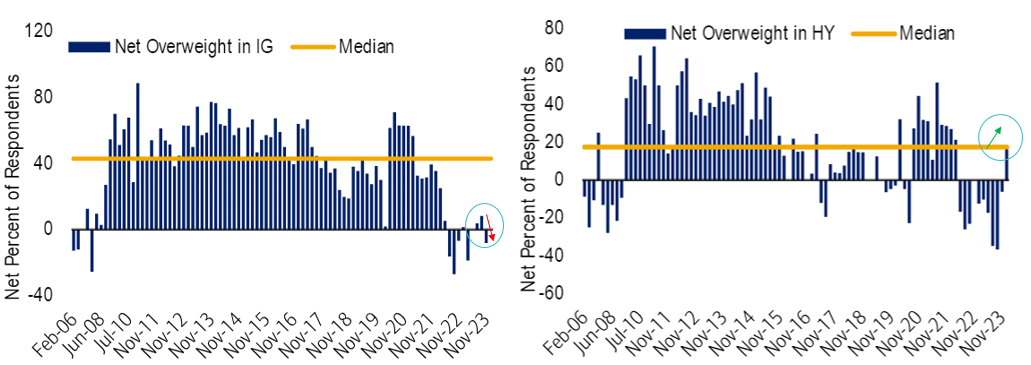

The recent BofA Credit Investor Survey reveals significant shifts in market sentiment. For Investment Grade (IG) investors, net positioning dropped to -8% net underweight in November from a +8% net overweight in September. Conversely, High Yield (HY) witnessed an uptick, reaching +18% net overweight in November, the highest since Jan-2022. Notably, HY investors are more optimistic about spreads, with the net share expecting wider spreads dropping significantly for the 3 and 6-month horizons.

Delving deeper into investor positioning, the HY landscape presents a nuanced picture. The primary repositioning in November focused on the #frontend (1-3y) and #higherquality of the HY.

Many asset allocators are embracing a barbell strategy, blending exposure to the intermediate/long end of high-quality corporate bonds or Treasuries with a portion invested in the front end of the US HY, enhancing the average yield. The goal is to navigate economic uncertainties by benefiting from the safety of high-quality fixed income and compensating for potential defaults in the HY space. Could this strategic approach push the HY-IG Yield Ratio lower, considering it already reaches post-GFC lows?

#CreditMarkets #Investing #FinanceInsights 📊💼

Source: BoFA